Electric vertical takeoff and landing (eVTOL) and advanced air mobility stocks have captivated investors dreaming of a transportation revolution, but enthusiasm hasn't always translated to steady returns. While the sector promises long-term disruption, companies are still navigating regulatory, manufacturing, and cash-burn challenges that make short-term volatility common.

One company in the spotlight is Archer Aviation (ACHR), which drew renewed attention when Cathie Wood’s ARK Invest just bought more than 3 million shares. The buys arrived the same day Archer reported Q3 results and announced plans to acquire Hawthorne Airport for $126 million, following a $650 million equity raise that lifted liquidity above $2 billion.

For investors wondering whether ARK’s move signals a buying opportunity, here’s a closer look at ACHR.

About ACHR Stock

Based in California, Archer Aviation is a startup developing electric “air taxi” aircraft. Its four-seat Midnight eVTOL is designed for short urban hops and is still in testing. The company aims to launch a sustainable city-flight network, but it has no commercial flights or revenue yet. It has drawn attention with partnerships, e.g., Korean Air, and infrastructure moves like acquiring Hawthorne Airport control, but remains in a high-investment, pre-revenue stage.

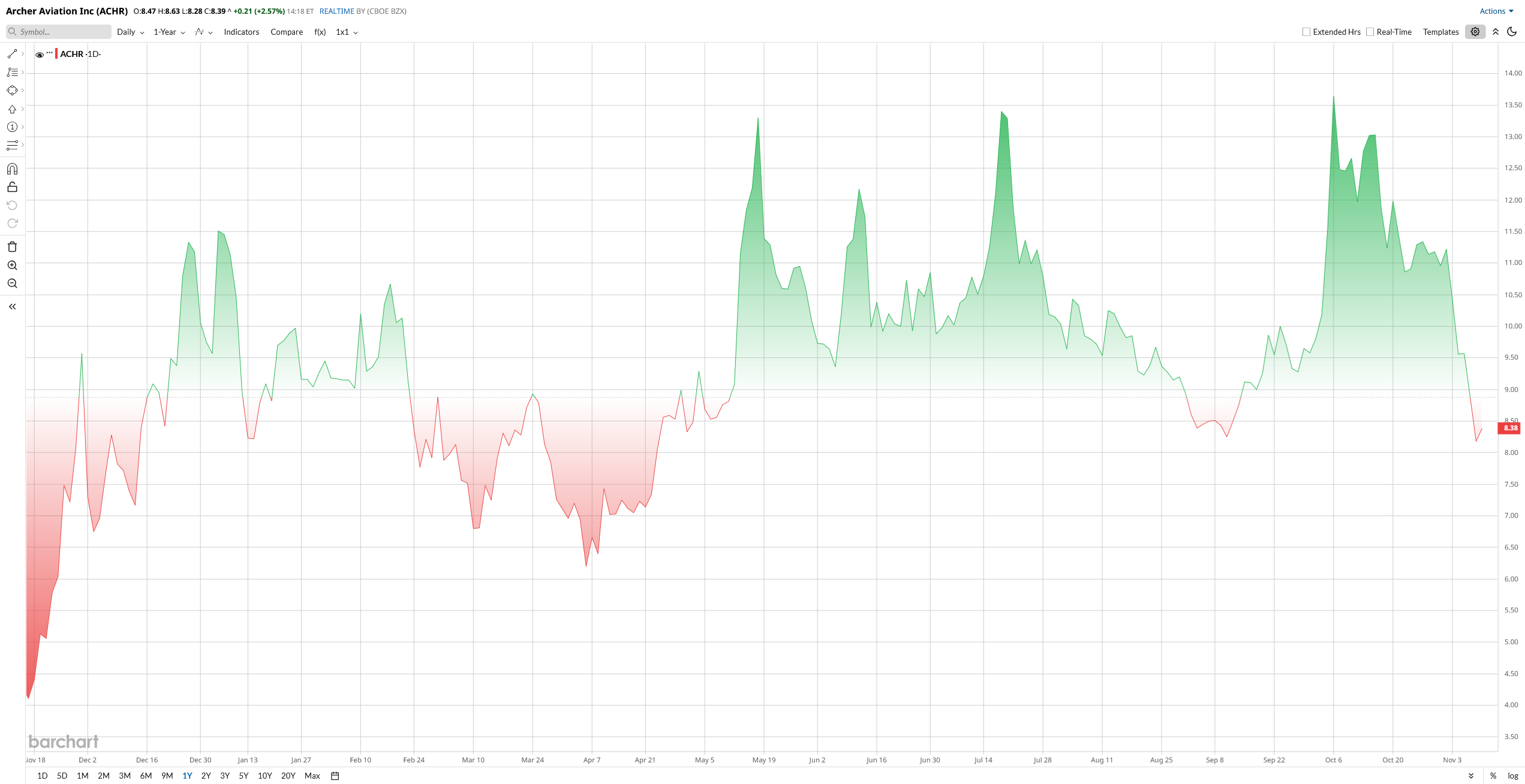

With a market cap of around $5.5 billion, Archer’s stock has been wildly volatile year-to-date (YTD) in 2025. After reaching its 52-week high of $14.62 mid-year, it has since slid toward the high-$7 to low-$8 range. In fact, the shares have fallen about 43% from their early-October peak. This drop shows that investors are nervous because Archer still doesn’t have FAA approval, and its losses were larger than expected, even though it did a bit better than last quarter. Investors should note that the stock’s ups and downs are normal for early-stage air taxi companies, as they have big future potential but aren’t making money yet.

