Westminster, Colorado-based Ball Corporation (BALL) is one of the world's leading suppliers of metal packaging to the beverage, personal care, and household products industries. With a market cap of $13.1 billion, Ball’s operations span various countries in the Americas, Europe, Indo-Pacific, the Middle East, and Africa.

The packaging giant has significantly underperformed the broader market over the past year. Ball stock has tanked 23% over the past 52 weeks and 15.8% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 14% gains over the past year and 16.2% returns on a YTD basis.

Zooming in further, Ball has also underperformed the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11.1% gains over the past year and 6.5% uptick on a YTD basis.

Ball’s stock prices gained 1.5% in the trading session following the release of its better-than-expected Q3 results on Nov. 4. The company observed a notable boom in demand, and its topline for the quarter surged 9.6% year-over-year to $3.4 billion, beating the Street’s expectations by 1.7%. Further, its adjusted EPS increased 12.1% year-over-year to $1.02, coming in line with analysts’ estimates.

Moreover, the company has returned more than $1 billion to shareholders in the first three quarters of 2025 and remains on track to meet or exceed its expected financials.

For the full fiscal 2025, ending in December, analysts expect Ball to deliver an adjusted EPS of $3.57, up 12.6% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

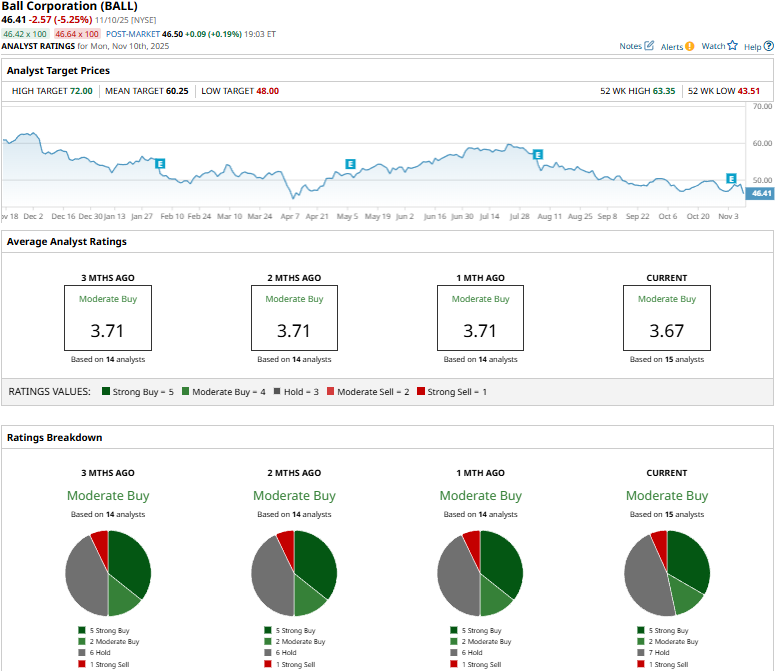

Among the 15 analysts covering the Ball stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buys,” two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration has remained mostly stable over the past three months.

On Nov. 6, JP Morgan (JPM) analyst Jeffrey Zekauskas reiterated a “Neutral” rating on Ball, but reduced the price target from $56 to $50.

As of writing, Ball’s mean price target of $60.25 represents a 29.8% premium to current price levels. Meanwhile, the street-high target of $72 suggests a staggering 55.1% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart