Winona, Minnesota-based Fastenal Company (FAST) engages in the wholesale distribution of industrial and construction supplies in North America and internationally. Valued at approximately $46.9 billion by market cap, Fastenal offers various industrial and construction-related products through its company-owned stores.

The industrial giant has lagged behind the broader market over the past year. FAST stock prices have gained 13.6% on a YTD basis and dropped 1.7% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains in 2025 and 12.7% returns over the past year.

Narrowing the focus, Fastenal has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 16.4% surge in 2025 and 9.1% gains over the past year.

Fastenal’s stock prices plunged 7.5% in a single trading session following the release of its mixed Q3 results on Oct. 13. While the industrial production was still sluggish in Q3, the company’s performance was positively impacted by previous customer contract signings. Its topline for the quarter surged 11.7% year-over-year to $2.1 billion, but missed the Street’s expectations by 11 bps. Meanwhile, its adjusted EPS increased by a notable 12.3% year-over-year to $0.29, but missed the consensus estimates by 3.3%.

For the full fiscal 2025, ending in December, analysts expect FAST to deliver an adjusted EPS of $1.11, up 11% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it met the projections on two other occasions.

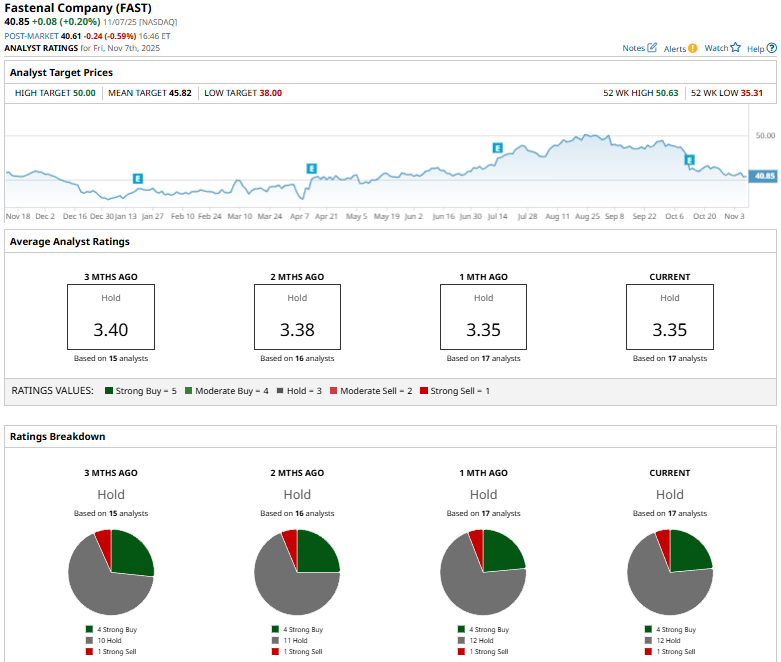

Among the 17 analysts covering the FAST stock, the consensus rating is a “Hold.” That’s based on four “Strong Buys,” 12 “Holds,” and one “Strong Sell.”

This configuration has remained mostly consistent over the past three months.

On Oct. 14, Barclays (BCS) analyst Guy Hardwick maintained an "Equal-Weight" rating on FAST, but lowered the price target from $49 to $45.

FAST’s mean price target of $45.82 represents a 12.2% premium to current price levels. Meanwhile, the street-high target of $50 suggests a 22.4% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Missed The AI Trade? The Next Wave Of Alpha Is Hidden In Structure

- Technical Support Levels, CPI and Other Key Things to Watch this Week

- Nvidia Looks 22% Undervalued Here Based on Projected FCF Margins - $230 Price Target

- Michael Burry Is Betting Against Palantir Stock. At Least 1 Analyst Thinks It Can Gain 50% from Here.