With a market cap of $80.8 billion, Waste Management, Inc. (WM) is a leading provider of comprehensive waste management and environmental solutions across North America and internationally. The company offers waste collection, recycling, disposal, renewable energy generation, and specialized services such as regulated waste management and secure information destruction.

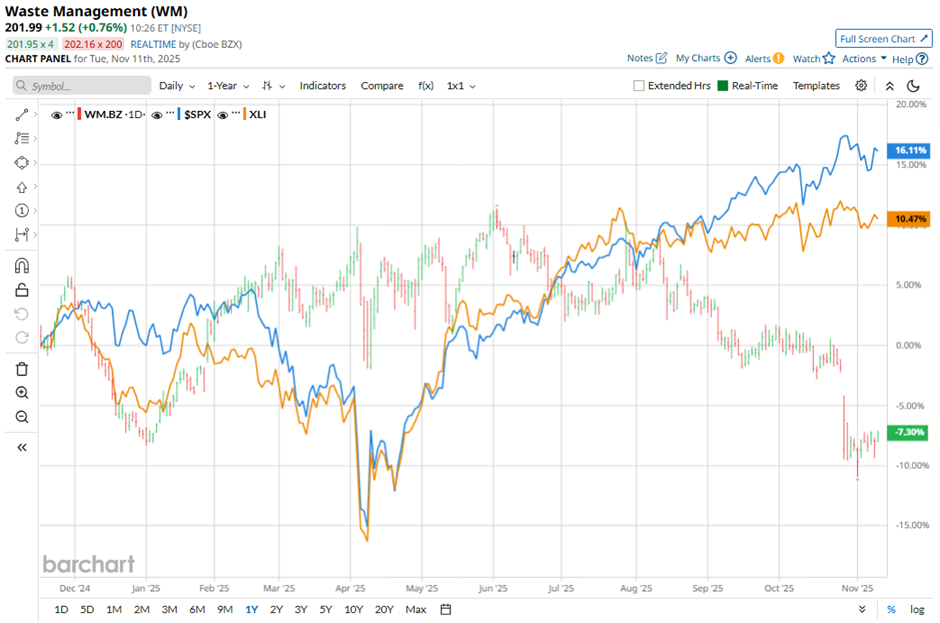

Shares of the Houston, Texas-based company have lagged behind the broader market over the past 52 weeks. WM stock has declined 9.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.4%. Moreover, shares of the company are up marginally on a YTD basis, compared to SPX’s 15.8% gain.

Focusing more closely, shares of the garbage and recycling hauler have underperformed the Industrial Select Sector SPDR Fund’s (XLI) 7.2% rise over the past 52 weeks and a 16.5% YTD return.

WM shares fell 4.5% following its Q3 2025 results on Oct. 27. The company reported adjusted EPS of $1.98 and revenue of $6.44 billion, below forecasts. Investors were also disappointed that total revenue guidance was trimmed to ~$25.28 billion, the low end of the prior range, due to weaker recycled commodity prices and softer WM Healthcare Solutions revenue.

For the fiscal year ending in December 2025, analysts expect Waste Management’s adjusted EPS to grow 4.2% year-over-year to $7.53. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions.

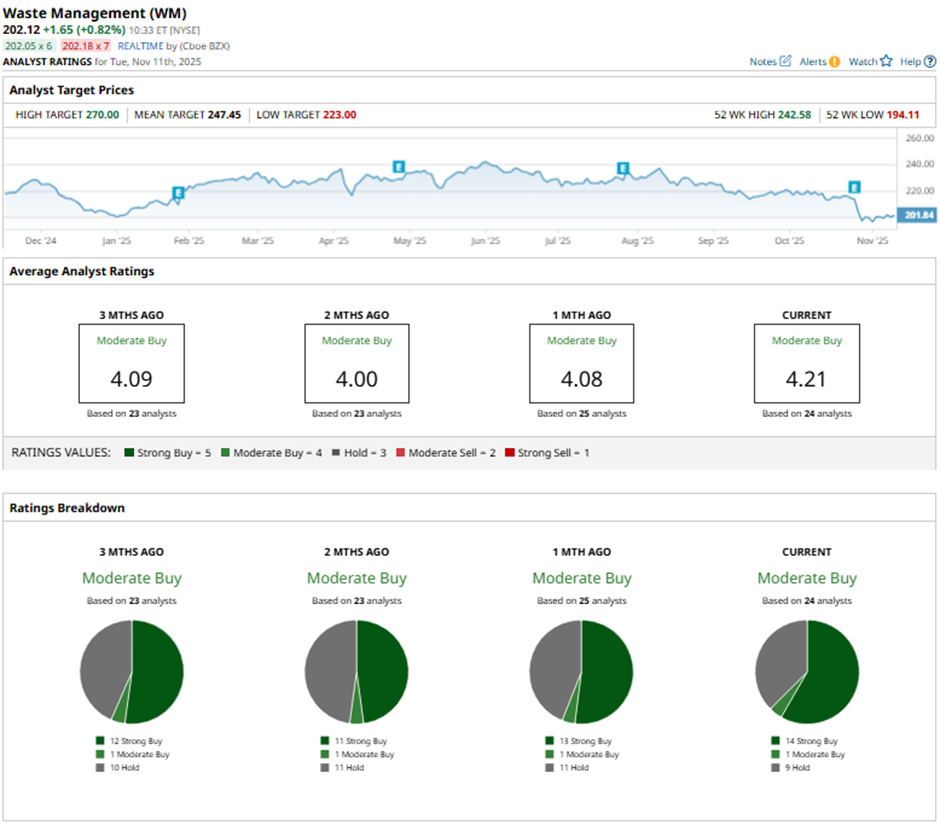

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration is more bullish than three months ago, with 12 “Strong Buy” ratings on the stock.

On Oct. 29, BMO Capital cut its price target on WM to $227 while maintaining a “Market Perform” rating.

The mean price target of $247.45 represents a 22.4% premium to WM’s current price levels. The Street-high price target of $270 suggests a 33.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- This ‘Strong Buy’ Tech Stock Just Inked a Deal with AWS. Should You Buy It Now?

- This Super Micro Computer Rival Is Betting Big on Quantum Computing. Should You Buy Its Stock Now?