Dan Ives, the popular tech analyst at Wedbush Securities, is quite gung-ho about the AI revolution. Quite often heard saying that “It is still 10 PM in the AI party, and the party goes on till 4 AM,” Ives certainly has his party favorites, chief among them being chip giant Nvidia (NVDA) and AI-driven data analysis company, Palantir (PLTR).

However, his other bets in the AI race do not garner as much limelight as the aforementioned duo. Thus, its recent note on SoundHound AI (SOUN) is worth, well, listening to.

About SoundHound

Founded in 2005, SoundHound builds voice, sound and natural-language AI technologies involving speech recognition, natural language understanding, sound recognition, voice interfaces, and conversational agents. Its applications span multiple verticals, including automotive (voice assistants in cars), smart devices & IoT, enterprise customer service, restaurant/delivery voice ordering, and other conversational-AI use cases.

Valued at a market cap of $5.8 billion, the SOUN stock is down 27% on a year-to-date (YTD) basis. Yet, Ives and his associates remain bullish about the company, stating, “SOUN slightly raised its FY25 guidance to $165.0 million to $180.0 million (prior guidance of $160.0 million to $178.0 million) which we believe is conservative as demand remains strong across all vertical as it continues to see slight improvements in automotive along with strong growth in other verticals.”

So, should investors also tune in to SoundHound? Let's analyze.

Record Revenues Fail to Bring In Profits

SoundHound AI's latest results for Q3 2025 saw the company reporting record revenues. Yet, its losses came in wider than expected when compared to Street estimates, as profitability remains elusive for the company.

In Q3, the company's revenues came in at $42 million, up 68% from the previous year as the company secured several deals across industries such as automotive, financial services, healthcare, and insurance, among others. Conversely, losses widened significantly to $0.27 per share from $0.06 per share as the company struggles to deal with scale. Estimates were for a loss of $0.09 per share.

Notably, net cash used in operating activities also increased for the nine months ended September 30, 2025, to $76.3 million from $75.8 million in the year-ago period. Despite the widening in the cash outflow from operating activities, SoundHound closed the quarter with a cash balance of $268.9 million, which was much higher than its short-term debt levels of $2.3 million.

Bet on Future Growth Potential

So, the financials do not really inspire that much confidence in the SOUN stock as an investment. What does is its growth potential, and there are certainly some solid drivers for it, underpinned by AI?

SoundHound AI's leadership in the AI-driven conversational tech market is commendable, which acts as a solid base for the company to capture the rapidly growing agentic AI market. Notably, the company's expansive data repository stands as a pivotal asset in advancing these objectives. The management has previously highlighted that its platforms now handle in excess of 1 billion queries monthly, a metric that underscores robust operational expansion and a pronounced edge in data accumulation. Going forward, as platform usage intensifies, the resultant insights sharpen the efficacy of machine learning and AI-driven enhancements, facilitating accelerated innovation in product development. This dynamic establishes SoundHound's inaugural point of distinction relative to industry peers.

SoundHound further sets itself apart from established voice assistants, including Amazon's (AMZN) Alexa and Google's (GOOG) (GOOG) Home devices, by fusing its proprietary machine learning frameworks, CaiNET and CaiLAN, with generative AI and large language models to yield more fluid and precise conversational interactions. This integration empowers clients to preserve their distinctive branding, retain ownership over their information, and shape the end-user journey on their terms.

Moreover, strategic buyouts, including those of Amelia and SYNQ3, are poised to deliver meaningful accretive value. The Amelia acquisition fortifies SoundHound's foothold in financial services, insurance, and medical sectors, whereas SYNQ3 brings expertise in voice-enabled solutions tailored for hospitality, backed by a prospective base exceeding 100,000 restaurant sites and commitments from over 10,000 to date.

Lastly, recent alliances have additionally reinforced SoundHound's stature as a frontrunner in agentic AI applications. One such arrangement involves the casual dining operator Red Lobster, which plans to implement a novel agentic AI solution for managing inbound telephone orders across its network of more than 500 outlets. This deployment aims to refine order processing workflows, thereby elevating service quality. For SoundHound, the initiative offers a compelling showcase of deployment at scale, potentially enticing additional participants within the fast-casual dining segment.

Equally significant is the expanded collaboration with Apivia Courtage, a prominent French intermediary in commercial insurance. The broker intends to integrate SoundHound's Amelia 7 agentic AI system across its call center infrastructure to address diverse client engagements. This builds upon an established relationship dating to 2023, during which prior SoundHound implementations yielded a 20% improvement in contact center performance. The current phase advances those foundations by incorporating autonomous agents adept at deliberation, strategy formulation, and fulfillment of intricate, multifaceted requests, eliminating the need for human intervention. At the same time, the partnership extends SoundHound's international profile well beyond its primary domestic stronghold of the United States.

