Mountain View, California-based Alphabet Inc. (GOOG) operates as a holding company, providing various internet products such as Google Chrome, Google Cloud, Google Maps, etc., and healthcare services, and more. With a market cap of approximately $3.3 trillion, Alphabet operates through Google Services, Google Cloud, and Other Bets segments.

Alphabet has notably outperformed the broader market over the past year. GOOG stock has soared 60.8% over the past 52 weeks and 44.5% in 2025, compared to the S&P 500 Index’s ($SPX) 18.1% gains over the past year and 17.2% returns on a YTD basis.

Narrowing the focus, GOOG has also outperformed the Communication Services Select Sector SPDR ETF Fund’s (XLC) 26% surge over the past year and 20.1% gains on a YTD basis.

In Q3 2025, Google Search, YouTube ads, Google subscriptions, platforms, and devices all observed a solid double-digit growth in revenues, while Google Cloud observed an even more impressive 33.5% surge in revenues to $15.2 billion. Moreover, the company’s revenues crossed the $100 billion mark for the first time in a quarter. Its topline grew 15.9% year-over-year to $102.3 billion, exceeding the Street’s expectations of $99.9 billion by 2.4%. Moreover, its EPS soared 35.4% year-over-year to $2.87, surpassing the consensus estimates by a notable margin. In the anticipation of solid growth, Google’s stock prices gained 2.5% in yesterday’s trading session before its Q3 results were released after markets closed.

For the full fiscal 2025, ending in December, analysts expect GOOG to deliver a 23.4% year-over-year growth in earnings to $9.92 per share. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

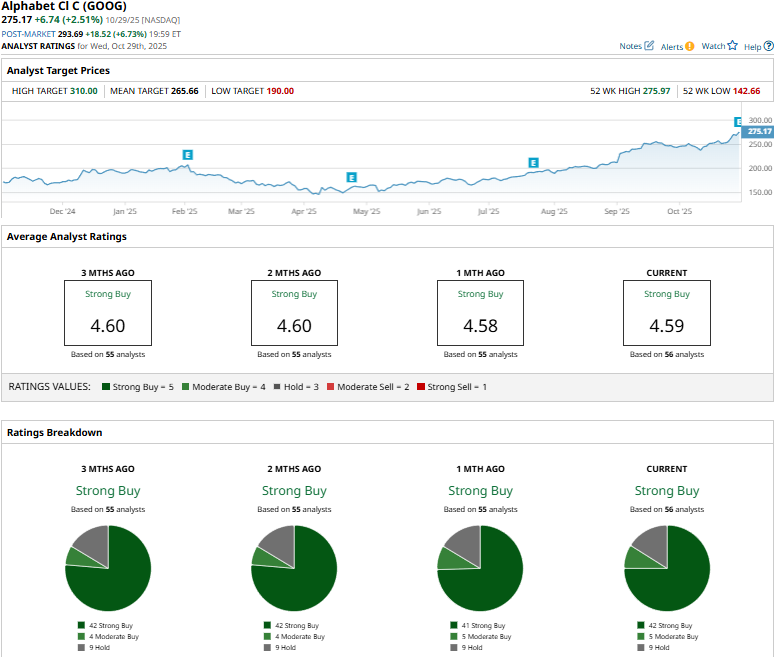

Moreover, analysts remain optimistic about the company’s prospects. GOOG has a consensus “Strong Buy” rating overall. Of the 56 analysts covering the stock, opinions include 42 “Strong Buys,” five “Moderate Buys,” and nine “Holds.”

This configuration is slightly more bullish than a month ago, when 41 analysts gave “Strong Buy” recommendations.

On Oct. 20, Oppenheimer analyst Jason Helfstein maintained an “Outperform” rating on Alphabet and raised the price target from $270 to $300.

As of writing, Google is trading above its mean price target of $265.66, and its street-high target of $310 suggests an upside potential of 12.7% from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart