Board continues to advance strategic review following sale of SRB business

TOMBALL, TX / ACCESSWIRE / August 21, 2023 / RiceBran Technologies (NASDAQ: RIBT) ("RiceBran" or the "Company"), an innovator in the development and manufacture of nutritional and functional ingredients derived from rice, barley and oats, today announced financial results for the second quarter ended June 30, 2023.

Eric Tompkins, Executive Chairman of RiceBran, commented, "The divestiture of our stabilized rice bran ("SRB") business during the second quarter was the first step in a process aimed to reduce costs and curb losses, creating more optionality to explore strategic alternatives and better position the Company to realize the value of its remaining assets."

"Operationally, RiceBran delivered positive gross profit in 2Q23 from continuing operations, reversing prior quarters of gross losses, due to improved efficiency, recent capacity enhancements and higher volumes," Tompkins added. "Moving forward we are focused on further rationalizing our costs while exploring any and all alternatives to create value. With an ongoing strategic process in place and the Company's Board of Director (the "Board") actively evaluating a variety of potential outcomes, we have opted to forgo a quarterly conference call until a time when we are in a better position to share more meaningful disclosures on our strategic progress."

Second Quarter 2023 Financial and Operational Overview

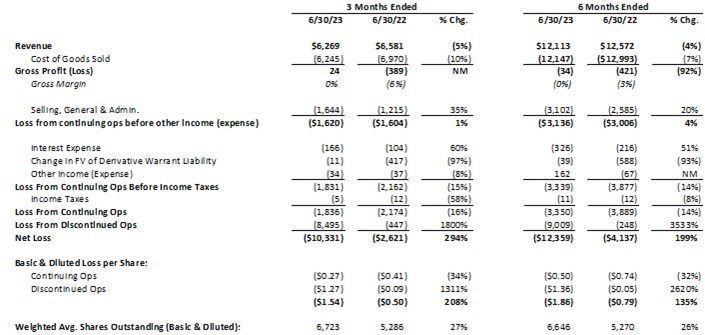

- Revenue: Total revenue from continuing operations was $6.3 million in 2Q23, down 4.7% from 2Q22 as lower MGI Grain Inc, ("MGI") milling revenues were offset by an increase in Golden Ridge Rice Mills ("Golden Ridge") milling revenues.

- Gross Profit: Gross profit from continuing operations for 2Q23 was $24,000 compared to a gross loss of $0.4 million in the second quarter of 2022, reflecting higher gross profit at Golden Ridge related to increased volume and at MGI due to the elimination of certain operational inefficiencies.

- SG&A and Operating Loss: SG&A from continuing operations increased $0.4 million year-over-year due to increased legal costs as the Board continues to explore strategic alternatives. Loss from continuing operations before other income (expense) was $1.6 million in 2Q23, consistent with 2Q22, because the impact of improved gross margins was offset by increased legal expenses.

- Loss from Continuing Operations and Loss from Discontinued Operations: The Company reported a loss from continuing operations of $1.8 million in 2Q23 compared to $2.2 million in 2Q22. RiceBran also reported a loss from discontinued operations of $8.5 million in 2Q23 compared to $447,000 in 2Q22. The loss from discontinued operations reflects the sale of the SRB business, including a loss on the sale of $8.6 million.

- Net Loss and EPS: Inclusive of the loss from discontinued operations, net loss was $10.3 million in 2Q23 compared to $2.6 million in 2Q22. Loss per share from continuing operations was $(0.27) in 2Q23 compared to $(0.41) in 2Q22. Loss per share from discontinued operations was $(1.27) in 2Q23 compared to $(0.09) in 2Q22.

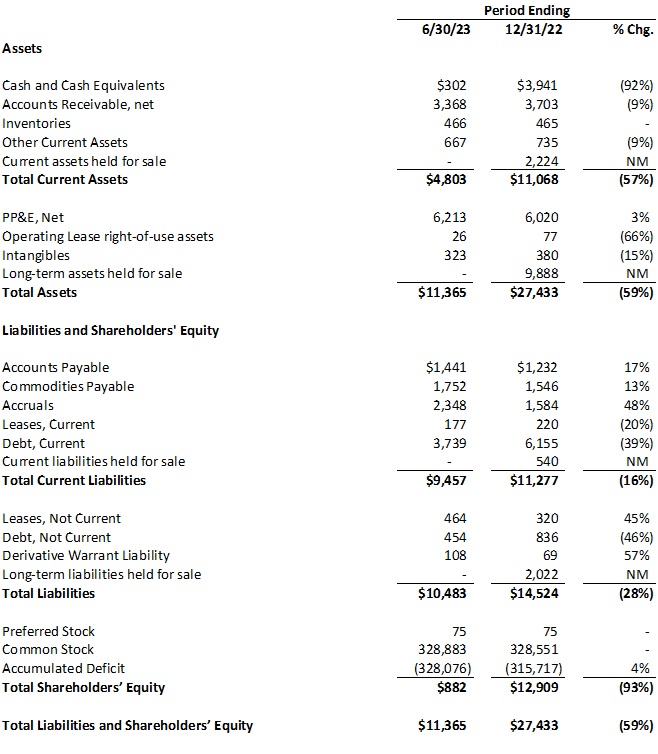

Balance Sheet: Total cash was $0.3 million at the end of 2Q23 down from $3.9 million at the end of 4Q22, after repayments of $3.0 million on the Company's factoring, line of credit and long-term debt and finance lease liabilities. Our current liquidity, consisting of cash and availability from our factoring facility, is $0.6 million.

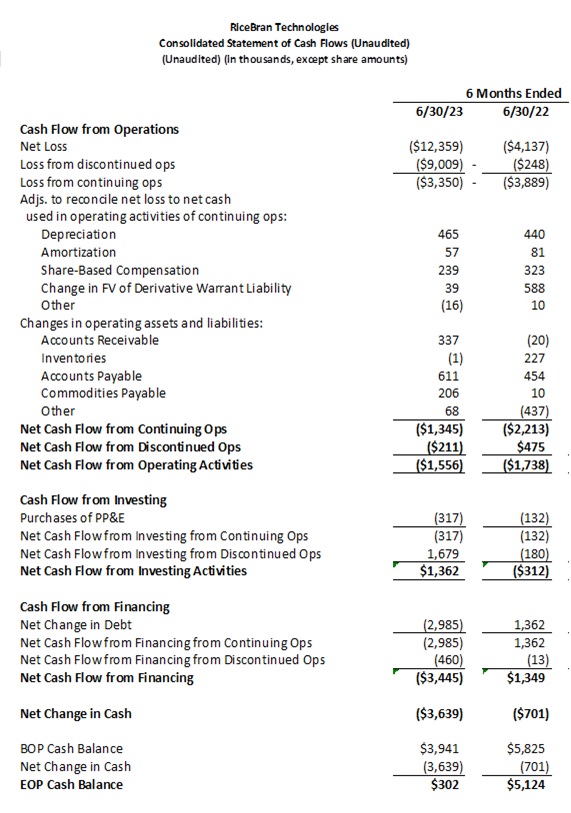

In our continuing operations, during the first half of 2023, we used $1.3 million of cash to fund operating activities and $0.3 million for capital expenditures. This was offset by the $1.0 million of cash provided by the SRB business' operations and its June 23,2023 disposition.

About RiceBran Technologies

RiceBran Technologies is a specialty ingredient company focused on the development, production and marketing of products derived from traditional and ancient small grains. We create and produce products to deliver improved nutrition and ease of use, while addressing consumer demand for all natural, non-GMO and organic products. The target markets for our products include human food, animal nutrition manufacturers and retailers, as well as specialty food retailers. More information can be found in the Company's filings with the U.S. Securities and Exchange Commission (the "SEC") and by visiting our website at http://www.ricebrantech.com.

Forward-Looking Statements

This press release includes statements concerning RiceBran and its future expectations, plans and prospects that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such "forward-looking statements" include, but are not limited to, statements about RiceBran's intentions, beliefs or current expectations. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "would," "expect," "plans," "anticipate," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," or the negative of these terms or other similar expressions. The forward-looking statements in this press release are based on current expectations, estimates, forecasts and projections about the industry and markets in which the Company operates and management's beliefs and assumptions. The Company cannot guarantee that it actually will achieve the plans, intentions, expectations or guidance disclosed herein. Such forward-looking statements, and all phases of the Company's operations, involve a number of risks and uncertainties, any one or more of which could cause actual results to differ materially from those described in its forward-looking statements. Assumptions and other information that could cause results to differ from those set forth in the forward-looking information can be found in RiceBran's filings with the SEC, including its most recent annual report on Form 10-K and its quarterly reports on Forms 10-Q. Except as required by law, RiceBran does not undertake to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking information.

Investor Contact

Rob Fink

FNK IR

ribt@fnkir.com

646.809.4048

RiceBran Technologies

Condensed Consolidated Statements of Operations

(Unaudited) (in thousands, except share and per share amounts)

RiceBran Technologies

Condensed Consolidated Balance Sheets

(Unaudited) (in thousands, except share amounts)

SOURCE: RiceBran Technologies

View source version on accesswire.com:

https://www.accesswire.com/774974/RiceBran-Technologies-Reports-Second-Quarter-2023-Results