Moderna, Inc. (MRNA) is a biotechnology firm based in Cambridge, Massachusetts, that focuses on mRNA technology to create innovative medicines and vaccines. The company’s operations encompass designing mRNA sequences that instruct cells to produce proteins for the prevention or treatment of diseases.

Moderna integrates extensive research and development with both in-house and partner manufacturing to rapidly develop and scale mRNA-based therapies. Their efforts span vaccines for infectious diseases, cancer, and rare conditions, supported by global distribution and regulatory functions. The company has a market capitalization of $9.58 billion.

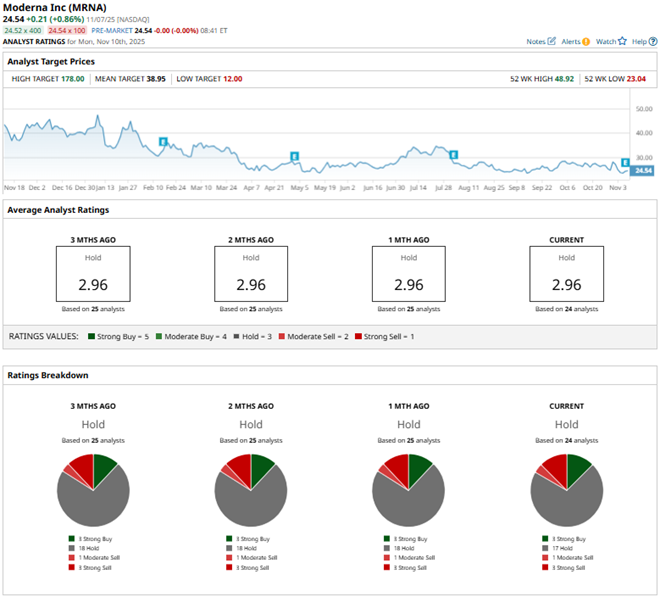

Following a significant decline in demand for its COVID-19 vaccine, Moderna’s stock has dropped over the past year. Over the past 52 weeks, the stock has declined by 51.2%, while it has decreased by 7.8% over the past three months. It had reached a 52-week low of $23.04 on Nov. 7, but is up 6.5% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 12.7% and 6.1% over the same periods, respectively. Next, we compare the stock with its own sector. The Health Care Select Sector SPDR Fund (XLV) has declined about 2% over the past 52 weeks, but rose 13.3% over the past three months.

Although better than what the analysts had expected, Moderna’s third-quarter results for fiscal 2025 were characterized by a sharp drop in COVID vaccine sales, which dropped by 46.4% year-over-year (YOY) to $971 million. This subsequently resulted in the company’s overall topline declining by 45.4% from the prior year’s period to $1.02 billion. However, this figure was higher than the $769.60 million that Wall Street analysts had expected.

Its EPS also dropped from a profit of $0.03 to a loss of $0.51 YOY. However, Wall Street analysts were expecting a far bigger loss per share of $2.38. Following these results, Moderna narrowed the fiscal 2025 projected revenue range from $1.50 billion - $2.20 billion to $1.60 billion - $2 billion.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Moderna’s loss per share to grow 8% YOY to $9.58 on a diluted basis. However, loss per share is expected to decrease 24% to $7.28 in fiscal 2026. On the other hand, the company has a solid history of surpassing consensus EPS estimates, topping them in each of the four trailing quarters.

Among the 24 Wall Street analysts covering Moderna’s stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 17 “Holds,” one “Moderate Sell,” and three “Strong Sells.” The ratings configuration has remained relatively unchanged over the past three months.

On Nov. 10, BofA Securities analyst Dimple Gosai maintained an “Underperform” rating for Moderna’s stock, while lowering the price target from $24 to $21. This month, analysts at Barclays lowered Moderna’s price target from $31 to $25, while maintaining an “Equal Weight” rating on its stock. Moderna’s mean price target of $38.95 indicates a 58.7% upside over current market prices.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart