GoDaddy Inc. (GDDY) is a digital services company headquartered in Tempe, Arizona. Valued at around $18.3 billion by market cap, GoDaddy serves millions of small and micro businesses around the world through domain registration, web-hosting, website-builder tools, SSL certificates and related services.

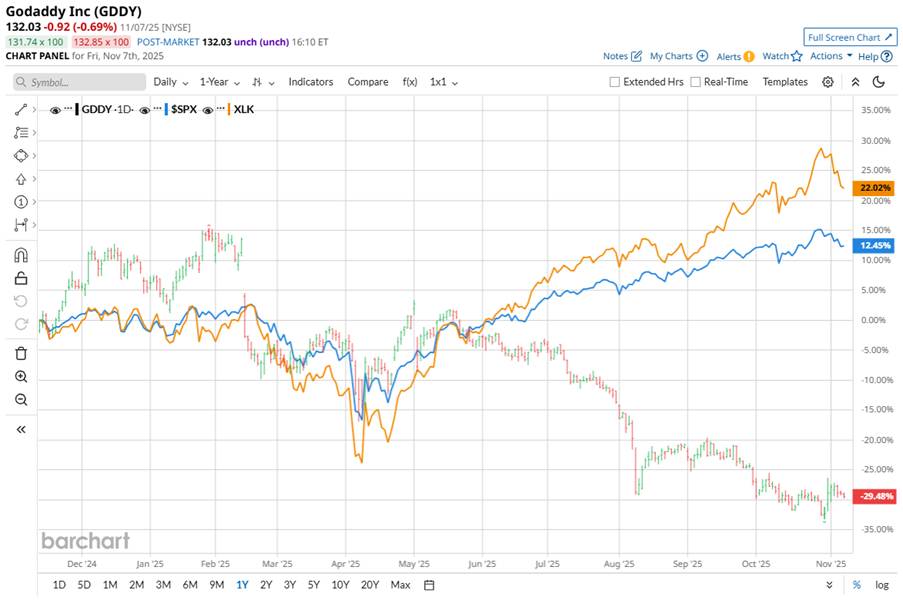

Shares of GoDaddy have lagged behind the broader market. Over the past 52 weeks, GDDY stock has dipped 25.5%, while the broader S&P 500 Index ($SPX) has gained 12.7%. Moreover, the stock has slipped 33.1% on a year-to-date (YTD) basis, compared to SPX’s 14.4% rise.

Looking closer, GDDY stock has also underperformed the Technology Select Sector SPDR Fund’s (XLK) return of 21.4% over the past 52 weeks and a 23.9% gain on a YTD basis.

GoDaddy’s shares have been declining in 2025 largely due to investor concerns surrounding growing AI competition and recent strategic shifts. Market sentiment turned negative after the company announced it would no longer serve as the registry service provider for the .CO top-level domain.

Moreover, analysts such as UBS have voiced concern that GoDaddy’s limited activity in generative AI acquisitions could leave it trailing behind competitors in an increasingly AI-driven tech landscape. These company-specific challenges, compounded by overall market volatility, have driven the stock’s downturn.

For the fiscal year ending in December 2025, analysts expect GoDaddy’s EPS to grow 19.4% year-over-year to $5.79. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

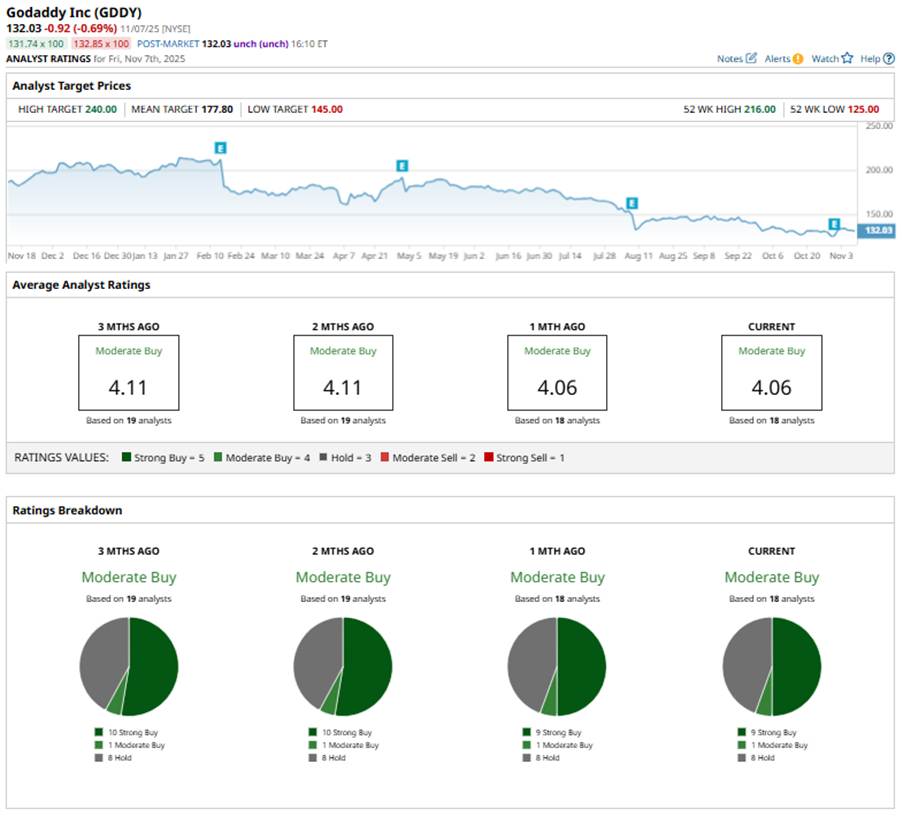

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buys,” one “Moderate Buy” rating, and eight “Holds.”

This configuration is slightly less bullish compared to two months ago, when there were 10 “Strong Buy” ratings.

Last month, Cantor Fitzgerald reiterated its “Neutral” rating and $150 price target on GDDY stock.

The stock’s mean price target of $177.80 indicates an upside of 34.7%. The Street-high price target of $240 implies a potential upside of 81.8% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart