Valued at $191.1 billion, Uber Technologies (UBER) is building a digital transportation and logistics network that moves people, food, and goods efficiently across the world. The ride-hailing giant posted its fastest trip growth since 2023, showing its growing dominance across mobility, delivery, and emerging technologies.

After years of heavy investment, Uber has finally shifted into high gear. Uber stock has surged 54.96% year-to-date, wildly outpacing the overall market gain. However, it is down 8.4% from its all-time high of $101.99. Is this a buying opportunity?

Mobility and Delivery Firing on All Cylinders

Uber Technologies continues to deliver strong growth and profitability, signaling that its dual focus on scaling core businesses and investing in future technologies is paying off. In the third quarter, total revenue jumped 20% year-over-year to $13.5 billion, surpassing the consensus estimate by $205.5 million. Total trips in the quarter also rose by 22% to 3.5 billion, with a 21% increase in gross bookings. Net earnings rose an impressive 159% to $3.11 per share.

Uber’s core Mobility business grew 20% to $7.7 billion, exceeding forecasts due to increased rider engagement and a record number of active users. Meanwhile, Delivery experienced its strongest increase in four years, thanks to innovation in Grocery and Retail. According to management, it now has an annualized gross bookings run rate of over $12 billion and is expanding faster than traditional restaurant delivery. The company now leads the delivery market in major countries such as the U.K. and France, while expanding its presence in Germany and Spain. The segment generated $4.5 billion in revenue, a 29% rise year over year, indicating that Uber’s expansion into non-restaurant categories is succeeding. Its Freight division sales remained consistent with the previous year quarter, at $1.3 billion.

Building a Hybrid Future with AVs and AI

Uber’s long-term goal is to seamlessly integrate human drivers and autonomous vehicles (AVs) in a single marketplace. Its collaboration with Nvidia (NVDA) and Stellantis (STLA) is a significant step toward that future. Nvidia’s Hyperion architecture will power Level 4-ready AVs, which will eventually be deployed on Uber’s platform at scale.

Uber’s proven strategy is to invest early in new categories, boost supply and liquidity, and promote user adoption until the product reaches scale. While AVs are not yet profitable, Uber views them as a long-term growth engine. Beyond mobility and delivery, Uber is embedding generative AI throughout its operations, from logistics optimization and driver matching to more personalized customer experiences.

The company expects high-teens growth in gross bookings and low-to mid-30s growth in adjusted EBITDA in the fourth quarter. Uber has also decided to move from adjusted EBITDA to an adjusted EPS model. Management believes the change aligns the company’s reporting with that of other large-cap peers, making it easier for investors to compare Uber’s performance across the broader market.

Uber is also taking a strict approach to capital allocation, having generated roughly $9 billion in free cash flow over the last year, which it is utilizing to lower share count. With a unified global platform and deep technology investments, Uber is starting its next growth phase on a strong footing. The company’s revenue has grown drastically from $11.1 billion in 2020 to an estimated $51.9 billion for 2025. For the full year, analysts expect Uber’s earnings to increase by 17.8% to $5.37 per share. Trading at 17 times forward earnings, Uber is a reasonable growth stock.

Uber’s ability to combine high growth with expanding profitability highlights how rapidly it has evolved from a ride-hailing app to a disciplined, tech-driven logistics powerhouse. The company has positioned itself well for the next decade, and investors might find the current dip in Uber’s stock a buying opportunity.

What Is the Target Price for Uber Stock?

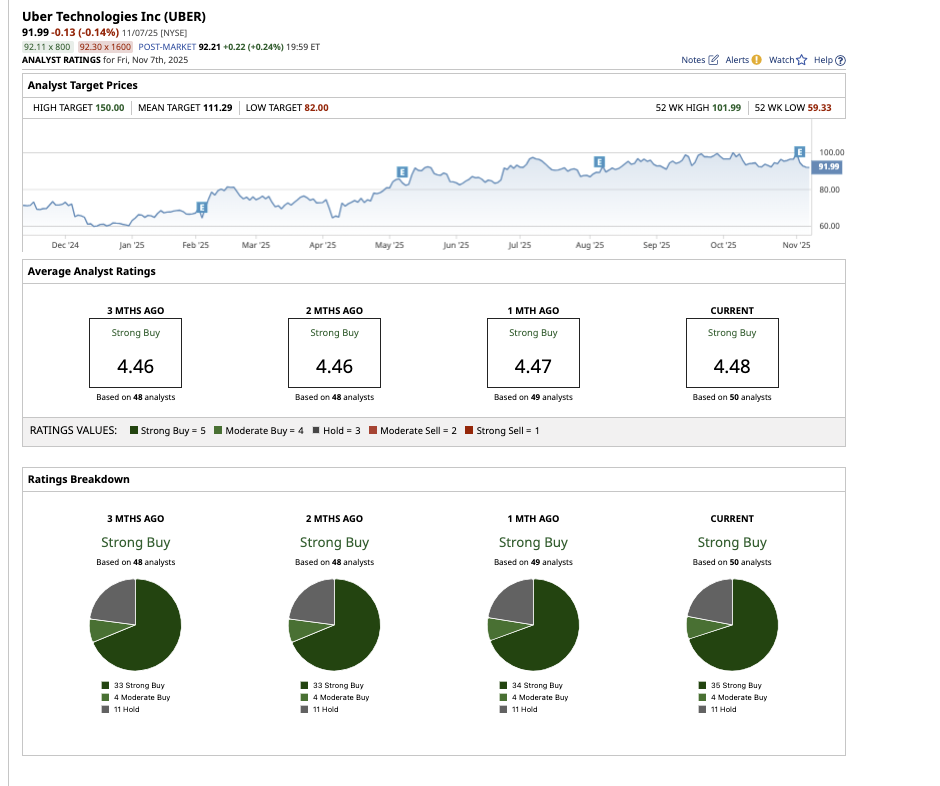

Overall, Wall Street remains strongly bullish about Uber stock. Of the 50 analysts covering UBER, 35 have a “Strong Buy” recommendation, four have a “Moderate Buy” rating, and 11 suggest a “Hold.” Based on the analysts’ average price target of $111.29, Uber stock has upside potential of 21% from current levels. Its high price target suggests the stock can climb as high as 63% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap