Quantum computing has been garnering high interest with “surging investment and faster-than-expected innovation,” boosting the quantum market to $100 billion in a decade.

IonQ (IONQ), an attractive name in the field of quantum computing, has rallied by 42% year-to-date (YTD).

With good Q3 numbers, high financial flexibility after fundraising, and acquisitions, IONQ seems well positioned to build strong growth momentum. IONQ stock is therefore among the attractive names to consider.

About IONQ Stock

IonQ is a developer of quantum computers and networks in the United States. The company has a vision of achieving 2 million qubits and 80,000 logical qubits for its quantum computers by 2030.

While the business is at an early-growth stage, positive developments have triggered positive price action. As an example, IonQ achieved the technical milestone of #AQ 64 on IonQ Tempo three months ahead of schedule.

Further, with a new contract with Oak Ridge National Laboratory to develop advanced energy applications, IONQ stock has surged by 80% in the last six months.

Advance to Stage B of DARPA

In an important development, IonQ announced its selection for Stage B of the Defense Advanced Research Projects Agency's (DARPA) Quantum Benchmarking Initiative.

The current QBI stage is dedicated to developing a research & development roadmap through 2033. In the final stage, Stage C, the focus will be on the system being ready for real-world deployment.

It’s worth noting that the company’s quantum system is already available on three major cloud platforms globally. Specific to DARPA, the company intends to collaborate on “national security and national economic security.” The advancement to Stage B is therefore important from a validation as well as a long-term growth perspective.

Other Positive Business Developments

Recently, IonQ reported its Q3 2025 results, and the company seems to be making steady business progress. For Q3, revenue growth was robust at 222% on a year-on-year (YoY) basis to $39.9 million.

While adjusted EBITDA loss was $48.9 million, cash burn is unlikely to be a concern as the business is at an early stage. For the full year, IonQ has guided for an adjusted EBITDA loss of $212 million.

It’s also important to note that IonQ ended Q3 with a strong cash buffer of $1.5 billion. The $2 billion equity offering after the quarter implies a pro forma cash buffer of $3.5 billion. This provides the company with ample flexibility to invest in innovation and potential acquisitions.

In Q3 2025, IonQ completed the acquisition of Oxford Ionics and Vector Atomic. The acquisition of Oxford is likely to support expansion into international markets like the UK, Europe, and Asia. The latter acquisition of Vector adds advanced precision atomic clocks, inertial sensors, and synchronization hardware to the company’s portfolio.

What Analysts Say About IONQ Stock

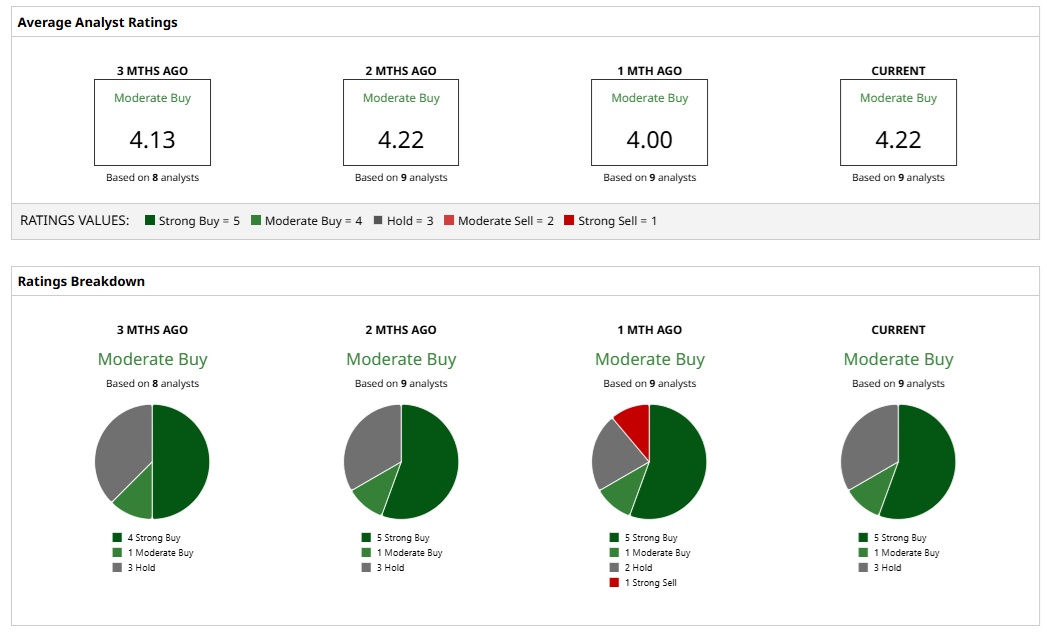

Based on the rating of nine analysts, IONQ stock is a “Moderate Buy.”

While five analysts opine that the stock is a “Strong Buy,” one analyst has a “Moderate Buy” rating. Further, three analysts have assigned a “Hold” rating for the stock.

A mean price target of $74.12 implies an upside potential of 33%. Furthermore, the most bullish price target of $100 implies an upside potential of 79%. Given these targets, it’s likely that IONQ stock will remain in an uptrend.

It’s worth mentioning here that in October, IonQ priced a $2 billion equity offering at $93. This was at a premium of 20% as compared to IONQ's closing price on Oct. 9. The current stock price of $55.88, therefore, seems attractive. With earnings growth for FY 2026 expected at 70.3%, there is a case for IONQ stock trending higher.

Further, from a valuation perspective, an important point to note is that IonQ utilizes the trapped-ion quantum computing approach. Industry experts believe that this differs from superconducting methods used by competitors and gives companies like Quantinuum and IonQ an edge. The valuation premium might therefore be justified.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Qualcomm Wants to Beat Nvidia in AI Chips, but QCOM Stock Needs to Win Over Wall Street First

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now