Stagwell (STGW) is a digital-first global marketing network focused on delivering seamless, scalable marketing solutions by blending creativity with cutting-edge technology. It empowers ambitious B2C, B2B, and DTC brands through its diverse portfolio of forward-thinking agency partners. Stagwell emphasizes the integration of data-driven analytics and cultural insight to adapt quickly and provide superior value in an evolving digital landscape.

Stagwell’s Stock Struggles

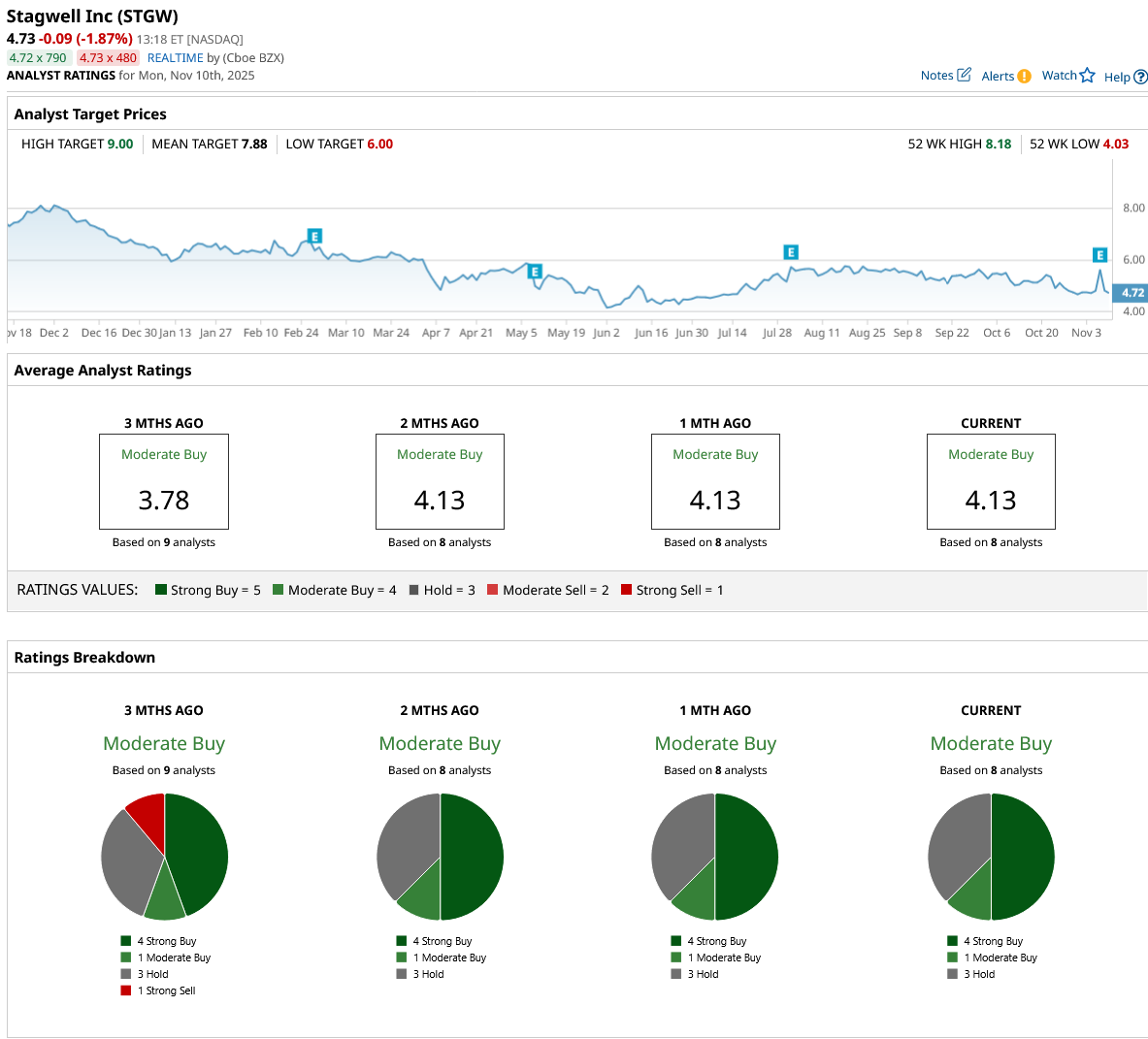

STGW stock has experienced a turbulent 2025, declining sharply earlier in the year but rallying recently on robust Q3 results. Over the last five days, shares are down almost 1%, and the one-month loss stands at 6%, and the six-month deficit is 3%. STGW remains down about 28% for the full year, underperforming the Russell 2000 index, which saw single-digit gains in the same span.

Notably, the stock hit a 52-week low near $4 in June but has rebounded nearly 17% from those levels.

Stagwell Reports Mixed Results

Stagwell reported its Q3 2025 financial results, with revenue of $743 million, a 4% year-over-year (YoY) increase but slightly below analyst estimates of approximately $748.6 million. The company posted adjusted EPS of $0.24, outperforming consensus estimates of $0.2363, reflecting improved operational efficiency and cost control.

Net income attributable to common shareholders rose significantly to $25 million from $3 million in the prior year, while adjusted EBITDA grew 3% to $115 million, delivering a 19% margin on net revenue.

Financially, Stagwell showed key improvements with a 6% growth in net revenue and a 23% increase in adjusted EBITDA excluding advocacy. The company reported a $100 million increase in year-to-date (YTD) cash flow from operations, supporting ongoing investments in technology and marketing. Stagwell’s net new business reached $122 million in Q3, contributing to a last twelve-month total of $472 million, underscoring strong sales momentum and client acquisition.

Looking ahead, Stagwell provided guidance projecting 8% total net revenue growth for 2025, with adjusted EBITDA expected between $410 million and $460 million and free cash flow conversion exceeding 45%. The company emphasized ongoing investments in AI-driven marketing solutions, highlighted by its recent strategic partnership with Palantir, signaling confidence in sustained growth and innovation.

Stagwell and Palantir

Stagwell and Palantir Technologies (PLTR) have teamed up to create an industry-first AI-powered marketing platform designed to revolutionize corporate marketing strategies. This breakthrough platform integrates Palantir’s Foundry data operating system with Stagwell’s Code and Theory orchestration software and The Marketing Cloud’s proprietary data sources, enabling large, complex marketing teams to effectively build and execute campaigns at scale.

The solution provides clients with a centralized source of marketing and advertising targeting data, unlocking unprecedented ROI opportunities. Employing advanced AI, the platform sifts through tens of millions of records for precise audience segmentation, campaign optimization, and actionable insights, all while utilizing novel differential privacy technology to safeguard consumer data. Early deployment of the platform is underway through Stagwell’s media company, Assembly, with plans for broader rollout on an opt-in basis.

Should You Buy STGW?

Stagwell is well considered by analysts as deserving a consensus “Moderate Buy” rating and a mean price target of $7.88, reflecting an upside potential of 67% from the market rate, showing plenty of growth space.

It has been rated by eight analysts, with four “Strong Buy,” one “Moderate Buy,” and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap