TeraWulf (WULF) is a fast-growing developer and operator of environmentally sustainable, industrial-scale digital infrastructure focused on high-performance computing (HPC) and Bitcoin (BTCUSD) mining. TeraWulf leverages hydroelectric and nuclear energy at its major facilities, such as Lake Mariner, to deliver low-carbon operations at scale. As a vertically integrated platform, TeraWulf combines disciplined capital deployment and strategic partnerships to drive rapid growth and industry-leading data center economics.

Founded in 2021, the company is headquartered in Easton, Maryland.

About WULF Stock

WULF stock has displayed strong performance in 2025, gaining approximately 12% over the last five days and surging over 26% in the past month. The six-month return stands at over 418%, while its 52-week gain is 109%, significantly outperforming the Russell 2000 Index, which posted modest growth under 12% during the same period.

This impressive outperformance is driven by strategic partnerships and strong revenue growth expectations. TeraWulf’s focus on sustainable crypto mining and data center strategies has propelled investor interest, positioning it well above the small-cap benchmark.

TeraWulf Tops Results

TeraWulf reported Q3 2025 revenue of $42 million, marking an 84% increase year-over-year (YoY), beating analyst estimates projecting approximately $38 million. The company’s EPS reached $0.10, outperforming the consensus forecast of $0.07, driven by growing demand in its sustainable crypto mining operations and data center services. This strong top- and bottom-line performance highlights TeraWulf’s operational scaling amidst rising market interest in environmentally responsible digital asset infrastructure.

Delving deeper, TeraWulf improved gross margins to 43%, a notable rise from the prior quarter, supported by enhanced efficiency and increased production capacity. Operating expenses remained under control despite expansion efforts, resulting in improved operating income.

Cash and cash equivalents at quarter-end stood at $65 million, up from $58 million in Q2, reflecting steady free cash flow generation and prudent capital management.

Looking ahead, TeraWulf’s guidance anticipates continued robust revenue growth in Q4 2025, targeting a range of $48 million to $52 million with EPS estimated between $0.11 and $0.13. Management emphasized expansion of mining capacity and leveraging AI-related computing partnerships as core growth drivers, positioning TeraWulf strategically in the energy-efficient crypto and digital infrastructure market.

TeraWulf Signs a $9.5 Billion Deal

TeraWulf shares surged 20% on Tuesday following the announcement of a strategic 25-year AI compute joint venture with Fluidstack, aiming to develop 168 megawatts (MW) of high-performance computing capacity at its Texas campus. This JV, with a contracted revenue value of approximately $9.5 billion, grants TeraWulf a 51% stake in the project, with the total cost estimated at $8 million to $10 million per MW of critical IT load. Google (GOOG) (GOOGL) supports Fluidstack by backing $1.3 billion of the long-term lease obligations, aiding project financing.

Additionally, TeraWulf secured exclusive rights to partner with Fluidstack on the next ~168 MW data center, potentially increasing its contracted HPC capacity to over 510 MW. The company targets adding 250 to 500 MW of contracted IT load annually, reinforcing its robust growth strategy.

CEO Paul Prager emphasized that securing over 510 MW in the past 10 months confirms the execution of their expansion plans and solidifies their position in sustainable, low-carbon digital infrastructure.

This partnership and expansion reflect TeraWulf’s pivot from traditional Bitcoin mining toward AI-driven data center infrastructure, leveraging strong institutional backing and positioning for significant growth in the AI compute market.

Should You Buy WULF?

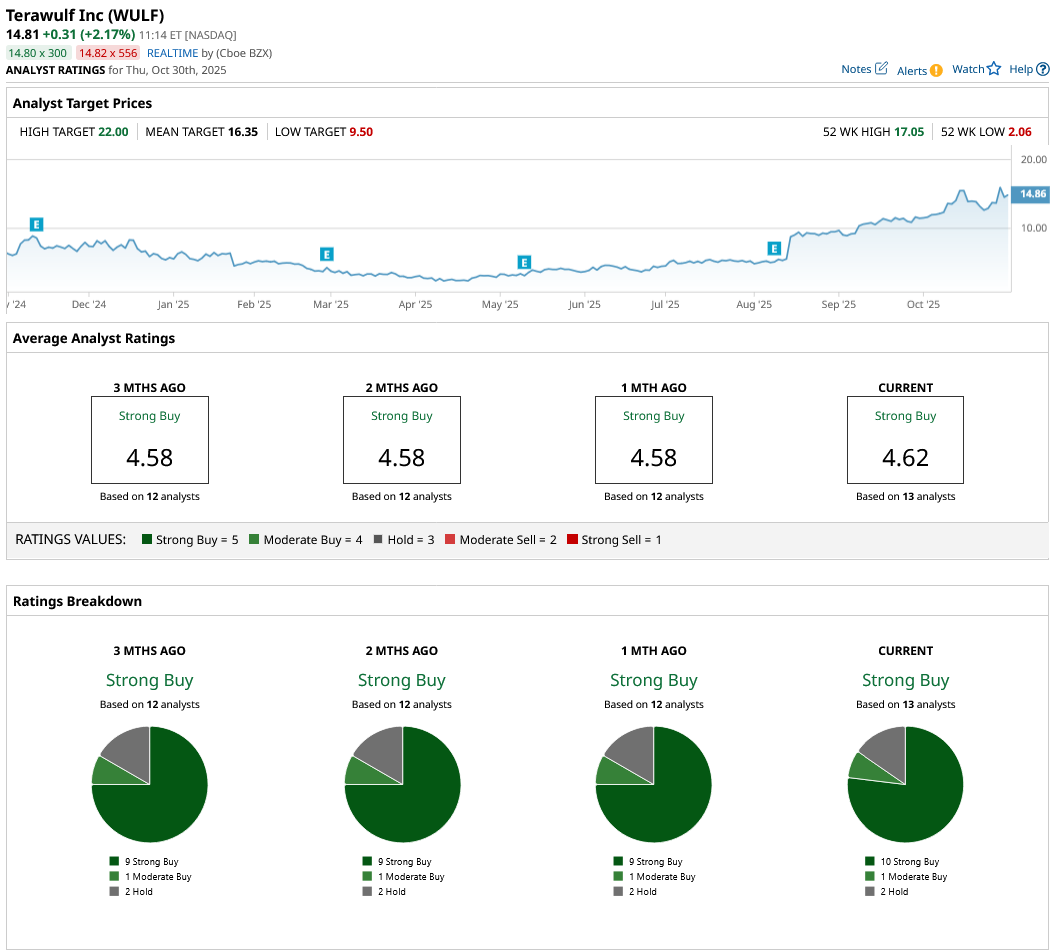

As TeraWulf surges ahead, analysts have given WULF stock a consensus “Strong Buy” rating with a mean price target of $16.35, reflecting an upside potential of 10.4% from the market rate.

The stock, which has been analyzed by 13 analysts, has received 10 “Strong Buy” ratings, one “Moderate Buy” rating, and two “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart