If Nvidia (NVDA) is the defining company of the AI revolution, Palantir (PLTR) is one of its most exciting components. One of those rare companies that has been a multibagger on its own merit and not by association with the chip major, Palantir's collaboration with Nvidia brings another paradigm in the application of AI to data analytics.

At its GTC conference, amid several partnerships announced by the company, a noteworthy and powerful one was with Palantir. The terms of the partnership reveal that Nvidia will join hands with Palantir to build an integrated technology stack for operational AI, combining the latter's AI-based decision-intelligence platform (Ontology) with Nvidia's accelerated computing, software libraries, and open models.

Implications of the Alliance

This alliance unites two seminal players in the AI landscape whose stock performances have generated enormous returns for investors. In particular, the collaboration opens avenues for each to fortify its nascent yet expanding secondary operations: the software division at Nvidia and the commercial client base at Palantir.

From Nvidia's perspective, incorporating its computational resources and algorithms into Palantir's ecosystem aims to elevate the profitability of its software offerings. This step reassures market participants that the company extends far beyond its core hardware sales (notably GPUs), evolving from a mere supplier of components into a comprehensive provider of AI infrastructure. Such a shift bolsters its standing in emerging domains like autonomous agents and physical AI, a domain of special interest to CEO Jensen Huang.

For Palantir, harnessing Nvidia's algorithmic capabilities and processing muscle enhances the potency of its Ontology framework, yielding swifter and more sophisticated agents that resonate with demanding corporate customers in areas such as logistics, procurement networks, and government services. The arrangement further endorses Palantir's pivot toward business-oriented deployment scenarios, potentially fostering steady subscription income and extended engagement terms.

That said, challenges persist. Palantir will need to seamlessly weave Nvidia's technologies into its architecture and translate them into tangible benefits for end-users. Nvidia, in turn, confronts hurdles in embedding its sophisticated algorithms within varied corporate environments, which is a demanding endeavor that demands extensive tailoring and synchronization with clients' established technology frameworks.

Which Is a Better Pick?

Now to answer the billion-dollar, if not trillion-dollar, question: Which stock will be more rewarding at this point? And the answer is both. Both Nvidia and Palantir stocks should be part of investors' portfolios in the age of artificial intelligence. While Nvidia remains the undisputed leader in the area of chips, almost single-handedly driving the global AI ambitions, Palantir's expertise in leveraging AI to provide powerful insights that play a crucial role in the decision-making process for governments and enterprises alike is unmatched.

Financially, too, one cannot ask more from the companies. Both Nvidia's and Palantir's earnings have been topping Street expectations consecutively over the past two years, accompanied by expanding margins.

Coming to the most recent quarter, the scenario remained unchanged as both reported significant yearly growth in revenue and earnings.

While Nvidia's Q2 2025 revenue of $46.7 billion represented a year-over-year (YoY) growth rate of 56%, Palantir's quarterly revenue crossed the billion-dollar threshold for the first time. Palantir's Q2 2025 revenues of $1 billion marked an annual jump of 48%.

In terms of earnings, Nvidia's shot up by 54% from the previous year to $1.05. Meanwhile, Palantir's EPS of $0.16 denoted an even sharper growth of 77.8% in the same period.

Cash flow from operations also remained robust. Nvidia's net cash from operating activities grew to $15.4 billion in Q2 2025 from $14.5 billion in the prior-year period, while Palantir's figure for the same metric in the same period stood at $539.3 million, substantially up from the previous year's $144.2 million.

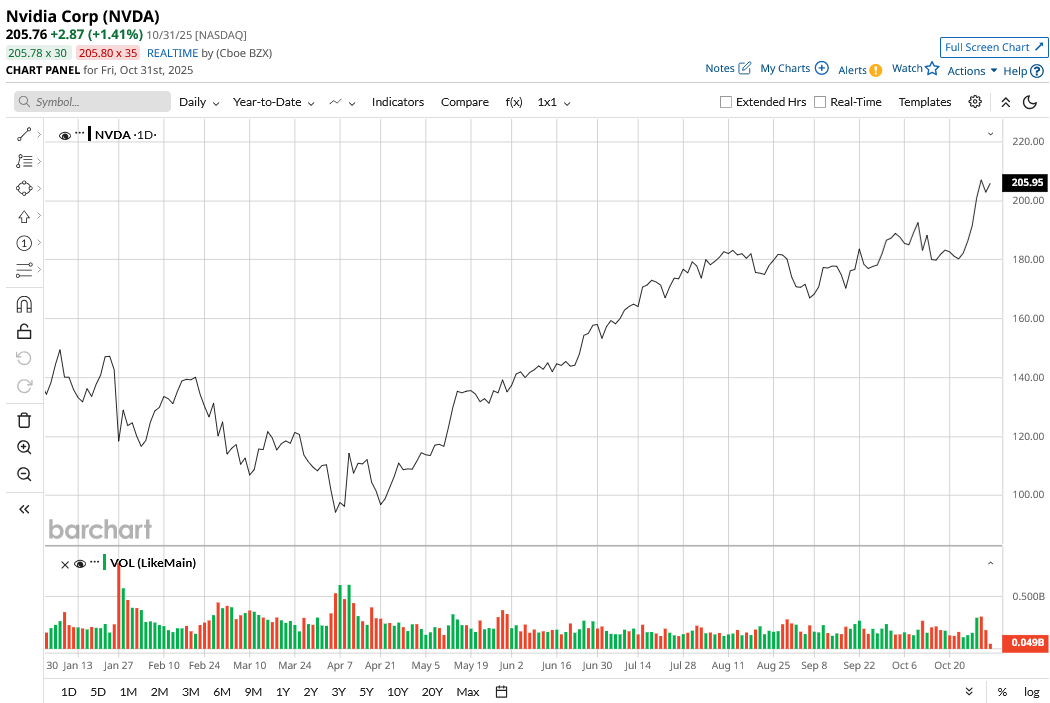

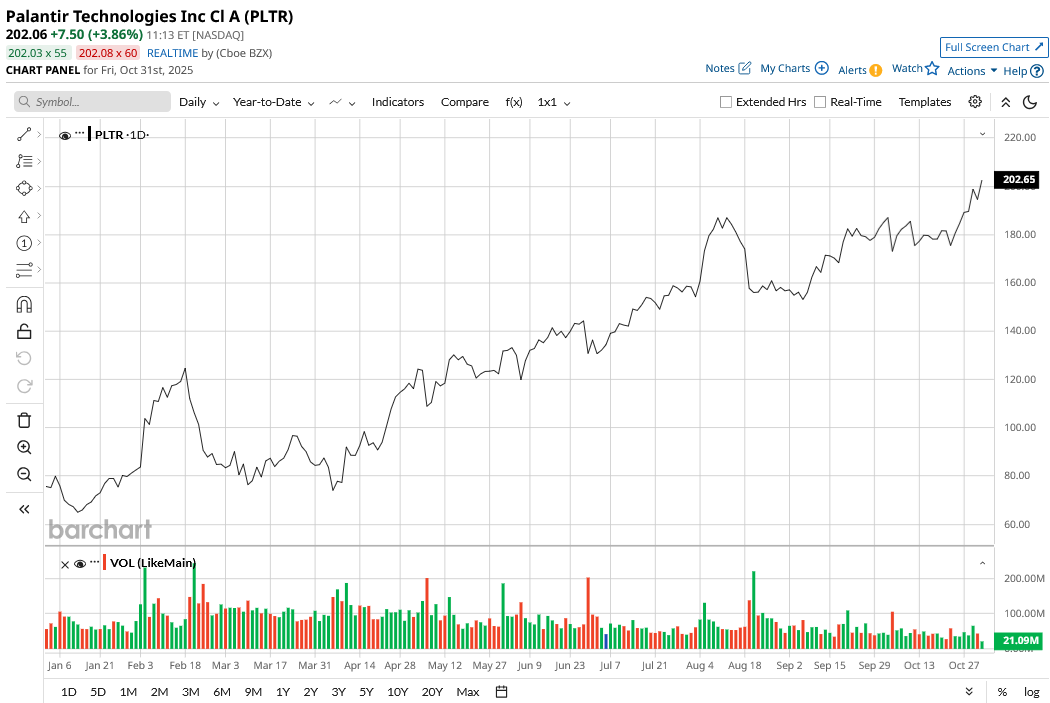

Finally, in terms of share price performance, there is a wide gap. While Nvidia is “just” up 54% on a year-to-date (YTD) basis, Palantir has rallied by 169% in the same period. However, comparing the share price performance of a company that became the first one in history to have a market cap of more than $5 trillion, as was the case with Nvidia recently, with a company whose market cap is close to one-tenth of it (Palantir's current market cap is $471.6 billion) is foolhardy.

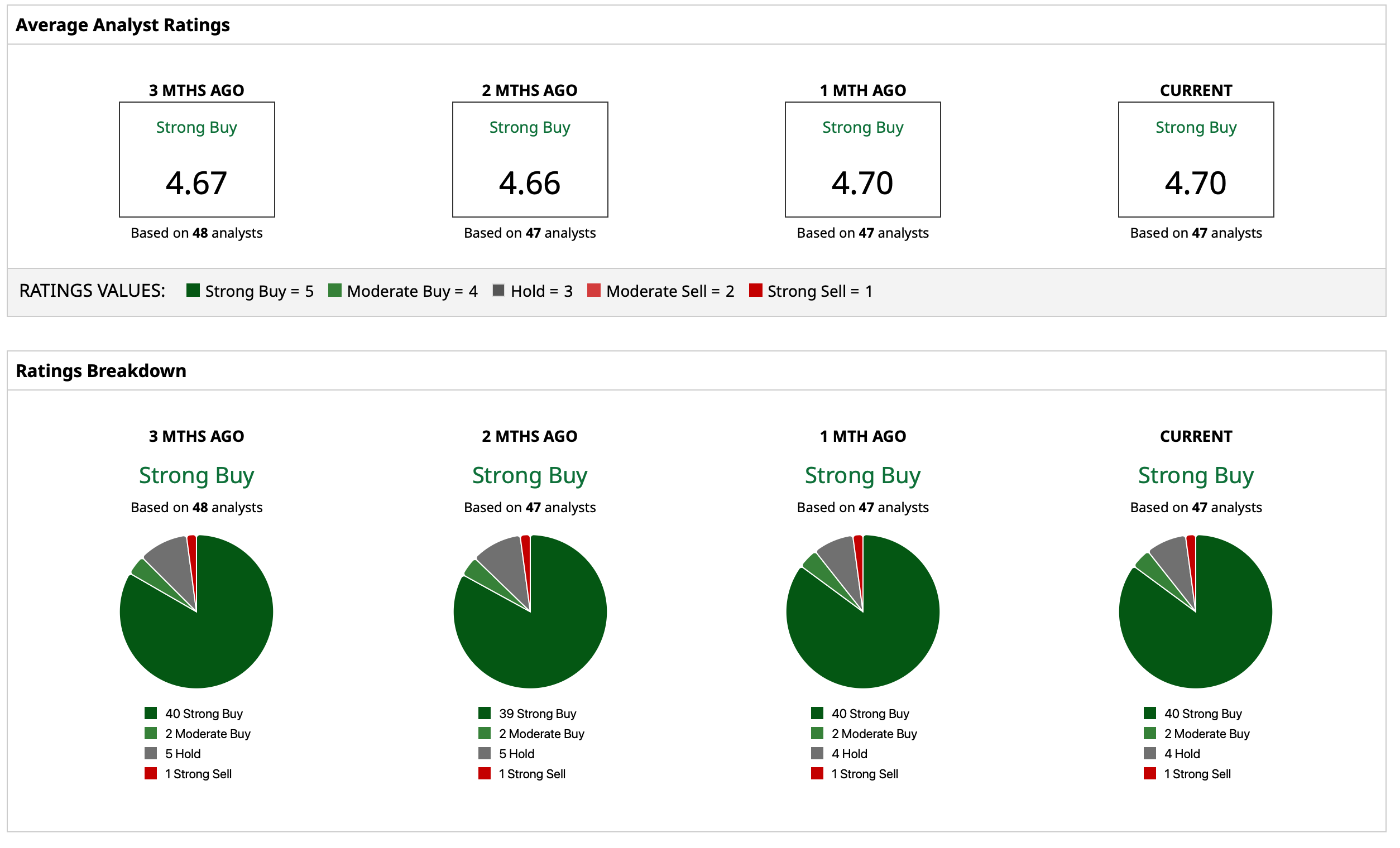

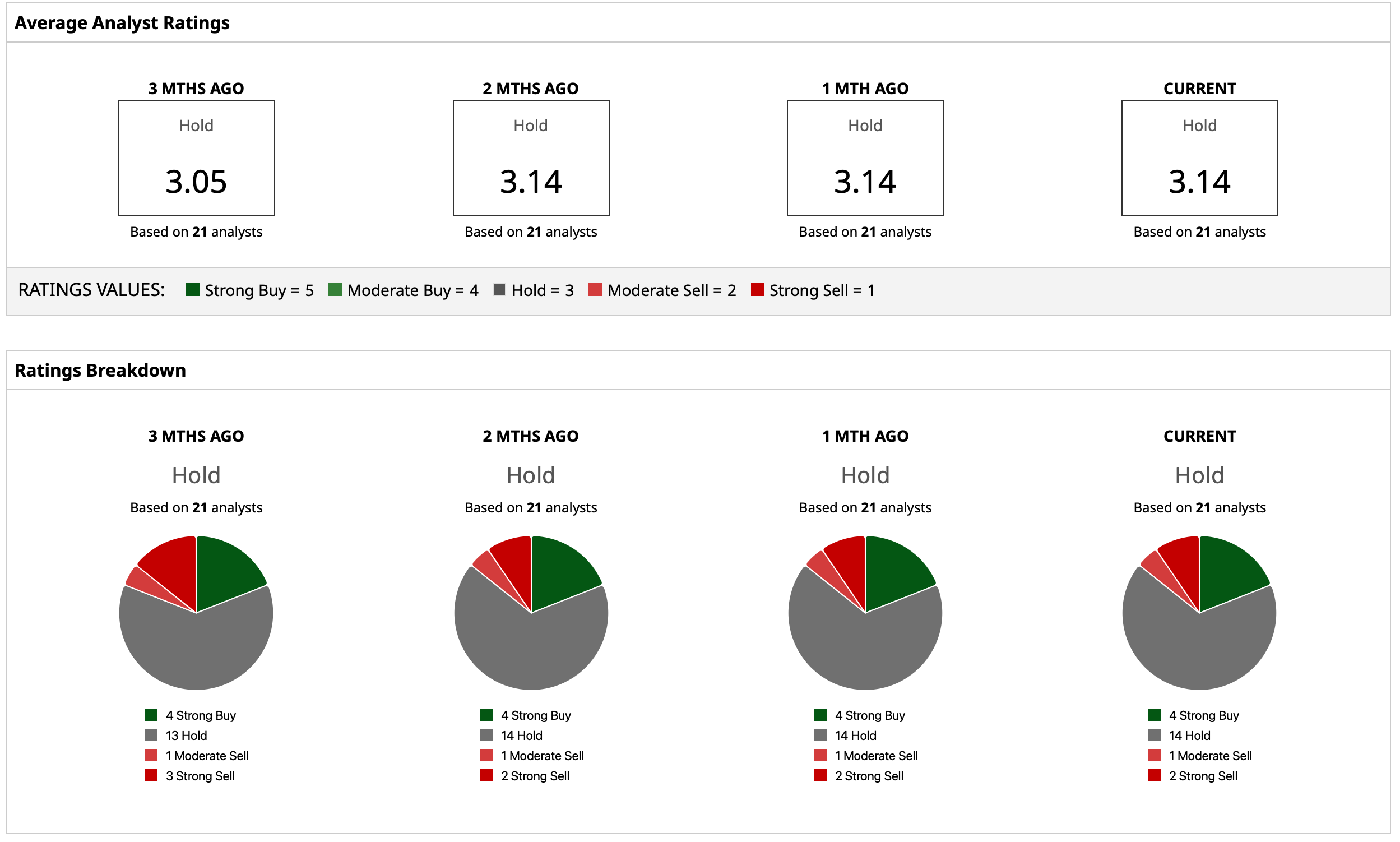

Analysts Take on Both PLTR and NVDA Stocks

Overall, analysts have deemed the NVDA stock a “Strong Buy” with a mean target price of $225.86. This indicates an upside potential of about 10% from current levels. Out of 47 analysts covering the stock, 40 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.

For PLTR stock, analysts are a bit less enthusiastic (thanks to its punchy valuations), having earmarked a rating of “Hold.” With the mean target price already surpassed, the high target price of $215 indicates an upside potential of about 4% from current levels. Out of 21 analysts covering the stock, four have a “Strong Buy” rating, 14 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s New Focus Isn’t on Cars, But on ‘Sustainable Abundance.’ What Does That Mean for TSLA Stock and Buy-and-Hold Investors?

- Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued

- As Apple Turns the Corner With the iPhone 17, Should You Buy AAPL Stock for 2026?

- This Stock Lets You Profit from Building the Power Grid