Analyst Opinion on SOUN Stock

SoundHound is a pure play on voice-enabled by AI, which separates it from other larger players, for whom it is just one of their products. Although this differentiates it from them, the company does not have the deep pockets that they possess. Yet, the company is not ceding ground and remains a credible choice for enterprises, as evidenced by the recent partnerships. Now, the primary goal of the company should be to do this profitably.

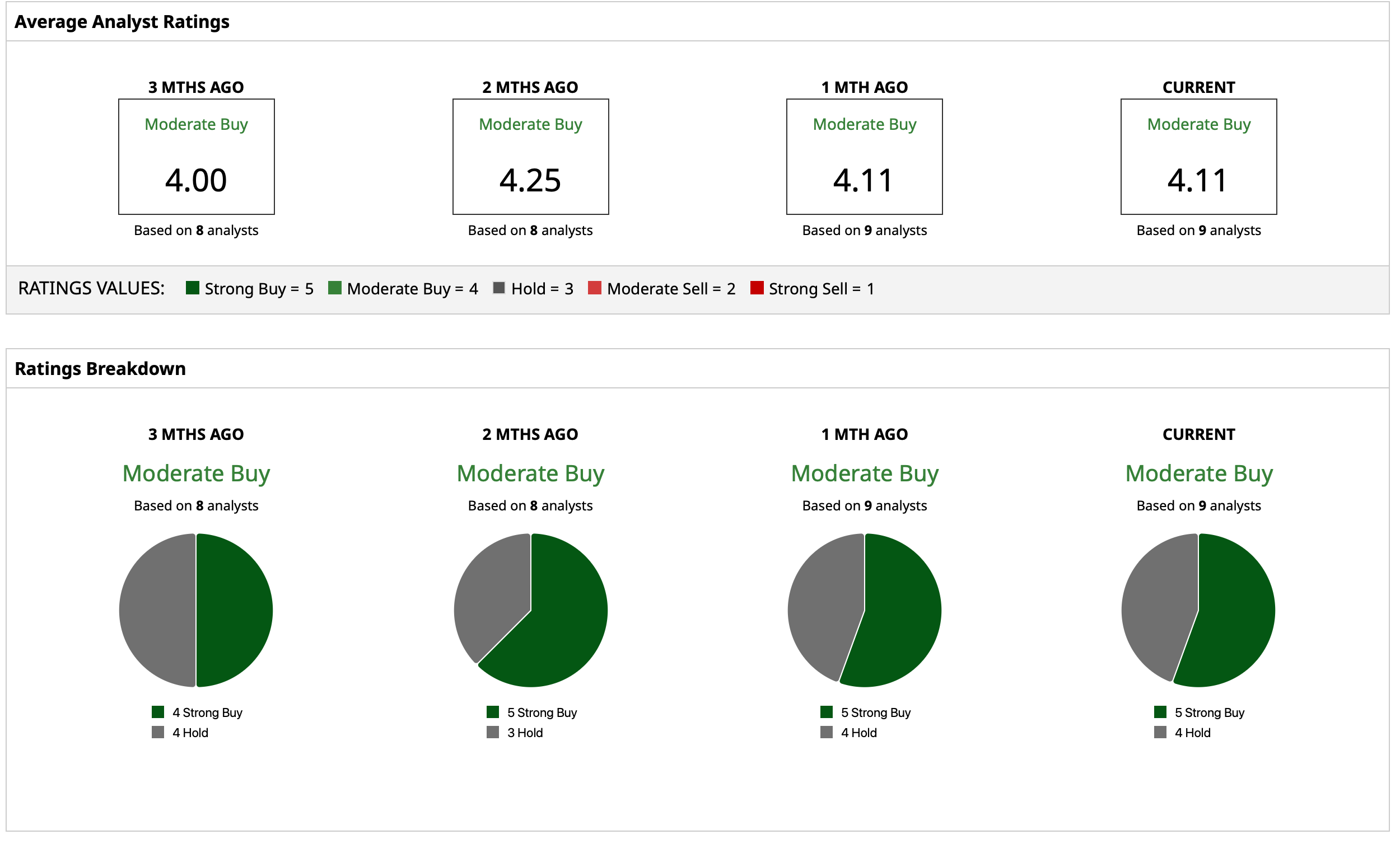

Overall, analysts have rated SOUN stock a “Moderate Buy”, with a mean target price of $16.50. This implies an upside potential of about 17% from current levels. Out of nine analysts covering the stock, five have a “Strong Buy” rating, and four have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week