Conshohocken, Pennsylvania-based Cencora, Inc. (COR) is a pharmaceutical sourcing and distribution company. With a market cap of approximately $69.9 billion, Cencora operates through the U.S. Healthcare Solutions and International Healthcare Solutions segments, providing pharmaceutical supplies, healthcare products, and services to various healthcare providers.

The pharma distributor has significantly outperformed the broader market over the past year. COR stock has soared 62.3% on a YTD basis and 46.8% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.2% gains in 2025 and 14% returns over the past year.

Narrowing the focus, Cencora has also outperformed the industry-focused VanEck Pharmaceutical ETF’s (PPH) 10.8% gains on a YTD basis and 5.1% uptick over the past 52 weeks.

Cencora’s stock prices gained 2.8% in the trading session following the release of its robust Q3 results on Nov. 5. Driven by its growth-oriented investments and digital transformation, the company further solidified its position in the healthcare space. Its topline for the quarter increased 5.9% year-over-year to $83.7 billion, beating the Street’s expectations by 69 bps. Meanwhile, its adjusted EPS soared 15% year-over-year to $3.84, surpassing the consensus estimates by 1.3%.

For the full fiscal 2026, ending in September, analysts expect COR to deliver an adjusted EPS of $17.64, up 10.3% year-over-year. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

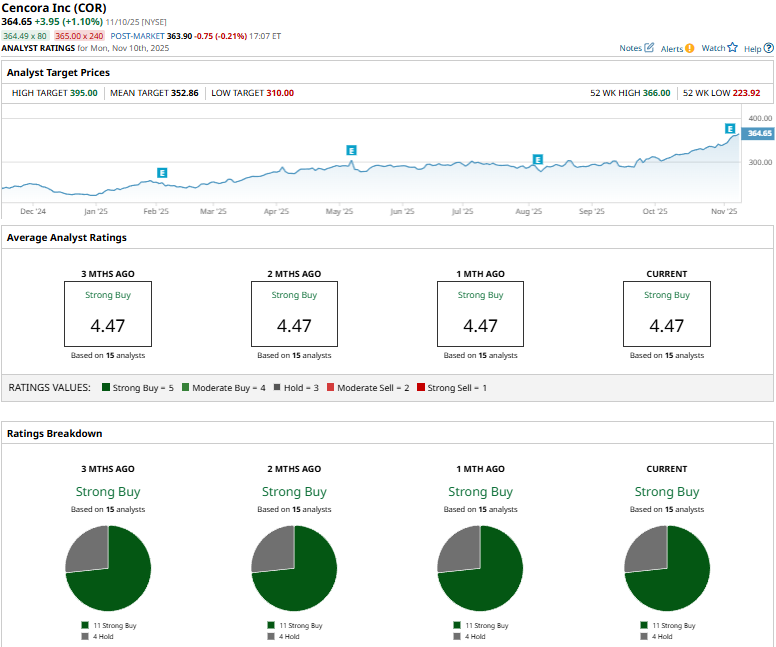

Among the 15 analysts covering the COR stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buys” and four “Holds.”

This configuration has remained stable over the past three months.

On Nov. 10, TD Cowen analyst Charles Rhyee reiterated a "Buy" rating on COR and raised the price target from $350 to $400.

As of writing, Cencora is trading above its mean price target of $352.86.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart