With a market cap of $16.3 billion, Fortive Corporation (FTV) is a diversified industrial technology company headquartered in Everett, Washington. It delivers essential tools, software, and instrumentation across industrial and healthcare markets, organized mainly into Intelligent Operating Solutions, Advanced Healthcare Solutions, and Precision Technologies.

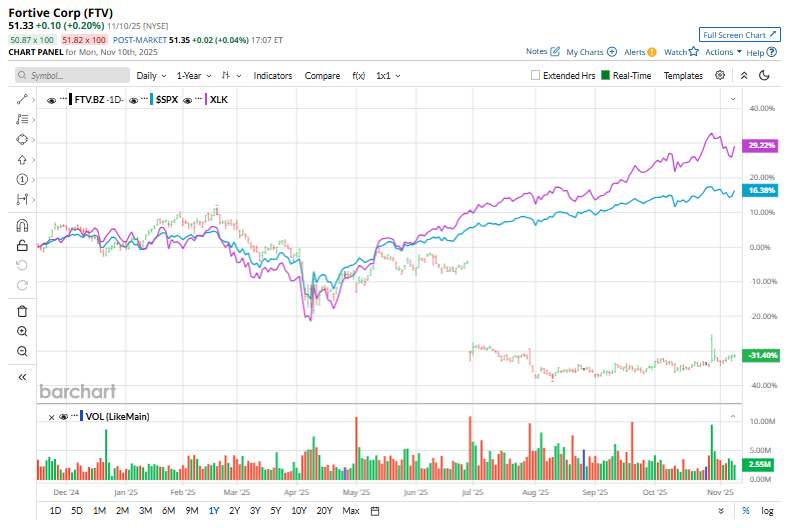

Fortive has significantly underperformed the broader market over the past year. FTV stock has plunged 31.7% over the past 52 weeks and 31.6% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 14% surge over the past year and 16.2% returns in 2025.

Narrowing the focus, Fortive has also trailed the sector-focused Technology Select Sector SPDR Fund’s (XLK) 24.6% surge over the past 52 weeks and 27.1% gains on a YTD basis.

On Oct. 29, shares of Fortive surged 8.4% after the company delivered stronger-than-expected third-quarter results and raised its full-year profit outlook. The industrial tech firm beat estimates on both earnings and revenue, posting adjusted EPS of $0.68 and revenue of $1.03 billion. Adjusted EBITDA margin expanded to roughly 30%, supported by gains across both the Intelligent Operating Solutions and Advanced Healthcare Solutions segments. For the full year 2025, Fortive now anticipates adjusted diluted net earnings per share of $2.63 to $2.67, as compared to the prior expectation of $2.50 to $2.60.

For the current fiscal 2025, ending in December, analysts expect Fortive to deliver an adjusted EPS of $2.64, down 32.1% year-over-year. The company has a mixed earnings surprise history. While it surpassed or matched the Street’s bottom-line estimates thrice over the past four quarters, it missed the estimates on one occasion.

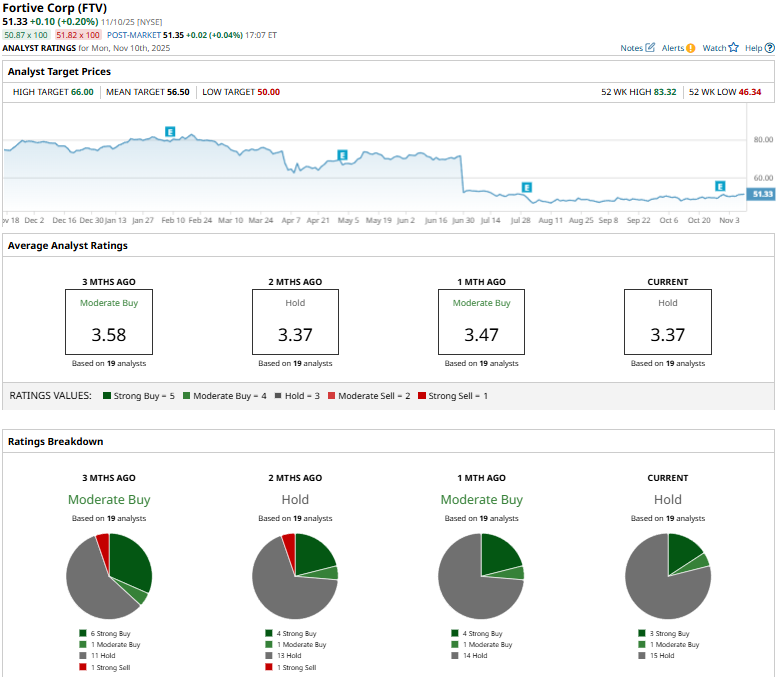

FTV maintains a consensus “Hold” rating overall, a step down from “Moderate Buy” a month ago. Among the 19 analysts covering the stock, opinions include three “Strong Buys,” one “Moderate Buy,” and 15 “Holds.”

This configuration is bearish than a month ago, when the stock had four “Strong Buy” recommendations.

On November 5, Morgan Stanley (MS) Chris Snyder reiterated an “Equal-Weight” rating on Fortive and slightly boosted the price target from $50 to $53, implying a modest 6% expected upside and signaling measured confidence in the stock’s valuation.

FTV’s mean price target of $56.50 represents a 10.1% upside potential. Meanwhile, the street-high target of $66 suggests a staggering 28.6% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart