Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) is one of the world’s largest food and beverage companies. Its offerings include sauces, cheese, meals, meat, refreshment beverages, coffee, and more. With a market cap of $31.8 billion, Kraft Heinz’s operations span the Americas, Europe, Indo-Pacific, and internationally.

The company has lagged behind the broader market in 2025 and over the past year. KHC stock prices have dropped nearly 20% in 2025 and 27.1% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16% gains on a YTD basis and 17.4% returns over the past year.

Narrowing the focus, KHC has also underperformed the Nasdaq Food & Beverage ETF’s (FTXG) 9.3% decline on a YTD basis and 14.4% drop over the past year.

Kraft Heinz’s stock prices plunged 4.5% in the trading session following the release of its mixed Q3 results on Oct. 29. The company has continued to face pressure on its topline. Due to a drop in organic revenues, the company’s overall sales declined 2.3% year-over-year to $6.2 billion, falling short of the Street’s expectations. Meanwhile, its adjusted EPS dropped 18.7% year-over-year to $0.61, but surpassed the consensus estimates by 7%.

While the company’s margins have been under pressure for several quarters, Kraft Heinz’s restructuring plan to reorganize itself as two separate companies by Q2 2026 can squeeze its margins further, at least in the short term, due to restructuring costs associated with reorganization.

For the full fiscal 2025, analysts expect KHC to deliver an adjusted EPS of $2.55, down 16.7% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

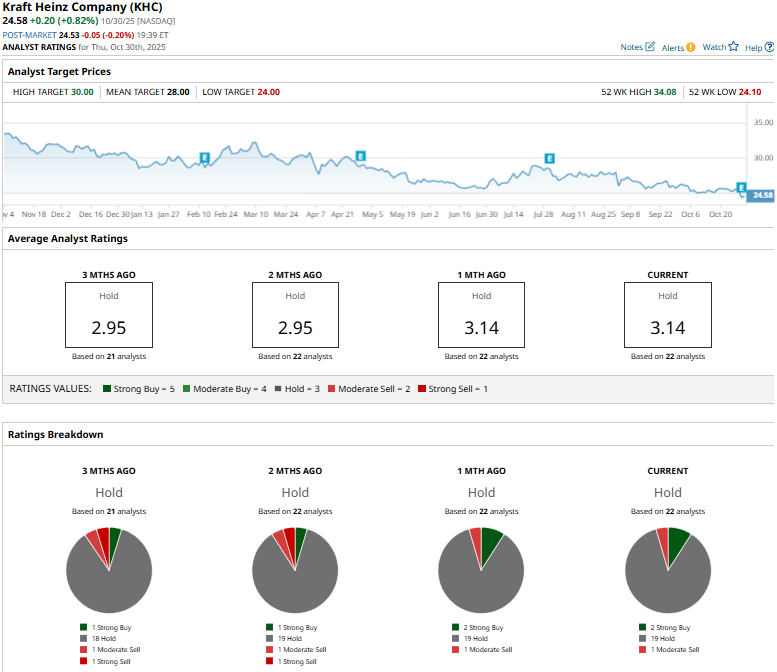

Among the 22 analysts covering the stock, the consensus opinion is a “Hold.” That’s based on two “Strong Buys,” 19 “Holds,” and one “Moderate Sell.”

This configuration is slightly less pessimistic than two months ago, when one of the analysts gave a “Strong Sell” recommendation.

On Oct. 29, TD Cowen analyst Robert Moskow reiterated a “Hold” rating on KHC and reduced the price target from $28 to $26.

KHC’s mean price target of $28 suggests a 13.9% upside potential. Meanwhile, the street-high target of $30 represents a 22.1% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever