The global hydrogen fueling station market is witnessing rapid growth, driven by the rising demand for clean energy solutions, government support for hydrogen infrastructure, and increasing adoption of fuel cell electric vehicles (FCEVs). As the world pivots towards decarbonization and sustainability, hydrogen is gaining traction as a viable alternative to fossil fuels, especially in sectors like transportation, heavy industry, and power generation.

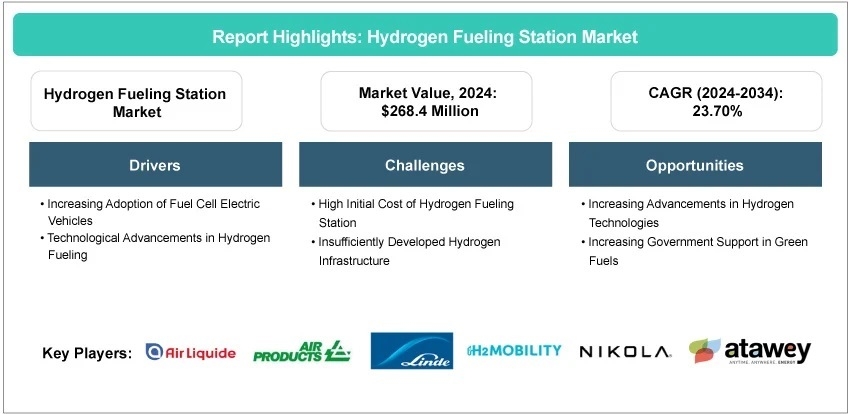

According to BISResearch, the hydrogen fueling station market is projected to reach $2,251.2 million by 2034 from $268.4 million in 2024, growing at a CAGR of 23.70% during the forecast period 2024-2034.

What is a Hydrogen Fueling Station?

A Hydrogen Fueling Station is a facility designed to refuel hydrogen-powered vehicles, primarily fuel cell electric vehicles (FCEVs). These stations store and dispense hydrogen gas, typically at high pressure, to enable efficient refueling. They play a critical role in supporting the adoption of hydrogen as a clean energy alternative in the transportation and industrial sectors. Hydrogen fueling stations are essential for the development of a sustainable hydrogen economy, contributing to reducing carbon emissions and advancing green mobility.

Light-Duty Vehicles to Lead the Market (by Application)

The light-duty vehicle segment is expected to dominate the hydrogen fueling station market, fueled by growing demand for zero-emission transportation solutions. In urban settings, hydrogen-powered fuel cell vehicles offer advantages like extended driving range and rapid refueling when compared to battery electric vehicles. Supportive government policies, expanding hydrogen vehicle fleets from leading automakers, and rising environmental awareness among consumers are key growth enablers. Ongoing advancements in fuel cell technology and stricter air quality and sustainability regulations further reinforce the role of light-duty vehicles in accelerating hydrogen infrastructure deployment.

Key Drivers of the Hydrogen Fueling Station Market

-

Rising Adoption of Fuel Cell Electric Vehicles (FCEVs): The global FCEV stock grew by 20% in 2023, with strong momentum in medium- and heavy-duty segments, particularly in China. This expansion is directly increasing the need for hydrogen refueling infrastructure.

-

Strategic Industry Collaborations: Partnerships such as BMW–Toyota and initiatives by companies like Nikola Corporation—introducing more fuel-cell trucks—are accelerating the deployment of hydrogen fueling networks.

-

Technological Advancements: Innovations in automation, high-pressure fueling systems, and station design are improving operational efficiency, reducing downtime, and enabling scalable infrastructure.

-

Support for Clean Energy Transition: Hydrogen stations are critical in supporting the shift toward decarbonization, helping governments and industries meet sustainability targets and clean mobility goals.

Request A Detailed Sample on the Hydrogen Fueling Station Market!

Why Is Asia-Pacific Emerging as a Leader in the Hydrogen Fueling Station Market?

Asia-Pacific is set to lead the hydrogen fueling station market, fueled by strong government investments in countries like China, Japan, and South Korea. These nations are integrating hydrogen into their energy strategies to cut emissions and enhance energy security. Supportive policies, rising FCEV adoption, and advancements in technology are accelerating infrastructure development, positioning the region as a global hydrogen hub.

Opportunities in the Hydrogen Fueling Station Market

-

Advancements in Hydrogen Production Technologies: Innovations in proton exchange membrane (PEM) electrolyzers are lowering production costs, making green hydrogen more commercially viable.

-

Improvements in Hydrogen Storage Efficiency: Breakthroughs in carbon nanotubes (CNTs) are enhancing hydrogen storage capabilities, enabling more efficient and compact fueling station designs.

-

Growing Industrial Demand: Increasing hydrogen use across transportation, steel, and chemical industries presents a strong investment opportunity in refueling infrastructure.

-

Government Support for Green Hydrogen: National programs such as India’s National Green Hydrogen Mission and Canada’s green hydrogen initiatives are accelerating infrastructure development and market expansion.

Key Players in the Hydrogen Fueling Station Market

-

Air Liquide

-

Nel ASA

-

Linde plc

-

Air Products and Chemicals, Inc.

-

Atawey S.A.S.

-

Iwatani Corporation

-

Ingersoll Rand

-

Chart Industries

-

H2 MOBILITY

-

sera GmbH

-

Powertech Labs Inc.

-

Galileo Technologies

-

Nikola Corporation

-

Maximator GmbH

-

Resato Hydrogen Technology

Future Outlook

The hydrogen fueling station market is set to play a pivotal role in the global clean energy transition. As investments grow and technology matures, hydrogen infrastructure will become increasingly mainstream, enabling widespread adoption of FCEVs and contributing to a low-carbon future.

Get Detailed Insights on Advanced Materials & Chemicals Market

Conclusion

The hydrogen fueling station market is rapidly evolving as a cornerstone of the global clean energy transition. Driven by technological innovation, supportive government policies, and growing adoption of fuel cell electric vehicles, the market is poised for significant expansion. As countries invest in hydrogen infrastructure and industries seek sustainable alternatives, hydrogen fueling stations will play a critical role in achieving zero-emission goals and shaping a low-carbon future.

About BIS Research

BIS Research is a global market intelligence firm delivering insights on emerging technologies and high-growth industries. We help businesses stay ahead with in-depth reports, custom research, and go-to-market strategies tailored to your goals.

Explore our Custom Research and Go-To-Market Strategy services.

Media Contact

Company Name: BIS Research

Contact Person: Bhavya Banga

Email: Send Email

Phone: +1-510-404-8135

Address:39111 PASEO PADRE PKWY STE 313, FREMONT CA 94538

City: Fremont

State: California

Country: United States

Website: https://bisresearch.com/