VANCOUVER, BC / ACCESS Newswire / May 13, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO), a North American mineral acquisition and exploration company, is pleased to announce that its submission of Form 211 to FINRA has been cleared and the Company's shares now qualify for trading in the United States on the OTCQB® Venture Market. The Company's shares will commence trading on the OTCQB® in the coming days under the symbol "FOMTF".

The OTCQB, operated by OTC Markets Group Inc., is recognized as a premier marketplace for emerging and growth-focused companies in the U.S. and globally. Companies listed on the OTCQB meet rigorous financial and reporting standards established by the U.S. Securities and Exchange Commission, providing investors with enhanced transparency and reliable information. This upgrade will not only reinforce Formation's commitment to excellence but also enhances its visibility among a broader investor audience, bringing new confidence to those investing in its future.

The uplisting of Formation's shares to the OTCQB® is a key piece of Formation's strategy to bring global visibility to the Company as it strives to establish itself as a leader in the precious metals industry.

"Uplisting to the OTCQB will be a transformative step for Formation Metals" said CEO Deepak Varshney. "We are thrilled to be joining this respected market, which, along with our existing DTC eligibility, may provide new opportunities for visibility, liquidity, and engagement with both institutional and retail investors in the US market."

Mr. Varshney continued: "With preparations for our fully funded 5,000 metre maiden drill program at N2 underway, the upcoming quarter will be a very busy one for Formation. Our maiden program will focus on building on the successes of our predecessors. The drilling discoveries made by Agnico-Eagle and Cypress after the initial historic resource estimate show the expansion potential at N2. With gold at nearly $3,300, almost 5 times the price in 2008 when Agnico last drilled the project, we believe that the timing is perfect for a near-surface multi-million-ounce deposit in a safe jurisdiction like Quebec. We see the potential for over three million ounces of gold at N2, and our maiden 5,000-metre drilling program will mark the beginning of Formation's pursuit of that goal."

Project Summary

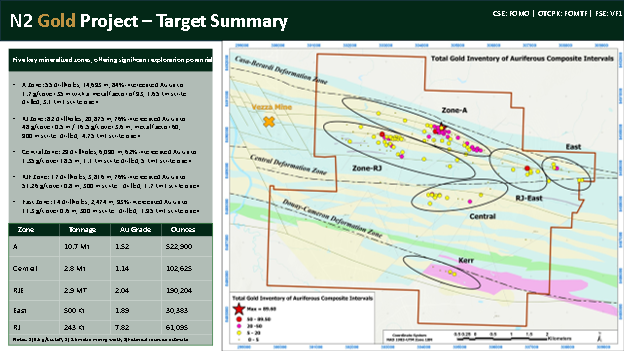

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project ("N2") is an advanced gold project with a global historic resource of 877,000 ounces: 18.2 Mt grading 1.48 g/t Au (~810,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~67,000 oz Au) across the RJ zone2,4. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

Formation's maiden drill program will focus on:

the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with numerous intermittent and consecutive auriferous intervals (84% of historical drill holes intercepted Au up to 1.7 g/t over 35 m)2, of which only ~35% of strike has been drilled (>3.1 km open); and

the "RJ" zone, host to bonanza intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

Figure 1 - Property overview summarizing historical work completed at each of the six mineralized zones and their respective historical resource.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic non-compliant intercepts.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of 877,000 ounces and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to historical bonanza intercepts as high as 51 gpt Au over 0.8 metres.

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email info@formationmetalsinc.com or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's uplisting to the OTCQB and the expected benefits and timing of same; the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's view that timing is perfect for a near-surface multi-million-ounce deposit the Property; the Company's view that the Property has the potential for over three million ounces of gold and the 5,000-metre drilling program marking the beginning of the Company's pursuit of that goal. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire