H.C. Wainwright analyst Scott Buck recently raised the price target on conversational artificial intelligence (AI) firm SoundHound AI (SOUN) from $18 to a Street-high of $26, while reaffirming a “Buy” rating. The price target upgrade follows the firm's assessment of SoundHound’s potential, although current sentiment is driven by market momentum, despite the high valuation.

Still, the company’s actual business growth is expected to support SOUN stock over the long term. There are also industry tailwinds at play, such as rising demand for AI-powered services.

Should you consider investing in SoundHound stock now? Let's take a closer look.

About SoundHound Stock

SoundHound specializes in voice-based AI technology. Founded in 2005 and based in Santa Clara, California, the company develops systems that enable machines to understand and respond to human speech. The firm's main goal is to add voice AI to various products, making interactions with technology quicker and easier.

The company’s solutions are used across many fields, like automotive, restaurants, and customer service, enabling brands to offer more natural and personalized communication experiences. Over the years, SoundHound has formed partnerships with big companies and made several acquisitions to expand its services. The company has a market capitalization of $5.7 billion.

SOUN stock's performance reflects optimism around the firm's business prospects, including further expansion through partnerships and strong revenue growth. Over the past 52 weeks, shares have gained 103%, while they are up 54% over the past six months. Although volatility remains, SOUN stock has been fueled by investor optimism.

SoundHound stock is also trading at an eye-watering valuation. Its price-to-sales ratio of 68.5 is considerably above the industry average.

SoundHound’s Numerous Acquisitions

SoundHound has made several notable acquisitions over the years. Most prominent among them is its acquisition of enterprise AI software company Amelia, which was acquired for $80 million last year. This helped the company unlock the potential of new industry verticals.

SoundHound also acquired SYNQ3 Restaurant Solutions, a voice AI provider, gaining access to over 10,000 signed locations, as well as online ordering platform Allset, opening up the frontier for voice-enabled food ordering and furthering the voice-based e-commerce ecosystem.

Finally, this year, the company announced a $60 million acquisition of Interactions, a customer service and workflow orchestration platform, expanding SoundHound’s scope in the field of agentic AI. This acquisition spree has led the company to achieve topline growth.

SoundHound’s Q2 Topline Kept Up Its Robust Expansion

As the company’s voice AI solutions gain traction, SoundHound reported one of its most successful quarters for the period ended June 30. During the second quarter, revenue increased 217% year-over-year (YOY) to an all-time high of $42.7 million. Back in Q1, revenue had grown 151% from the prior-year period, but this time around the company managed to top the preceding quarter’s robust performance. SoundHound's Q2 non-GAAP gross profit also climbed by 178% YOY to $24.92 million. SOUN stock gained 26.4% intraday on Aug. 8 following the results.

SoundHound seems to be working as a well-oiled machine, as its business highlights entail. For example, the firm unveiled Amelia 7 integrated with Polaris, its proprietary voice AI foundational model. SoundHound's voice commerce operations are expanding as well, with customer wins in the restaurant, automotive, healthcare, and retail sectors.

While the company is not yet profitable, its non-GAAP net loss per share for the quarter dropped from $0.04 in Q2 2024 to $0.03 in Q2 2025.

Wall Street analysts have mixed expectations regarding SoundHound’s ability to reduce its losses. For the next quarter, losses are expected to widen 125% YOY to $0.08 per share. However, for the current year, losses are projected to decline 58% annually to $0.44 per share, then decline another 41% to $0.26 per share in fiscal 2026.

What Do Analysts Think About SoundHound’s Stock?

Apart from bullish sentiment from H.C. Wainwright analysts, Wall Street analysts have offered varied opinions on SoundHound. In September, Oppenheimer analyst Brian Schwartz initiated coverage on the stock with a “Perform” rating. Analysts from the firm believe that the company has significant potential in the voice AI market.

Wedbush also reiterated an “Outperform” rating with a $16 price target on SOUN stock, following strong financial performance and strategic acquisitions, which is promising for the company in the AI space. In August, DA Davidson analyst Gil Luria maintained a “Buy” rating and raised the price target from $10 to $15 following the company’s strong Q2 financial performance.

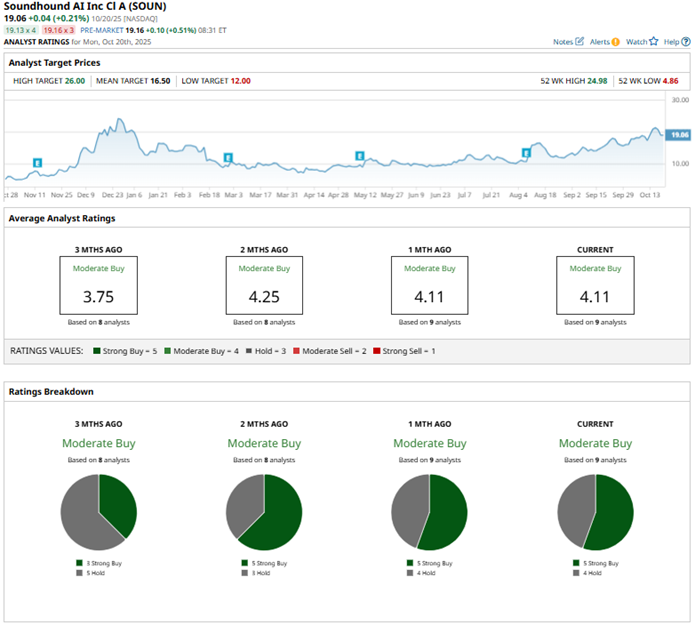

Wall Street analysts are still soundly bullish about SoundHound’s prospects, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the nine analysts rating the stock, five rate it a “Strong Buy” while four play it safe with a “Hold.” The consensus price target of $16.50 represents 17% potential upside from current levels. Meanwhile, the Street-high H.C. Wainwright-given price target of $26 indicates 84% potential upside.

Key Takeaways

SoundHound’s voice AI technology is becoming increasingly popular, and the company is bolstering its position through strategic acquisitions. As the company’s topline keeps growing, it might soon translate into bottom-line gains. Therefore, it might be wise to invest in the stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart