SINGAPORE, Aug 14, 2024 - (ACN Newswire) - SGX Catalist-listed AsiaMedic Limited (the “Company” and together with its subsidiaries, the “Group”) announced its financial results for the financial period ended 30 June 2024 (“1H2024”).

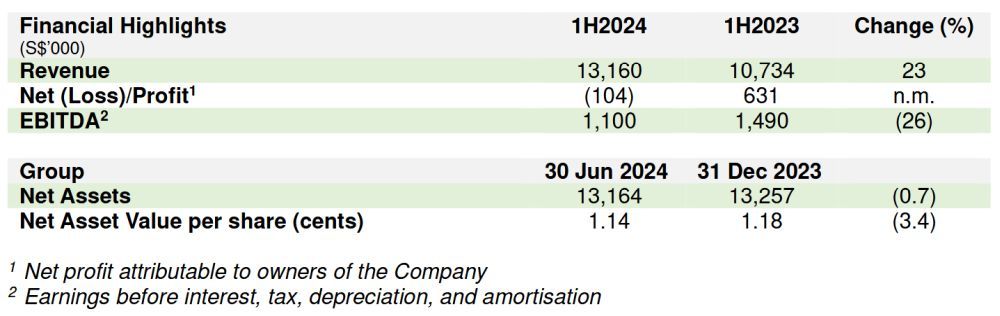

The Group’s 1H2024 revenue increased by S$2.4 million or 23% from S$10.7 million for 1H2023 to S$13.2 million due to the increase in revenue from the imaging and aesthetic businesses. The increase follows three consecutive years of revenue growth as the Group continues to pursue further capacity expansion to serve more patients.

The increase in revenue from the diagnostic imaging business was primarily due to the addition of a third MRI scanner in the last quarter of 2023 while the increase in revenue from the aesthetics business was due to the engagement of a senior aesthetic doctor and the acquisition of the medical aesthetics business of LE Private Clinic in August 2023.

The set-up of the new diagnostic imaging centre in Novena as well as expanded operations at Shaw Centre have necessitated the hiring of additional staff and doctors amidst intense competition for talent in the industry. The additional manpower was also supported by the purchase of new equipment incorporating the latest technology.

The Group’s consumables expenses increased by 44% to S$1.0 million, personnel expenses increased by 30% to S$7.3 million, and laboratory and consultancy fees increased by 55% to S$2.2 million. In addition, depreciation of right-of-use assets increased by 36% to S$0.7 million for 1H2024 due to the purchase of the new MRI scanner in the last quarter of 2023 and the new CT scanner in 1H2024, as well as the lease of new clinic space at Orchard Building in 1H2023.

As a result, the Group recorded a borderline loss of S$0.1 million for 1H2024 as compared to a profit of S$0.6 million for 1H2023. On the balance sheet, the Net Asset Value per share (cents) fell slightly by 0.04 cent from 1.18 cents per share to 1.14 cents per share.

Investing for Future Growth

Mr Arifin Kwek, Chief Executive Officer of AsiaMedic Limited, said, “We are encouraged by the continued revenue growth which reflects our ongoing pursuit of further capacity expansion to serve more patients. The Group’s new diagnostic imaging centre set-up in partnership with Sunway Berhad remains on track to commence operations by November 2024 and will nearly double the Group’s diagnostic imaging capacity.”

“While our initial essential investments in new talent and technology may lead to margin compression in the short term, the expanded capacity and increase in productivity will also generate economies of scale and operational efficiencies which will play a significant role in the Group’s focus on attaining sustainable higher margins in the longer term,” he added.

In August 2024, the Group implemented a new artificial intelligence virtual assistant to automate the scheduling of patient appointments. The system will free clinic staff from mundane tasks, allowing them to dedicate more time for high value in-person patient care.

The Group’s focus on talent acquisition and investing in technology will pave the way for long-term sustainable growth and the creation of shareholder value.

This press release should be read in conjunction with the financial statements announcement for 1H2024 uploaded on SGXNet.

For media and analysts’ queries, please contact:

Waterbrooks Consultants

Wayne Koo

T: (65) 9338 8166

E: wayne.koo@waterbrooks.com.sg

About AsiaMedic Limited

AsiaMedic Limited together with its subsidiaries (“AsiaMedic” or the “Group”) is a leading healthcare provider in Singapore which provides holistic solutions through integrated application of the latest medical technologies to prevent and detect early illnesses to achieve positive experiences and clinical outcomes for patients.

The Group is committed to helping clients through practical and personalised solutions delivered with the highest professional standards of service and expertise in a timely, safe and consistent manner. Conveniently located at Orchard Road, AsiaMedic is a preferred one-stop centre for:

- Diagnostic imaging and radiology services

- Medical wellness and health screening services

- Primary healthcare services

- Medical aesthetic services and products

For more information, please visit www.asiamedic.com.sg

This announcement has been reviewed by the Company's Sponsor, Xandar Capital Pte Ltd. It has not been examined or approved by the Singapore Exchange Securities Trading Limited (the “SGX-ST”) and the SGX-ST assumes no responsibility for the contents of this announcement, including the correctness of any of the statements or opinions made or reports contained in this announcement. The contact person for the Sponsor is Ms Pauline Sim (Registered Professional) at 3 Shenton Way, #24-02 Shenton House, Singapore 068805. Telephone number: (65) 6319 4954.

]]>Source: AsiaMedic Ltd

Copyright 2024 ACN Newswire . All rights reserved.