Broadcom (AVGO) stock has appreciated considerably in 2025, driven by the surge in artificial intelligence (AI) demand. The semiconductor and software giant’s stock has climbed more than 50% year-to-date. This surge has already propelled Broadcom past the $1 trillion mark in 2025, with its market capitalization now hovering around an impressive $1.65 trillion.

The optimism around Broadcom stems from the growing application of its semiconductor solutions across the AI ecosystem. Still, there are questions about how long this momentum can last. Notably, a slowdown in AI infrastructure spending could dampen demand for chips and related technologies, particularly as concerns about an AI bubble have begun to emerge.

Despite concerns, Broadcom’s recent financial performance suggests that its growth story is far from over. The company’s fiscal third-quarter 2025 earnings report highlighted continued strength in its AI semiconductor business. Broadcom also announced the addition of a fourth major AI customer, a significant development that could boost both revenue and profitability in 2026.

As Broadcom broadens its partnerships and customer base, its exposure to the AI boom appears to be translating into durable growth. If current trends persist, the company may be well-positioned to maintain its impressive trajectory into 2026 and beyond.

Broadcom Positioned for Robust Growth Heading into 2026

Broadcom appears to be entering 2026 with significant tailwinds, driven by surging demand for AI technologies. Furthermore, its growing partnership ecosystem and the addition of a new customer provide a solid foundation for growth.

Adding to the optimism is the solid momentum in its business. The company’s latest financial results highlight how AI-driven semiconductor demand could accelerate its growth in 2026, supporting its share price.

Broadcom posted record revenue of $16 billion in the third quarter, reflecting a 22% year-over-year increase and an acceleration from the 20% growth posted in the previous quarter. Profitability also strengthened, with adjusted EBITDA rising 30% to $10.7 billion compared to the same period last year.

The company’s consolidated backlog stood at $110 billion. This substantial order book provides a solid foundation for continued growth in 2026 and beyond, as enterprises and cloud providers invest heavily in next-generation computing capabilities.

Broadcom’s semiconductor division is growing rapidly. The segment generated $9.2 billion in revenue, up 26% year-over-year in Q3, driven primarily by the explosive growth in AI-related sales. AI revenue soared 63% to $5.2 billion, building on a 46% gain in the prior quarter.

The key growth catalyst for Broadcom has been its XPU product line, custom-designed accelerators tailored for AI workloads. These XPUs now make up 65% of the company’s AI revenue, supported by strong partnerships with its top three customers.

In a major development, Broadcom has added a fourth major AI client, further diversifying its customer portfolio and strengthening growth visibility. This new partnership already includes more than $10 billion in committed orders for AI racks powered by Broadcom’s XPUs, with shipments expected to ramp up significantly in 2026. The addition of this customer shows the increasing demand for Broadcom’s custom acceleration technologies.

Adding further momentum, Broadcom recently announced a collaboration with OpenAI to deliver 10 gigawatts of custom AI accelerators. This partnership validates Broadcom’s technical leadership and highlights the growing market preference for its scalable, energy-efficient AI hardware solutions.

With demand strengthening from both existing and new customers, Broadcom’s outlook for fiscal 2026 is highly optimistic. As global investment in AI infrastructure continues to accelerate, Broadcom is well-positioned to benefit from the rising need for high-performance semiconductors.

Will Broadcom Stock Hit the $2 Trillion Mark in 2026?

The year-to-date rally in Broadcom stock reflects the company’s ability to capitalize on the AI hardware opportunity. Its growing customer base, solid product line, and strong order backlog point to continued momentum. If current trends in the AI industry continue, Broadcom could remain one of the largest winners in the AI infrastructure space, and its market value could reach the $2 trillion mark by 2026.

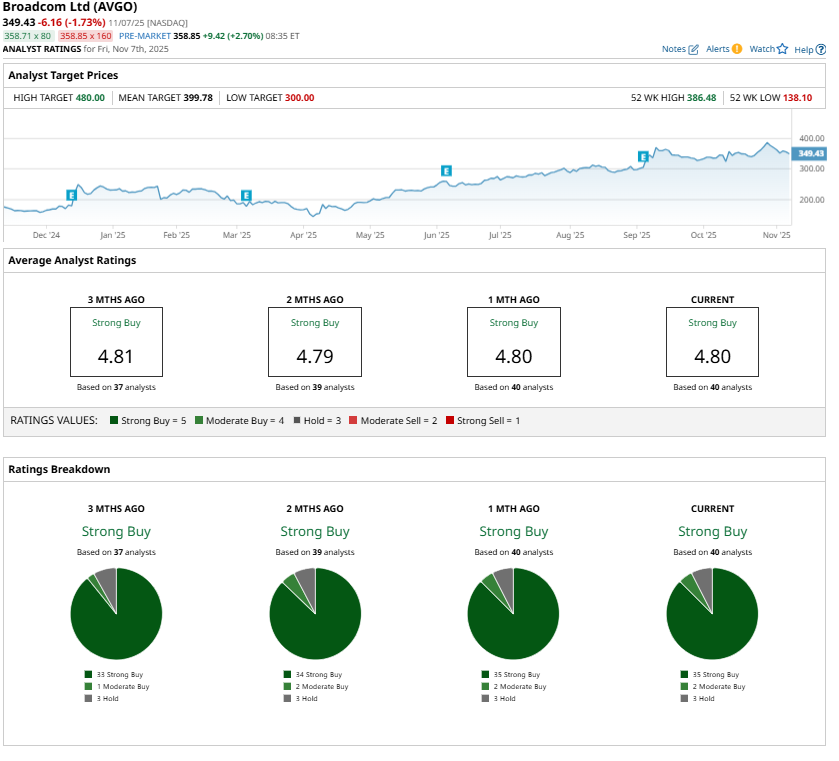

Analysts are optimistic, giving Broadcom stock a “Strong Buy” rating. The highest price target of $480 suggests approximately 33% upside potential. This indicates that reaching a $2 trillion market capitalization is not out of reach.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Does the Upcoming SoFi USD Crypto Launch Make SOFI Stock a Buy, Sell, or Hold?

- This Canadian Dividend Stock Just Hit New All-Time Highs

- These 2 Stocks Are Flashing Bright Red Warning Signs on the Charts… Plus 1 Stock That Looks Primed to Keep Breaking Out

- Can Xpeng Motors Eat Tesla’s Lunch in Humanoid Robots the Way BYD Did in EVs?