Talking about its valuation, ACHR stock presents a bit of a puzzle. Its price-to-book (P/B) ratio of 3.4x looks low compared to the sector median of 6.8x, suggesting it might be undervalued. However, the enterprise-value-to-sales (EV/Sales) ratio above 15x makes it appear expensive.

Cathie Wood Purchase: What It Means for Investors

The Cathie Wood factor puts a wig in Archer. On Nov. 6, Archer issued Q3 results and announced a $650 million stock raise and the purchase of a new Hawthorne Airport for $126 million. Shareholders responded by selling their stocks. ACHR stock then declined by 10% as the news of a $13,069 million loss sank in. ARK Invest came to the rescue of that selloff, acquiring about 3.01 million shares for its ETFs.

This buy-the-dip deal suggests that Cathie Wood has faith in Archer's future. Currently, the ARK purchase gave an immediate boost, which briefly pushed the stock higher at the start of the markets. It has also been a positive message to the other growth investors, who were countering some of the negative headlines. However, the actual effect is based on basics: Archer has to pass regulatory initiatives, and prototypes remain.

In the short term, Archer will focus on FAA certification (with milestones targetable by 2026) and initial revenue from relationships. If it reaches these targets, the stock may jump out of its current lows. However, any delays or cash constraints may continue to put pressure on the share price. The turnover by ARK is likely to make the moods, yet Archer is not a one-night-wonder, speculative long-term play.

Archer's Financial Overview

Archer, still pre-revenue, reported essentially no meaningful sales and invested heavily in R&D. Total operating expenses were about $175 million. The company lost $129.9 million in its latest quarter, narrower than the prior quarter’s $206 million loss. R&D alone was $120.7 million, underscoring its product development stage.

However, the balance sheet remains strong: as of quarter-end, Archer held about $595.5 million in cash and $1.05 billion in short-term securities.

Management gave only limited guidance. Interim CFO Priya Gupta said the Q4 adjusted EBITDA loss should be in the $110 to 140 million range as spending ramps up for aircraft production and the Hawthorne acquisition. Archer used about $126 million in cash for operations and capex in Q3. No firm revenue targets were set. The company won’t have commercial sales until after certification.

Analysts do have rough estimates: consensus models project only about $260 million in sales for 2026, with full-year 2025 EBITDA losses around $650 million. Street forecasts see 2025 EPS at roughly- $1.32 per share, improving to -$1.03 in 2026. Archer did reiterate its long-term vision. CEO Adam Goldstein enthused that “the era of advanced aviation has arrived, not as a distant vision, but as a tangible reality,” emphasizing confidence in the technology despite near-term losses.

Recent News and Developments

In recent weeks, a mix of positive and negative developments has influenced the story. On the plus side, Archer closed on the Lilium technology deal and is finalizing the $126 million Hawthorne airport purchase. It also secured a memorandum with Korean Air for up to 100 Midnight aircraft (a potential $500 million order). These strategic moves underscore growing commercial traction.

On the downside, there are still no certainties on flight approvals or revenue timing, and the hefty burn rate remains a concern. The Q3 report and stock sale highlighted those worries, even as Ark’s buying softened the blow. Overall, Archer’s headlines combine long-term promise (big partnerships, ARK support) with short-term growing pains.

Analysts Opinion on ACHR Stock

Wall Street remains divided over whether Archer should receive approval, and speculation continues. J.P. Morgan analyst Bill Peterson maintains a “Neutral” rating but has lowered his one-year price estimate from $10 to $8 due to concerns about the stock’s future performance.

On the other side, Needham’s Chris Pierce still rates it a “Buy,” but has reduced his target to $10. Moreover, in August, HCW issued another “Buy” at $18, while Cantor Fitzgerald remains “Overweight” at $13.

The Wall Street average target is around $12, suggesting the stock could still have 50% upside. Morgan Stanley sees urban air mobility as a massive opportunity, with the market potentially reaching $9 trillion by 2050. However, most observers note that for companies like Airbus to view it as a serious business, Archer would need to wait several years before making meaningful sales.

The overall consensus rating is “Moderately Buy,” but strategists caution that any delays in the technology timeline could hurt investor confidence.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoundHound Is Gearing Up for the ‘Next Stage of AI Growth.’ Should You Buy SOUN Stock First?

- Qualcomm Wants to Beat Nvidia in AI Chips, but QCOM Stock Needs to Win Over Wall Street First

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?