CoreWeave (CRWV) shares tumbled roughly 15% on Tuesday after the artificial intelligence (AI) infrastructure company posted a strong Q3 but issued disappointing guidance for the future.

Despite third-quarter strength, the Livingston-headquartered firm guided for up to $5.15 billion in revenue for the full year (2025), notably weaker than $5.29 billion that analysts had forecast.

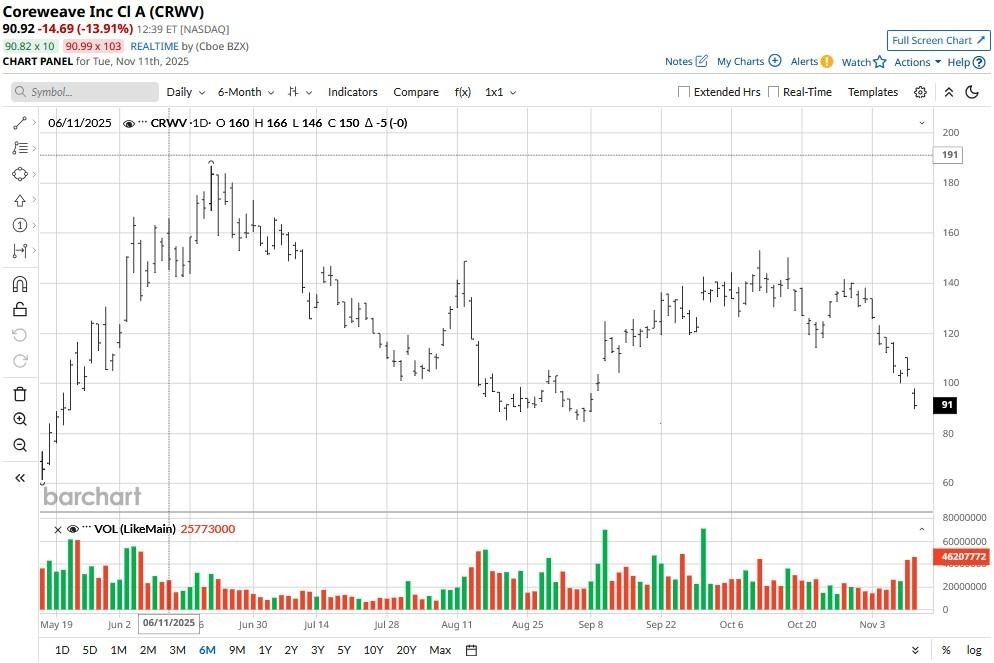

Including the post-earnings dip, CoreWeave stock is down an alarming 50% versus its YTD high. It has slipped to a 14-day Relative Strength Index (RSI) reading below 30, which could suggest that the stock is now oversold on the post-earnings selloff.

CRWV Stock Isn’t Worth Buying on the Post-Earnings Dip

Beyond the disappointing outlook, CRWV shares face several structural concerns that warrant cutting exposure at current levels.

For example, the company already has an enormous debt load (net interest expense surpassed $300 million in Q3) – and yet, next year, it plans on spending “well in excess of double” the $13 billion it’s on track to spending in 2025.

While the growing backlog (nearly $56 billion at the end of third quarter) sure signals strength, CoreWeave’s guidance for capital expenditures is a major red flag, especially given it’s still mired in losses.

Considering investors often reward profitability and cost discipline, this artificial intelligence stock seems rather out of step at about $91.

Insiders View CoreWeave Shares as Expensive to Own

Bulls may argue that CoreWeave shares’ price-sales (P/S) multiple of less than 15x is infinitely more attractive than the likes of Nvidia at about 35x.

However, the massive crash in the second half of 2025 still hasn’t turned CRWV into a particularly inexpensive name to own, and insiders know it.

According to Barchart, over the past six months, none of them have recorded even a single “buy” transaction, while there’s been 68 “sell” entries in total involving CoreWeave during the same time.

Moreover, the company’s failure to buy Core Scientific (CORZ) further weakens its bull case heading into 2026.

How Wall Street Recommends Playing CoreWeave

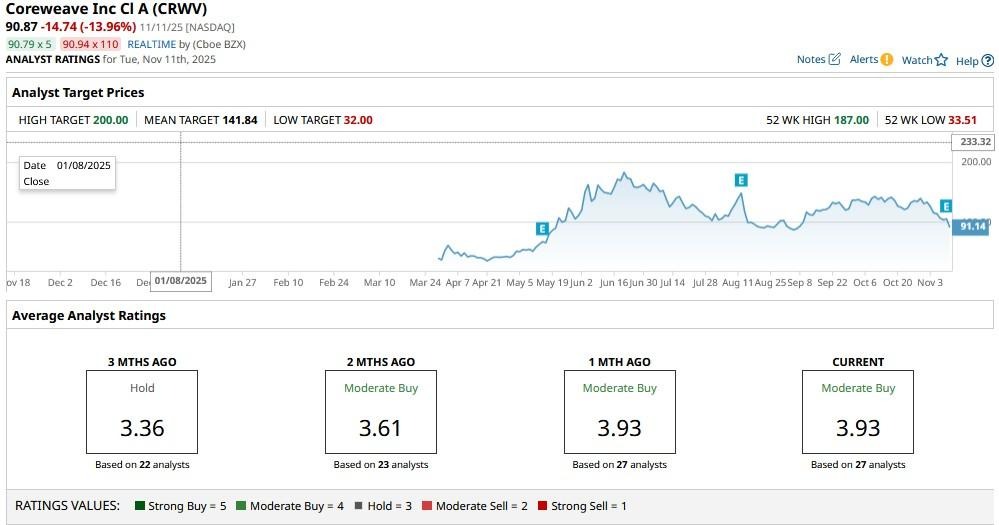

Despite the aforementioned concerns, Wall Street continues to recommend owning CoreWeave stock for the longer term.

The consensus rating on CRWV shares remains at “Moderate Buy” with the mean target of about $142 indicating potential upside of well over 50% from here.

Among the AI firm’s notable bulls is famed investor Jim Cramer as well.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?

- Opendoor Is Betting That It Can Become an AI Company. Does That Make OPEN Stock a Buy, or Should You Stay on the Sidelines Here?

- Peloton Is Betting on a Very Merry Christmas. Should You Buy PTON Stock Here?

- SoftBank Is Selling Nvidia Stock. Should You?