Beyond Meat (BYND) shares closed down slightly ahead of the plant-based meat company’s delayed third-quarter earnings scheduled for Nov. 10 (after the bell).

The Nasdaq-listed firm is expected to record roughly $69 million in revenue for its fiscal Q3, down some 15% on a year-over-year basis, with $0.43 a share of quarterly loss.

At the time of writing, BYND stock is trading more than 80% below its high in late October.

Where Options Data Suggests BYND Shares Are Headed

Options traders are bracing for volatility in Beyond Meat stock after its Q3 earnings on Monday.

According to Barchart, implied move through the end of this week is 30.07%, which translates to a potential trading range of $0.97 to $1.80.

This suggests traders expect a sharp reaction to BYND earnings with the wide spread reflecting uncertainty around the company’s financial health and future prospects.

With implied volatility elevated, short-term contracts are pricing in a binary outcome – a surprise rebound or a fresh breakdown.

Why Downside Is More Likely to Play Out in Beyond Meat Stock

Beyond Meat continues to burn cash, faces declining demand for plant-based meat, and operates in a fiercely competitive space dominated by better-capitalized rivals.

Therefore, the downside (as indicated by options contracts) is significantly more likely to play out in BYND shares through Nov. 14.

Plus, recent delays in reporting earnings due to impairment recalculations have added to concerns. Beyond Meat’s penny stock status makes it vulnerable to price manipulation and pump-and-dump behavior as well.

All in all, with little institutional support and fading meme momentum, the odds favor downside risk after the quarterly release. Investors must, therefore, proceed with caution in BYND stock.

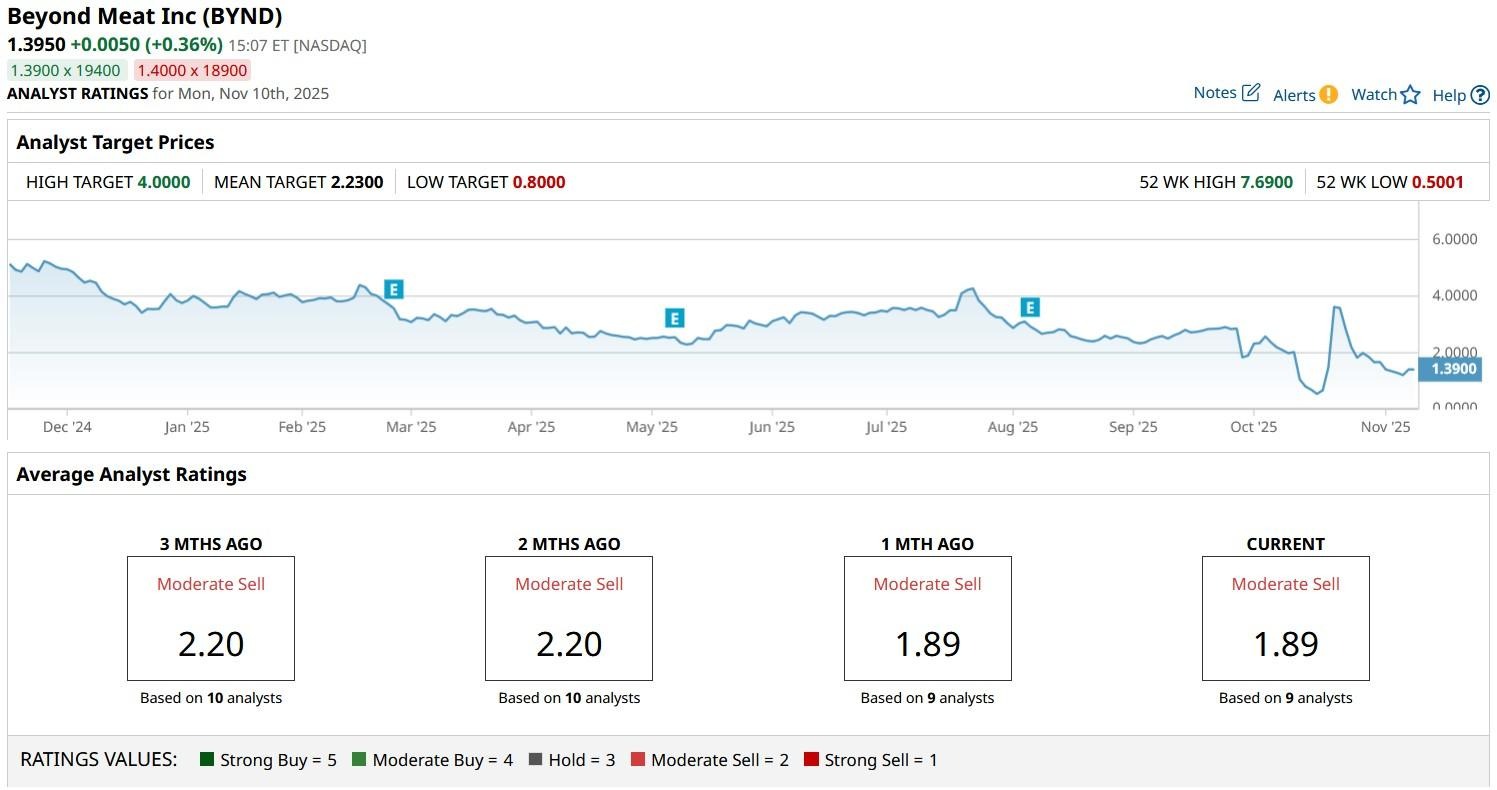

Wall Street Currently Rates BYND at ‘Moderate Sell’

Wall Street firms also recommend caution in playing Beyond Meat shares ahead of the company’s Q3 earnings release.

According to Barchart, the consensus rating on BYND stock currently sits at “Moderate Sell” with price targets going as low as $0.80, indicating potential downside of more than 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap

- Despite an Earnings Miss, Super Micro Computer’s (SMCI) Options Flow Points to a Potential Reversal

- Global Sugar Supply Peaks Near Mid-October: SB Drops 14/15 Years. Are You Trading the Macro or the Noise?