Tesla (TSLA) made headlines yet again as its shareholders approved CEO Elon Musk’s compensation package worth a staggering $1 trillion. Notably, 75% of its shareholders stood in favor of Musk’s compensation package amid increasing scrutiny leveled against its profitability and AI plans.

In addition to Musk’s compensation package, investors approved a resolution to allow Tesla to invest in CEO Musk’s artificial intelligence project, xAI. Notably, investors’ approval to invest in Musk’s AI project shows that investors believe Tesla should continue to lead in integrating AI technology in its operations despite increased costs. Although Tesla dropped 3.7% to $429.52 recently, Tesla remains one of those stocks investors are keenly watching in 2026.

About Tesla Stock

Tesla, based in Austin, Texas, develops and manufactures electric vehicles, solar energy solutions, and energy storage products. With an estimated market value of $1.4 trillion, Tesla continues to hold its position as the world’s most valuable automaker.

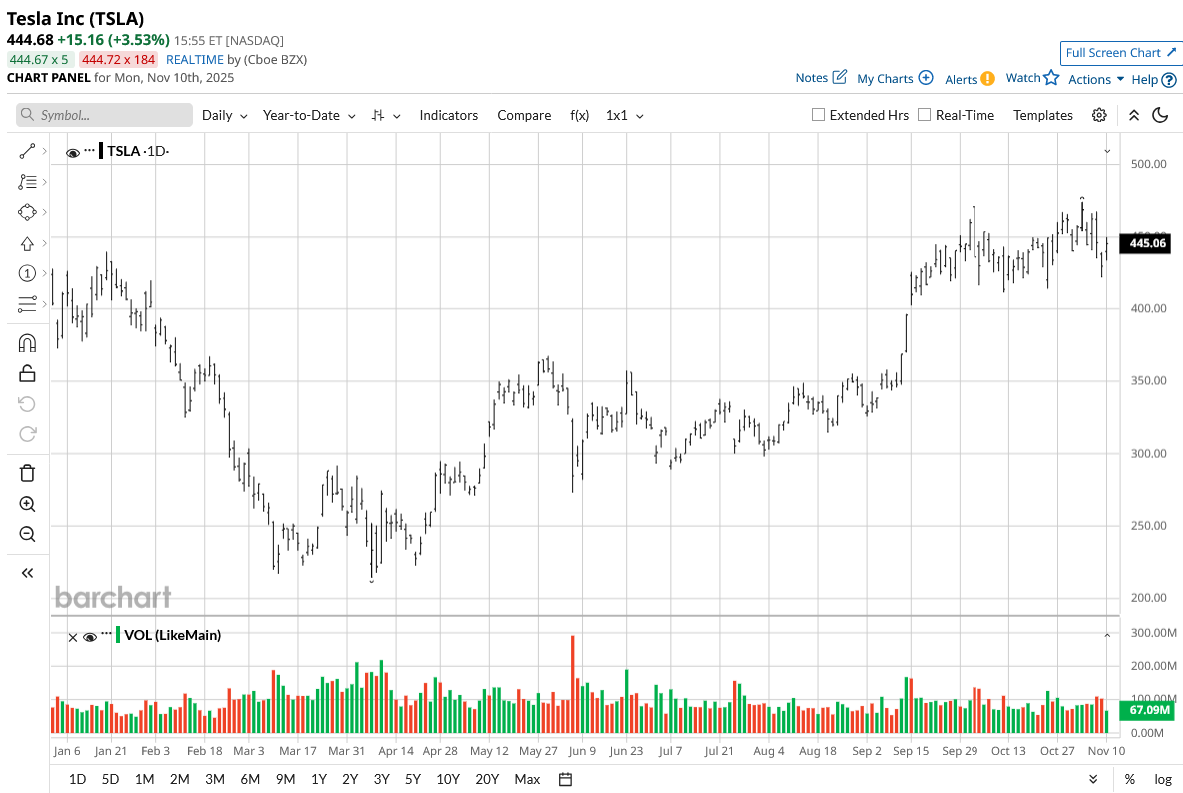

In the past year, Tesla’s shares have ranged from $214.25 to $488.54. Although Tesla’s stock is up over 105% from its 52-week low, there has been downward pressure since mid-October due to lower margins. TSLA stock's movement appears to demonstrate market excitement yet volatility stemming from Musk’s choices, compared to the 22% year-to-date (YTD) rise in the Nasdaq Composite ($NASX).

Valuation continues to be highly contentious. Tesla’s forward price-earnings multiple stands at 389.57. The stock’s price-to-sales (P/S) ratio of 15.18 and price-to-cash flow (P/CF) multiple of 115.12 are indicative of a rich valuation based on growth. Tesla’s return on equity stands at 6.61 percent. The profit margin stands at 7.3 percent. These indicators are pointers to how Tesla’s stock’s valuation stands for perfection.

Tesla Beats on Growth, but Margins Fall

In its last reported quarter, Tesla recorded a revenue of $28.1 billion, which marked an annual growth of 12%, backed by increased delivery numbers and good execution in its energy production and storage business. But its operating income slipped sharply to $1.6 billion, down 40% year-over-year (YoY). Margins narrowed to 5.8% due to increased operating expenses related to AI investments, R&D expenditures, and restructuring charges.

Management did admit to being affected by tariff increases and resisting cost pass-through in less resilient product lines but increasing its benefits in energy storage and services. The company finished with a cash position of $41.6 billion, which increased sequentially by $4.9 billion.

Looking forward, Tesla’s future expansion seems to involve optimizing its AI-based software and Full Self-Drive (FSD) functionality, sectors that could grow to justify its rich pricing. But investors are divided over Tesla’s prospects. Musk’s new compensation package ties incentives to market cap targets going up to $8.5 trillion.

What Do Analysts Expect for TSLA Stock?

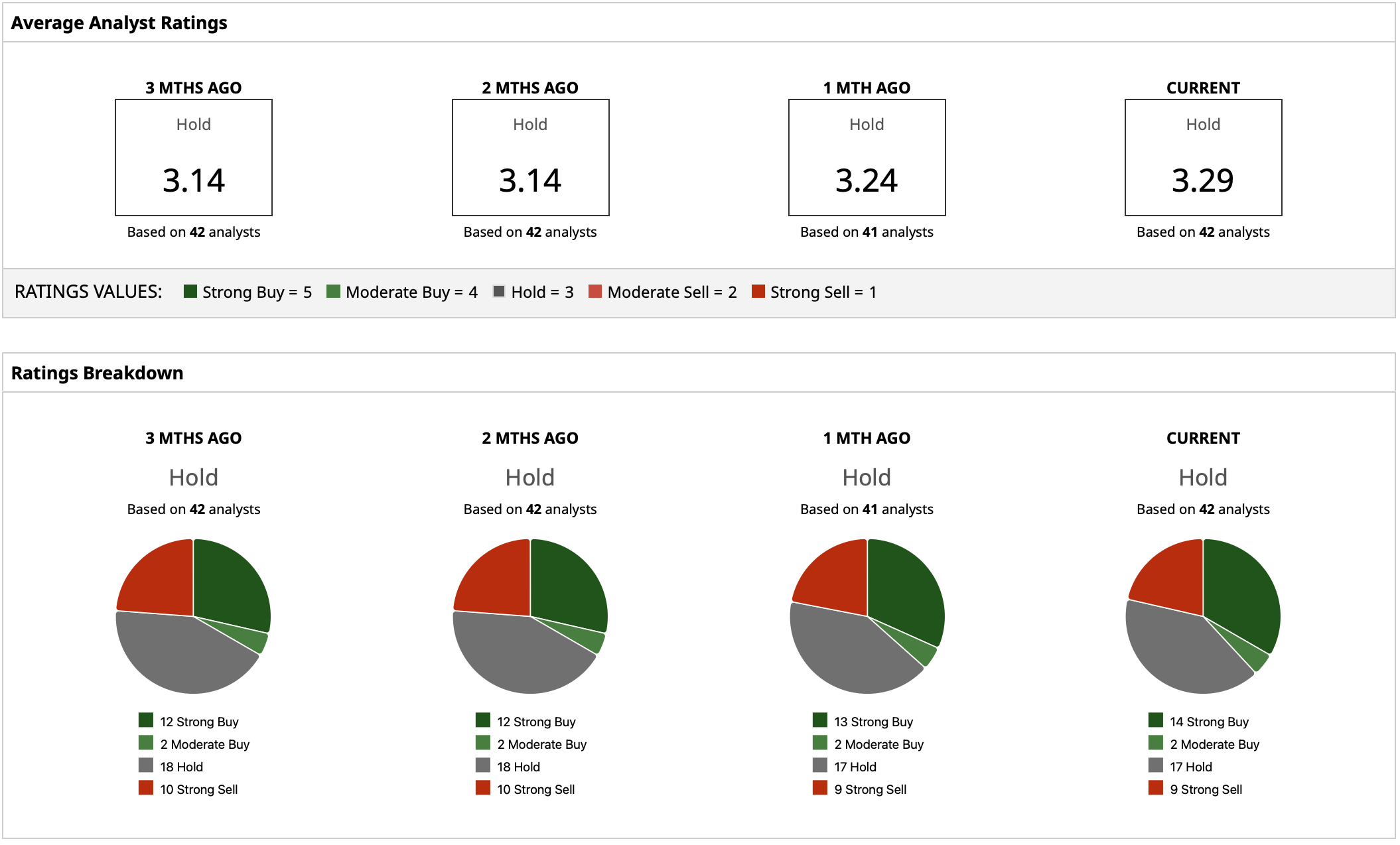

Analyst sentiment for Tesla shares remains mixed. Tesla has a “Hold” rating consensus, but analysts are weighing whether AI and Robotics can improve margins in 2026. The mean analyst price target of $385.26 represents potential downside of roughly 10% from the stock’s recent close near $429.

Meanwhile, the Street-high target of $600 reflects confidence from the most bullish analysts that new growth drivers, like xAI integration and next-generation manufacturing, could push Tesla’s valuation to new highs. On the other end, the lowest forecast of $120 underscores persistent skepticism about near-term profitability and the risk of multiple compression if earnings growth stalls.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week