NEW YORK, NY - Small and mid-sized businesses (SMBs), long considered the backbone of the U.S. economy, are navigating a period of relentless financial strain. A new survey from Revenued highlights how inflation, tightening credit, and trade uncertainty are eroding profitability, forcing business owners to rethink strategies to survive.

The Revenued Q3 2025 State of Small Business Report, based on responses from 131 Revenued accountholders, offers a candid look at these challenges and the steps SMBs are taking to stay afloat. A companion episode of The Revenued Review podcast provides real-world commentary from business owners dealing with these pressures firsthand.

Read and download the full report here: https://www.revenued.com/tariff-impact-small-businesses

Key Findings:

Inflation Takes a Toll on Margins: Nearly 40% of SMBs identified inflation as their top operational challenge, with many seeing an 11% drop in average margins over the past year. Businesses are split between raising prices (60%) and absorbing costs (38%), but both approaches come with significant trade-offs. As one Florida retailer noted on the podcast: “We can’t keep raising prices without losing customers, but costs keep climbing. We’ve halved our margins this year.”

Financing Remains Out of Reach for Many: Capital constraints continue to weigh heavily on SMBs, with 49% denied a traditional bank loan in the last two years. Startups and younger businesses are even more affected, with rejection rates reaching 68%. As a result, 70% have turned to alternative funding options like revenue-based financing to bridge gaps and stay operational.

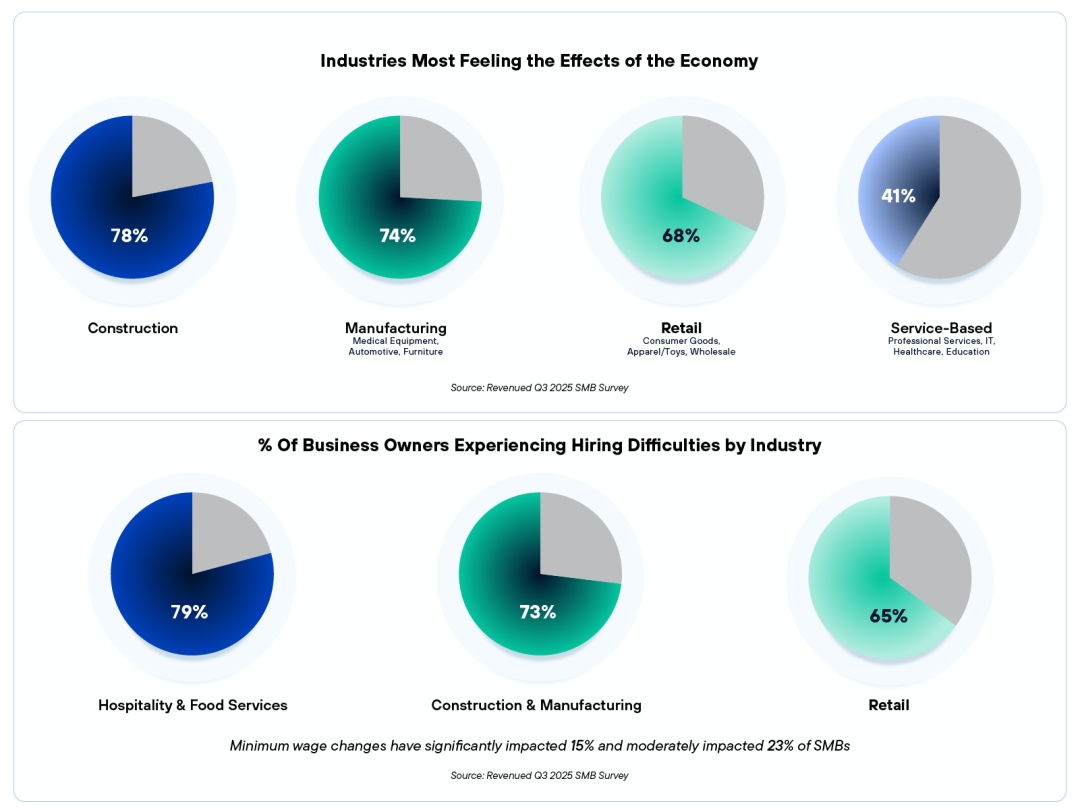

Tariff Fallout Disrupts Operations: Two-thirds of respondents reported being directly impacted by tariffs, leading to price hikes, inventory delays, and forced supplier changes. Manufacturers and construction companies have been hit hardest, with 78% facing rising raw material costs. One Texas construction owner explained: “Copper wire prices jumped 25% in two months, we had to start stockpiling just to stay on schedule.”

Resilience Under Pressure: While some entrepreneurs are planning investments and hiring, the report shows that growth ambitions are tempered by financial realities. Many are turning to defensive strategies, including diversifying revenue, renegotiating contracts, and building cash reserves.

A Ground-Level Perspective:

Numbers alone can’t capture the daily realities of operating under these pressures. The companion Revenued Review podcast episode features business owners sharing candid experiences, offering a fuller picture of how SMBs are navigating today’s turbulent market.

About Revenued:

Revenued provides revenue-based financing solutions that help small businesses manage volatility and access capital. Products like the Revenued Business Card and Flex Line offer flexible funding tied to a business’s revenue performance.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Revenued

Contact Person: Leah Hughes

Email: Send Email

Phone: +1 551-347-039

Address:55 Almeria Ave 2nd Floor

City: Coral Gables

State: Florida 33134

Country: United States

Website: https://www.revenued.com/