“You’ve been Fi-served.”

Down 44% in a day? Well, at least if you had a stop order… uh, nope. That’s the message here. Stop orders will not save you when a stock plunges overnight. In fact, for decades I’ve been trying to say the same thing, to prevent traders and investors from getting burned.

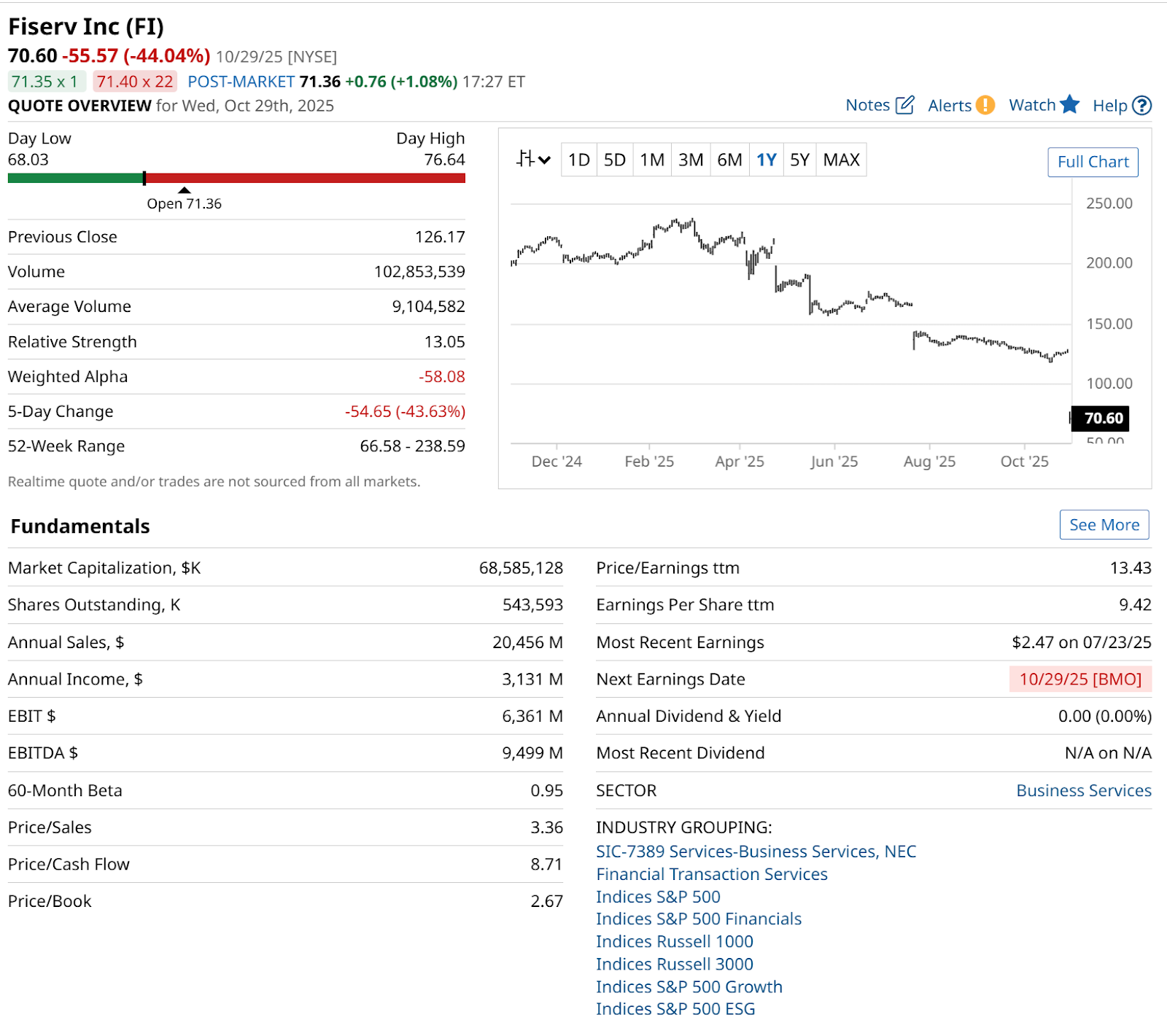

When you set a stop-loss order, unless it is a day-trade situation or a small down move in a stock that takes it right under your stop price level, you can’t rely on the order to help you. Case in point is Fiserv (FI), which is not a small stock. In fact, before Wednesday’s hot mess, it was one of the 150 biggest stocks in the U.S., well inside the top one-third of the S&P 500 Index ($SPX). Oops.

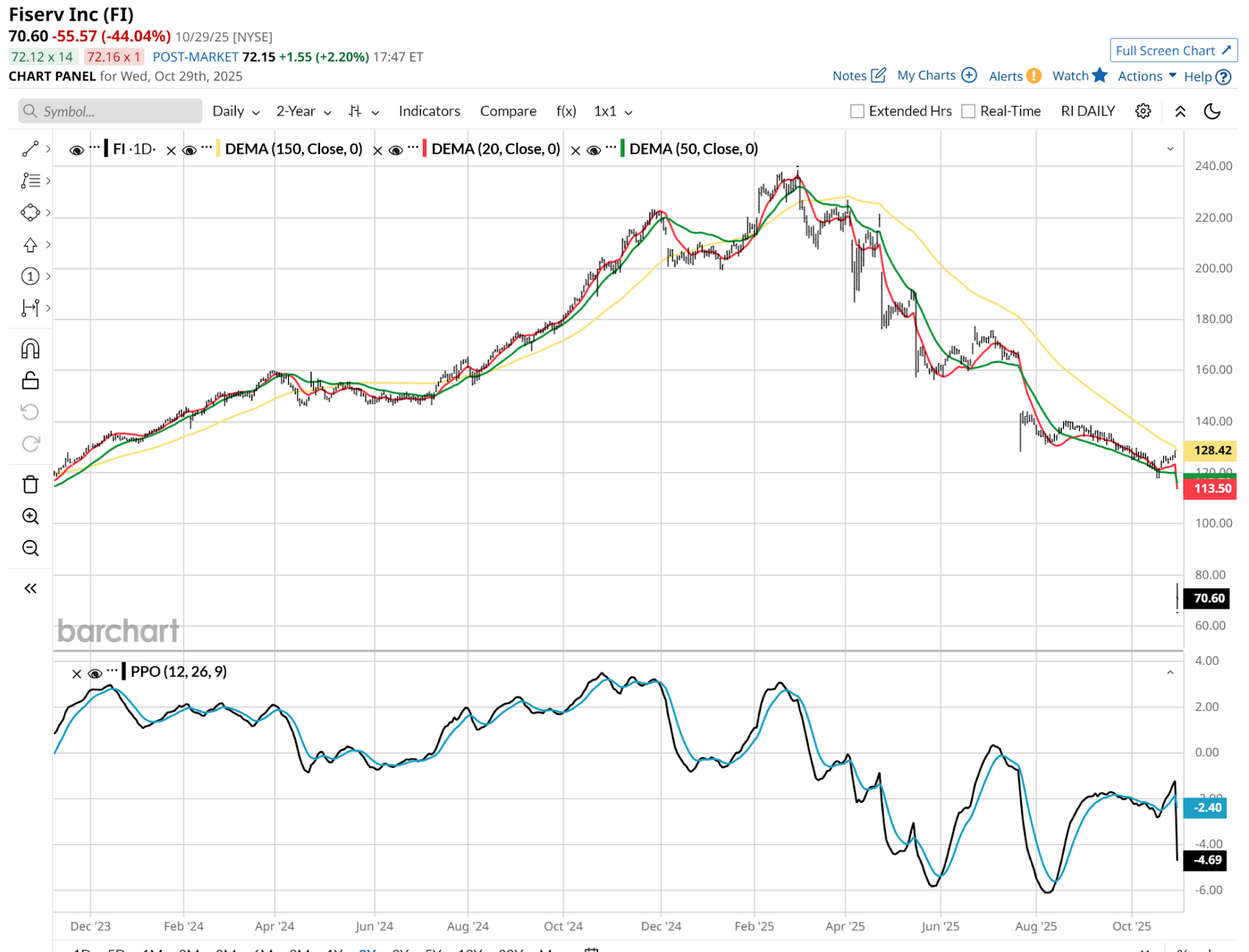

This is what it looked like up close. The stock closes one day at $128, and opens the next day at around half that value. If only it had been a 2:1 stock split. This is the issue I’ve always had with stop-loss orders. They get you out NOT at the price you’ve set, but where the market opens. Yes, you can place a stop-limit order, but that just means you’d still hold FI, down 44% in a day. That’s little consolation to me.

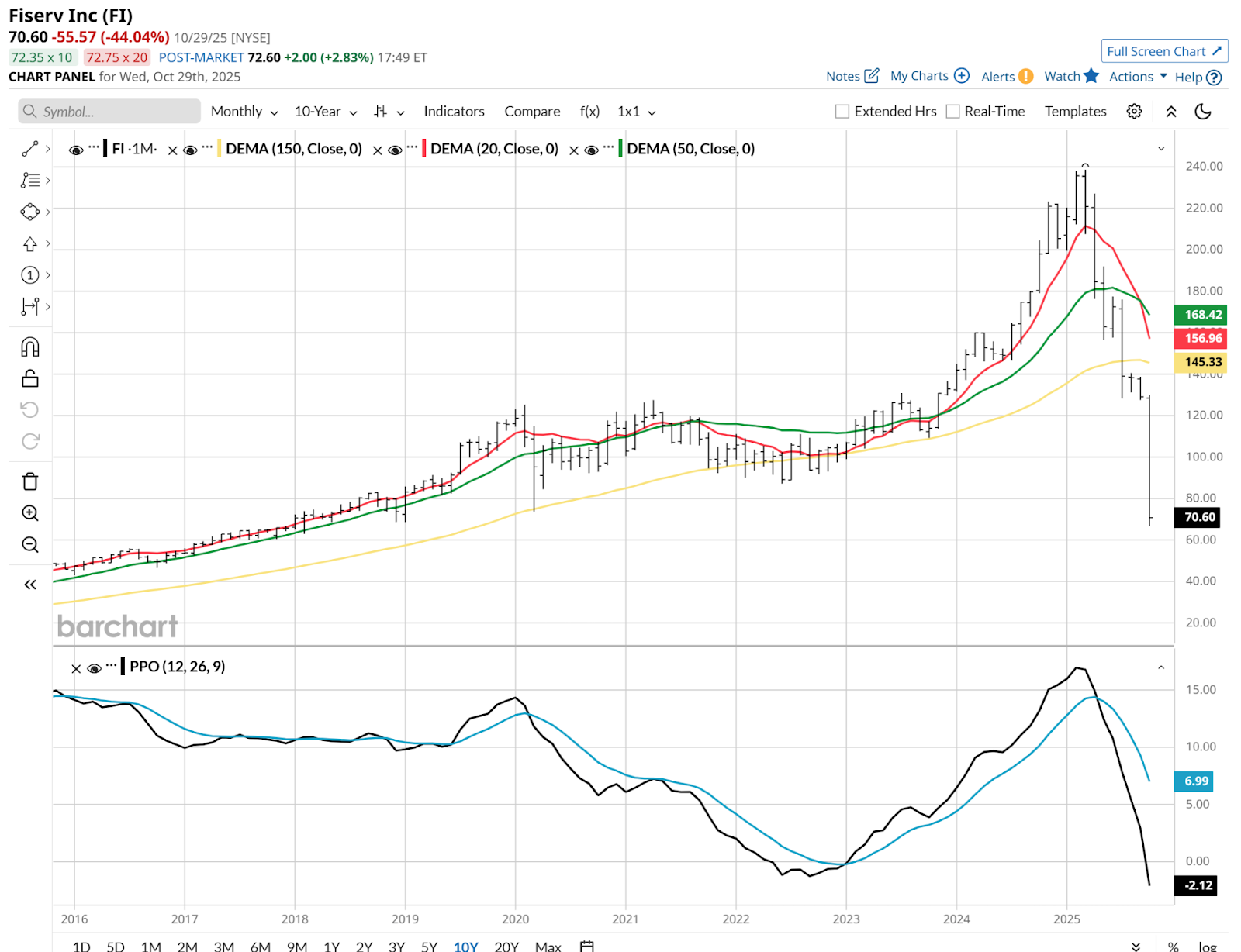

The crash in FI knocked it all the way back to its early 2018 level. Think about that.

This article is less about FI than it is a warning for traders. Fiserv was a stock selling at a reasonable multiple, with a history of market-like volatility. It is in a very competitive industry, but is a prominent business in its field. It is a fintech stock that even has its hands in crypto.

FI Is a Symptom of a Much Bigger Stock Market Problem

But none of that mattered on Wednesday. This is the stock market in 2025. And we should get used to it. Stocks rise and fall faster and stronger than many are used to. It is a very opportunistic market, but also a very dangerous one.

It is too late to consider using a collar to protect yourself from the carnage in Fiserv. But it is exactly why an option collar is such a viable strategy for so many stocks. Or at least a protective or “married” put option strategy.

The stock market of today is not about “buying great companies and holding them.” Unless that company is a virtual monopoly, or part of the favored network of artificial intelligence leaders. Risk management is more important in investing than at any time I’ve seen in 40 years in the markets.

If it could happen to FI, it could happen to nearly any stock.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- Options Volume in Banco Bradesco Soars, Fueling Breakout Buzz for Brazilian Bank

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move