Microsoft’s (MSFT) latest quarterly results and the market’s reaction highlight concerns around growing disparity between growth and spending in the age of artificial intelligence (AI). While the technology giant delivered better-than-expected first-quarter financial results last night, its stock came under pressure in after-hours trading as investors focused on ballooning capital expenditures and growing fears that the AI boom could morph into a bubble.

Microsoft spent $34.9 billion in capital expenditures during the quarter, surpassing its earlier guidance of $30 billion. An aggressive push to build out the infrastructure powering AI applications and services for years to come has driven expenses higher. The company said that nearly half of that spending was directed toward short-lived assets such as GPUs and CPUs, which are the computational engines behind AI training and inference. These investments are essential to support surging demand on Azure, to expand first-party AI solutions, and to modernize Microsoft’s server and networking hardware.

The other half of the spending was on data centers and large-scale infrastructure projects with lifespans extending well over a decade. This includes $11.1 billion in finance leases tied to major data center developments.

MSFT’s Capital Expenditure to Rise

Looking ahead, the company signaled that spending will continue to rise. With cloud and AI demand accelerating and its remaining performance obligations (RPO) swelling, Microsoft now expects capital investment growth in fiscal 2026 to exceed that in fiscal 2025.

However, this rapid spending pace has raised concerns. Investors worry that AI infrastructure investments are expanding faster than the economic returns they generate. The concern is not only about margin compression, but also about the possibility of an AI bubble, in which valuations, spending, and expectations rise in tandem without a clear link to sustainable profit growth.

Notably, the increasingly interdependent nature of the AI ecosystem, where hyperscalers, chipmakers, and model developers are all locking into long-term partnerships, has added to the sense of froth, raising concerns about how much of this growth is real demand and how much is self-reinforcing hype.

Still, it would be premature to dismiss Microsoft’s growth strategy, especially as the payoff from its AI investments is already visible in its financial performance. The company’s Intelligent Cloud segment, led by Azure, posted $30.9 billion in revenue, up 28% year-over-year. Within that, Azure and other cloud services surged 40%, outpacing even Microsoft’s internal projections. Demand for Azure’s AI services continues to exceed supply, suggesting that capacity expansion is necessary.

Commercial momentum was robust in Q1. Bookings soared 112%, driven by new Azure commitments, including from OpenAI and a rising number of mega-deals exceeding $100 million. Further, MSFT’s commercial RPO jumped 51% to $392 billion, nearly doubling over two years, with steady duration indicating healthy near-term monetization.

What Should Investors Do?

Microsoft is spending heavily to strengthen its position in the AI economy, a bet that could yield outsized returns if AI adoption continues to accelerate across industries. MSFT’s strong growth metrics, emergence as a leading provider of cloud solutions for AI workloads, and integration of AI across its ecosystem position it well to capitalize on the demand.

Microsoft plans to boost its total AI capacity by more than 80% this year and nearly double its global data center footprint within two years. This expansion is in response to surging demand for AI workloads that are already stretching existing capacity.

Microsoft’s Q2 outlook remains robust. Management projects revenue for its Intelligent Cloud segment between $32.25 billion and $32.55 billion, marking 27% year-over-year growth. Azure’s growth trajectory remains solid, with Q2 revenue expected to rise around 37% in constant currency. The guidance reflects healthy demand trends and Microsoft’s ability to effectively monetize them.

Adding to its AI moat is Microsoft’s recently amended agreement with OpenAI. The revised deal grants Microsoft a 27% stake in OpenAI, valued at around $135 billion, and secures a $250 billion commitment for Azure services. These extended intellectual property rights strengthen Microsoft’s strategic control over some of the world’s most advanced AI technologies and will drive Azure’s growth.

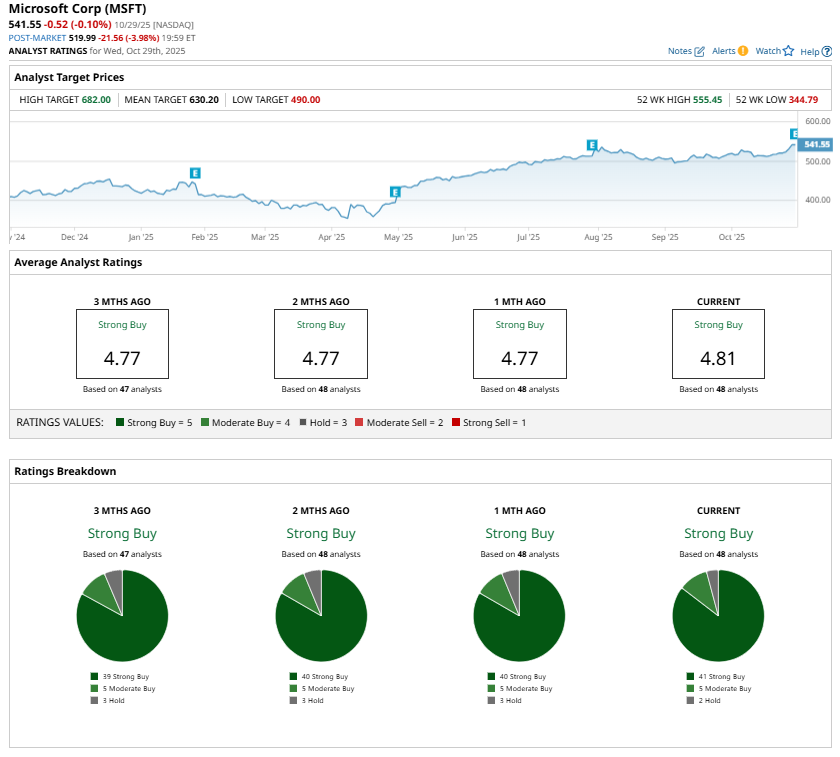

While the company’s capital expenditures are substantial and could pressure near-term margins, they are backed by accelerating demand. For long-term investors, MSFT stock is a buy. Analysts keep a positive outlook on MSFT stock and maintain a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart