Fintech giant Visa (V) reported its fourth quarter of fiscal 2025 earnings on Oct. 28. Visa’s results show why it remains one of the most dependable growth stories in fintech. With double-digit revenue and earnings growth, massive shareholder returns, and continued investment in artificial intelligence (AI), cross-border payments, and stablecoin innovation, the company is proving that its dominance in digital payments is far from over.

V stock has gained 9.5% year-to-date (YTD), compared to the S&P 500 Index ($SPX) gain of 16.5%. Let’s find out why this remains a must-own fintech stock.

Visa: A Quiet Compounder Still Dominating the Global Payments Game

Visa wrapped up another impressive fiscal year, proving that even in a volatile global environment, its growth engine remains intact. In the fourth quarter, Visa’s net revenue rose 12% year-over-year (YoY) to $10.7 billion, while adjusted earnings per share (EPS) rose 10% to $2.98 YoY. For the full year, revenue increased 11% to $40 billion, and adjusted EPS rose 14% to $11.47. Total payment volume for the year rose 8% to $14 trillion, while processed transactions totaled $258 billion, an increase of 10% over the prior-year quarter.

This success was driven by Visa's "network of networks," which is expanding at a rapid pace. In the Q4 earnings call, management noted that around 12 billion endpoints are now connected through Visa, including “4 billion cards, bank accounts, and digital wallets each.” The company added support for four stablecoins across four blockchains, convertible into 25 fiat currencies.

Visa’s core payment infrastructure continues to expand and modernize, with Visa credentials growing by 270 million in 2025. Visa’s tokenization push is also accelerating, now exceeding 16 billion tokens, up from 10 billion in mid-2024, as the company aims for 100% of e-commerce transactions to be tokenized. Additionally, its risk management system, which is backed by AI and external intelligence feeds, continues to battle fraud on a large scale.

Visa has quietly emerged as one of the main facilitators of cryptocurrency-related activity. Since 2020, it has handled $100 billion in cryptocurrency and stablecoin purchases using Visa credentials, as well as $35 billion spent on Visa-linked crypto cards. Management stated that momentum is strong in 2025, as stablecoin-linked Visa card spending has doubled year on year, with 130 programs in 40 countries. Furthermore, Visa is revolutionizing how consumers, merchants, and institutions interact with digital payments through the introduction of Visa Accept, Visa Pay, and Visa Flex Credential, among others.

Visa’s Commitment to Shareholders Is Intact

Visa ended the fourth quarter with $20 billion in cash, cash equivalents, and investment securities. Owing to its strong financial position, the board raised the quarterly dividend by 14%, highlighting Visa’s commitment to returning capital. With robust free cash flow generation, management reaffirmed its plan to continue repurchasing shares aggressively. In the fourth quarter alone, Visa repurchased $4.9 billion in stock and distributed $1.1 billion in dividends. As of September’s end, Visa still had $24.9 billion left under its share repurchase authorization.

Currently, Visa offers a dividend yield of 0.68%, compared to the financial sector average yield of 3.1%. However, its forward payout ratio of 19.1% implies that dividends are sustainable, leaving room for growth and continued investments in growth strategies.

Looking ahead, Visa's management anticipates another year of healthy growth in fiscal 2026. The company anticipates adjusted net revenue growth in the low double digits, similar to 2025 levels. EPS growth is also forecast to be in the low double digits, demonstrating Visa's ability to scale profitably while aggressively investing in future growth levers. Management remains confident that consumer spending will remain healthy, noting that macroeconomic conditions are expected to remain stable throughout the year.

Analysts covering Visa estimate earnings to rise 11.6% in fiscal year 2026, while revenue is projected to increase by 11%. Revenue and earnings are predicted to grow by 9.8% and 12.6%, respectively, in fiscal 2027. Currently, Visa is valued at 27 times forward 2026 earnings, compared to its five-year historical average price-to-earnings (P/E) ratio of 30x.

What Does Wall Street Say About V Stock?

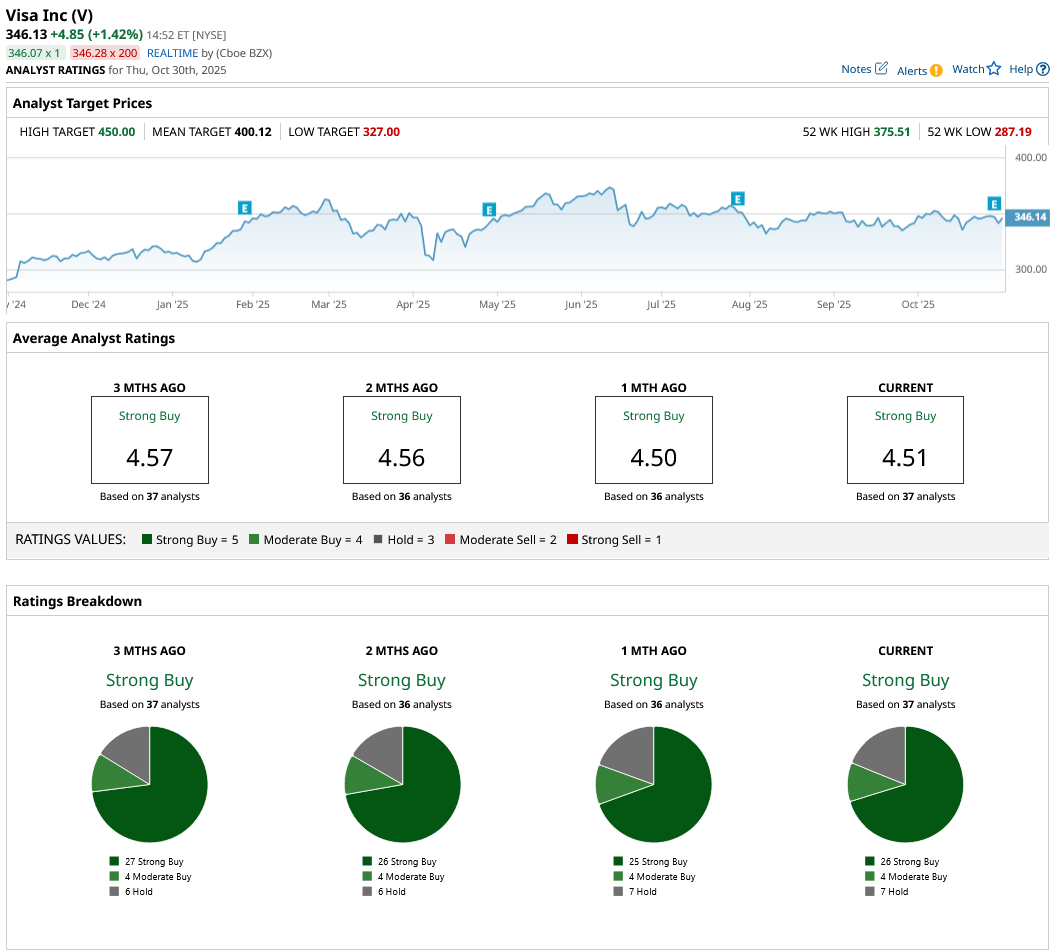

Overall, Wall Street rates V stock as a “Strong Buy.” Out of the 37 analysts covering the stock, 26 rate the stock a “Strong Buy,” while four rate it a “Moderate Buy,” and seven rate it a “Hold.” The average target price for V stock is $400.12, which implies an upside potential of 16%. The high price estimate of $450 suggests the stock can climb by 30% over the next 12 months.

With 12 billion endpoints, a next-generation network, and double-digit growth in all major metrics, Visa's story now is about reinvention. Despite being 66 years old, Visa is revolutionizing global payments in the digital era. For long-term investors seeking stability, scale, and steady compounding, Visa is a suitable fintech stock under $400 to include in a diversified portfolio.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G