Yesterday, Oct. 29, was a significant day for markets, marked by a flurry of tech earnings and the conclusion of the Federal Reserve’s October meeting, where the U.S. central bank cut rates by 25 basis points as expected.

Tech earnings were also strong, with Meta Platforms (META), Microsoft (MSFT), and Alphabet (GOOG) (GOOGL) all posting stellar revenue growth, which was at least in part driven by artificial intelligence (AI). However, the post-earnings price action today tells us that markets are not taking the ever-rising AI capex kindly, and both Meta and Microsoft are falling today after they upped their capex guidance.

Meta Stock Falls Below $700 After Q3 Earnings

Meta is particularly falling hard after the company announced a one-time tax charge of $15.93 billion related to the One Big Beautiful Bill Act. Also, the company talked about regulatory issues in the U.S as well as Europe. CFO Susan Li said that the company continues "to engage constructively with the European Commission on our less personalized ads offering,” but warned of a “significant impact” on revenues as early as the current quarter if the EU imposes more changes. In the U.S., several trials related to child safety are beginning next year, and Li cautioned that they might lead to a “material loss.”

Meta stock is trading below $700 today as the above-mentioned concerns more than offset the adjusted earnings beat and better-than-expected Q4 guidance. In this article, we’ll discuss whether the stock is a buy now or if more pain lies ahead for the Mark Zuckerberg-led company.

Meta Keeps Raising Its Capex Guidance

Meta’s burgeoning capex is spooking markets as the company is spending on AI as if there’s no tomorrow. During the Q3 earnings, Meta narrowed the 2025 capex guidance to between $70 billion and $72 billion. Notably, Meta had forecast 2025 capex to be between $60 billion and $65 billion during the Q4 2024 earnings call, which it subsequently raised to between $64 billion and $72 billion in the Q1 2025 earnings call. Since then, it has raised the midpoint of the guidance higher while keeping the top end at $72 billion. When it comes to AI capex, Meta has been aggressive. Its 2025 capex is expected to be 36% of the $197 billion in revenue that analysts predict it will generate this year.

The spending spree is far from over, and during the Q3 call, Li said, “As we have begun to plan for next year, it’s become clear that our compute needs have continued to expand meaningfully, including versus our own expectations last quarter.” Li talked about further “upward pressure” on capex and expenses in 2026 and said that the outlay will be “notably larger in 2026 than 2025.”

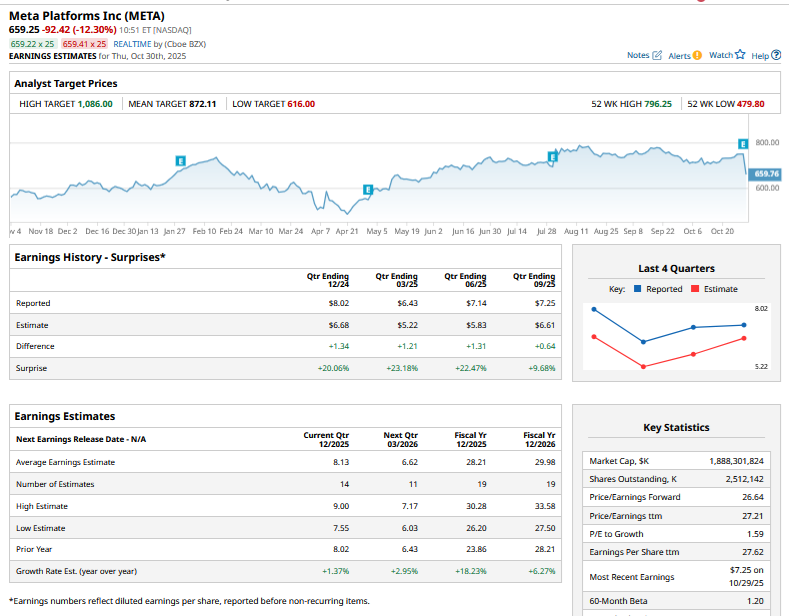

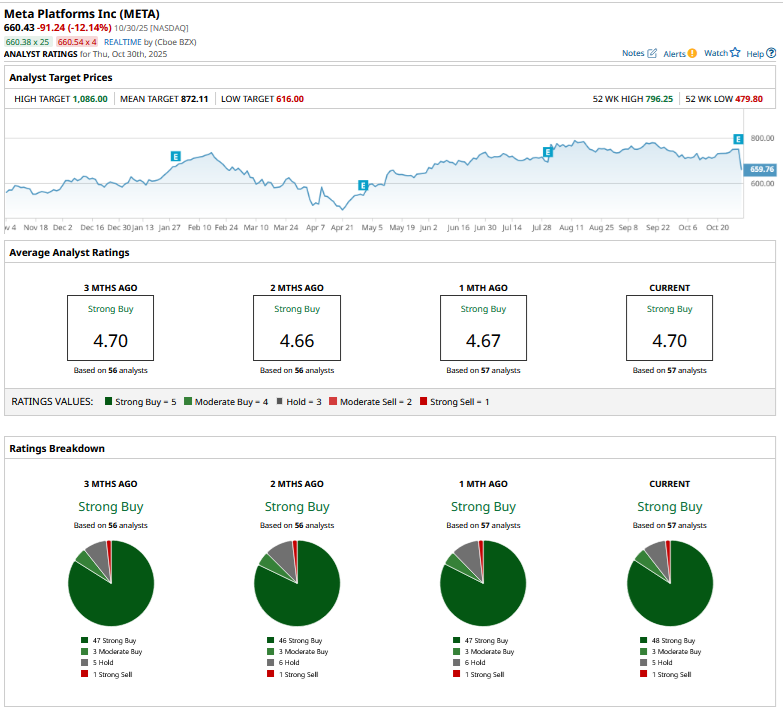

Meta Stock Forecast: Analysts Cut Their Target Prices

After Meta’s Q3 earnings release, several analysts lowered the stock’s target price. These include Bank of America, which cut the price estimate from $900 to $810, and Piper Sandler, which lowered the target price from $900 to $825. Oppenheimer went a step further and downgraded Meta from “Outperform” to “Perform." Oppenheimer analyst Jason Helfstein drew parallels with Meta’s investment in the metaverse, which hasn’t really paid off, and the segment continues to post massive losses that outstrip its revenues by almost 10x.

Will “Superintelligence” Become Another “Metaverse?”

I believe Helfstein raised a very pertinent question by comparing Meta’s capex in building its Superintelligence Lab, which is building new AI models, to the metaverse, which, in hindsight, is increasingly looking like a vanity project.

However, I believe that while Meta and Zuckerberg went ahead of the market to invest in the metaverse, it is doing the right thing by focusing on AI like other tech peers. AI initiatives have helped power Meta’s growth, and the Q3 revenue growth was the highest since Q1 2024. Meta’s core digital ad business is doing remarkably well, with AI only turbocharging growth.

That said, Meta’s profit growth might stay muted in the foreseeable future as the company’s AI spending puts pressure on the bottom line. At a forward price-earnings (P/E) multiple of over 26x, I believe Meta’s valuations are quite balanced, as the company sets the stage for the next era of growth. I find today’s dip an opportunity to add more shares as Meta strengthens its position as a leading AI play.

On the date of publication, Mohit Oberoi had a position in: META , GOOG , MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.