Valued at approximately $15.1 billion by market cap, New York-based News Corporation (NWSA) operates as a global media and information services company that creates and distributes content across various platforms, including newspapers, digital media, book publishing, and subscription video services.

The media giant has notably underperformed the broader market over the past year. NWSA stock prices have declined 3% on a YTD basis and 8.4% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains in 2025 and 12.7% returns over the past year.

Narrowing the focus, NWSA has also underperformed the Communication Services Select Sector SPDR ETF Fund’s (XLC) 15.8% gains on a YTD basis and 16% surge over the past 52 weeks.

News Corp.’s stock prices surged 6.5% in a single trading session following the release of its Q1 results on Nov. 6. Driven by the continued momentum in its Dow Jones and Digital Real Estate Services segments, the company’s overall topline for the quarter grew 2% year-over-year to $2.1 billion, beating the Street’s expectations by 1.5%. Meanwhile, its adjusted EPS increased 10% year-over-year to $0.22, surpassing the consensus estimates by 22.2%.

For the full fiscal 2026, ending in June, analysts expect NWSA to deliver an adjusted EPS of $0.97, up 9% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line expectations once over the past four quarters, it met or surpassed the projections on three other occasions.

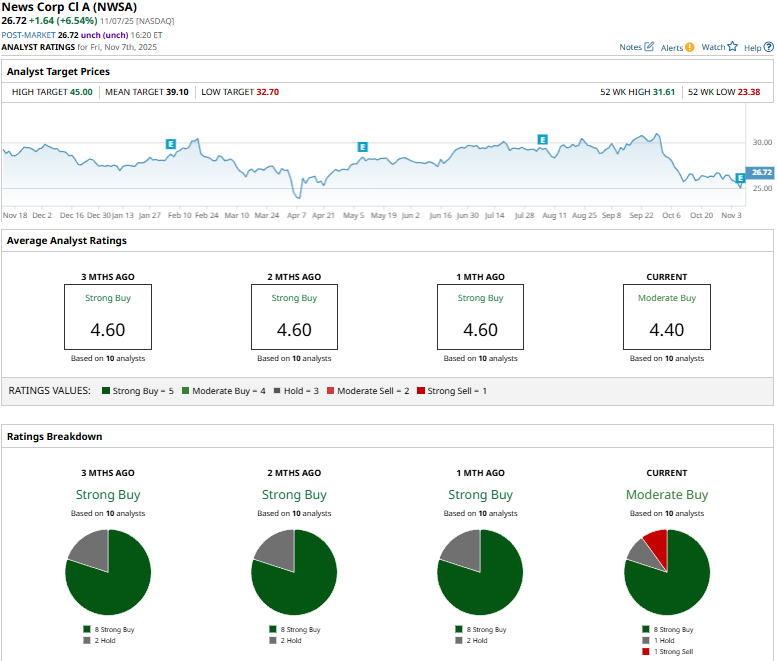

Among the 10 analysts covering the NWSA stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buys,” one “Hold,” and one “Strong Sell.”

This configuration is slightly less optimistic than a month ago, when none of the analysts gave “Strong Sell” ratings on the stock.

On Aug. 20, JP Morgan analyst (JPM) David Karnovsky maintained an "Overweight" rating on NWSA and raised the price target from $38 to $40.

NWSA’s mean price target of $39.10 represents a notable 46.3% premium to current price levels. Meanwhile, the street-high target of $45 suggests a staggering 68.4% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Missed The AI Trade? The Next Wave Of Alpha Is Hidden In Structure

- Technical Support Levels, CPI and Other Key Things to Watch this Week

- Nvidia Looks 22% Undervalued Here Based on Projected FCF Margins - $230 Price Target

- Michael Burry Is Betting Against Palantir Stock. At Least 1 Analyst Thinks It Can Gain 50% from Here.