In a bold move, H.C. Wainwright analyst Scott Buck recently raised his price target on SoundHound AI (SOUN) stock to a new Street high of $26, marking 84% potential upside from current levels and compelling the market to sit up and take notice. Buck sees more than just the current hype around conversational artificial intelligence (AI), he believes SoundHound has built a scalable voice-AI platform that is starting to land meaningful enterprise contracts and could see substantial margin expansion over time.

SoundHound has expanded into “multimodal” AI (vision and voice) and deepened relationships across verticals, from automotive OEMs to quick-service restaurants and enterprise customer-service deployments. In the automotive segment alone, the in-car voice-commerce opportunity is pegged at $35 billion annually, and SoundHound is securing major wins across global brands.

With momentum, a large total addressable market, real-world commercial traction, and shares already reacting, the upgrade suggests that this isn’t just upside; it could be quite meaningful.

About SoundHound Stock

Headquartered in Santa Clara, California, SoundHound is a voice-and-conversational AI company that develops speech-recognition, natural-language-processing and voice-commerce platforms for industries such as automotive, restaurants, customer service and smart devices. Its market cap is around $5.8 billion.

The stock price performance of SoundHound has been a vivid illustration of both the promise and the peril of high-growth technology plays. Year-to-date (YTD), shares are down 25%, underscoring investor caution despite the broader AI boom, as SoundHound remains far from profitability.

In contrast, when you look back over the full 52-week period, the story changes. SOUN has advanced by a sizeable amount, showing a gain of 106% over the past year. The robust 52-week gain reflects investor enthusiasm for SoundHound’s voice and conversational-AI platform, and its heavily anticipated growth as the business scales.

This divergence, strong annual appreciation yet YTD decline speaks to the volatility underlying the company’s narrative, making it one of those high-beta growth plays. SoundHound has a beta of 2.6.

The stock trades at a lofty valuation compared to its industry peers at 68.5 times forward sales.

Solid Q2 Revenue Growth

SoundHound reported its second-quarter 2025 financial results on Aug. 7, delivering record revenue of $42.7 million, marking a 217% year-over-year (YOY) increase. This performance surpassed analyst expectations and was driven by growth across key sectors, including automotive, enterprise AI for customer service, and AI automation for restaurants.

Despite the strong revenue growth, the company is still in losses. In Q2, SoundHound reported a non-GAAP net loss of $11.9 million, or $0.03 per share, an improvement from a $14.9 million loss or $0.04 per share in the same quarter the previous year. The adjusted EBITDA loss stood at $14.3 million, reflecting ongoing investments in scaling operations.

Looking ahead, SoundHound raised its full-year 2025 revenue guidance to a range of $160 million to $178 million. The company also reiterated its target of achieving adjusted EBITDA profitability by the end of 2025, supported by a robust balance sheet with $230 million in cash and equivalents at quarter end and no debt.

Strategic partnerships have further bolstered SoundHound’s growth prospects. In July 2025, the company partnered with AVANT Communications to distribute its Amelia 7.0 and Autonomics AI platforms, expanding its reach in financial services, insurance, retail, and healthcare sectors. Additionally, SoundHound collaborated with Acrelec to integrate its voice AI drive-thru system into Acrelec’s platform, enhancing automated ordering at quick-service restaurants.

Analysts predict loss per share to improve 58% YOY to around $0.44 for fiscal 2025 and improve another 41% annually to $0.26 in fiscal 2026.

What Do Analysts Expect for SoundHound Stock?

Most recently, H.C. Wainwright raised its price target on SoundHound AI from $18 to $26, maintaining a “Buy” rating. Despite underperforming in 2025, the firm expects “material outperformance" on the horizon. The recent Interactions acquisition is expected to boost 2026 revenue beyond current Street forecasts. Also, H.C. Wainwright expressed confidence in management’s ability to replicate its cross-sell and upsell strategy.

In September, Wedbush analyst Daniel Ives reiterated an "Outperform rating on SOUN, maintaining a price target of $16, reflecting continued confidence in the company’s growth trajectory and market position. However, Oppenheimer analyst Brian Schwartz initiated coverage with a “Perform” rating, signaling a more cautious outlook.

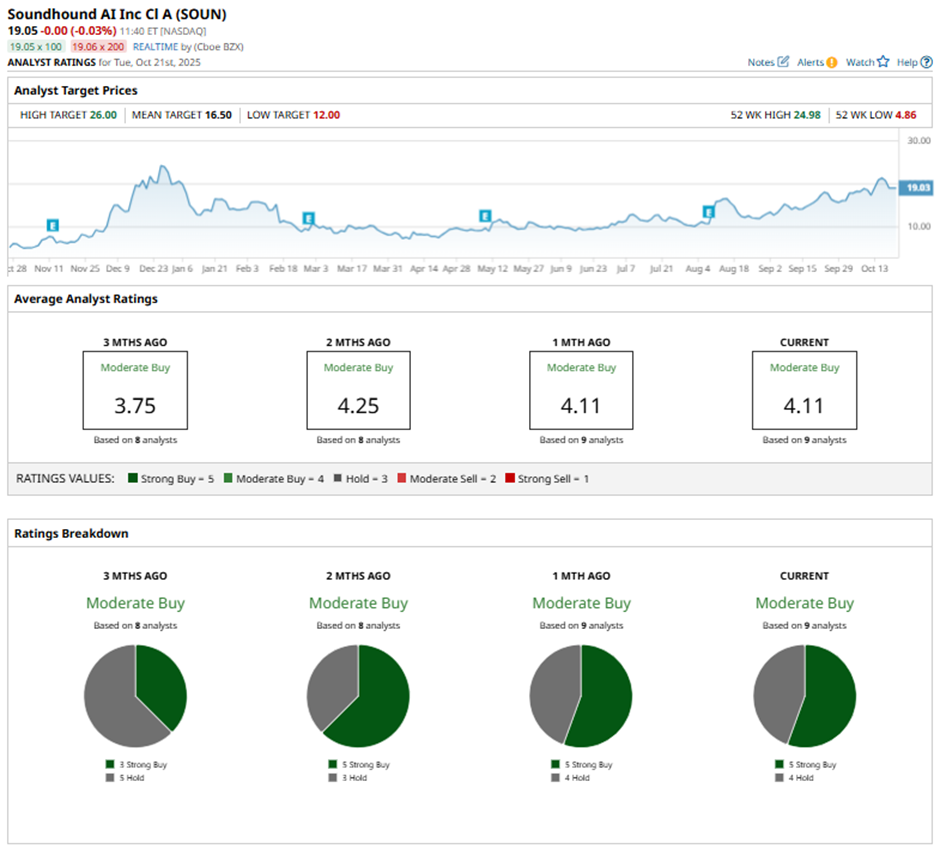

Wall Street is moderately bullish on SOUN. Overall, SOUN stock has a consensus “Moderate Buy” rating. Of the nine analysts covering the stock, five advise a “Strong Buy,” and the remaining four analysts are on the sidelines with a “Hold” rating.

The average analyst price target of $16.50 implies 17% potential upside from here. Meanwhile,, H.C. Wainwright’s Street-high target price of $26 suggests the stock could rally as much as 84%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart