With a market cap of $124.5 billion, Honeywell International Inc. (HON) is a global technology and manufacturing leader, operates across aerospace, industrial automation, building automation, and energy and sustainability sectors. With a strong presence in commercial aviation and defense, the company is expanding into emerging markets like unmanned aerial systems (UAS) and urban air mobility (UAM) through its dedicated UAS unit.

Shares of the Charlotte, North Carolina-based company have underperformed the broader market over the past 52 weeks. HON stock has fallen 12.8% over this time frame, while the broader S&P 500 Index ($SPX) has increased nearly 14%. In addition, shares of the company are down over 13% on a YTD basis, compared to SPX’s 16.2% gain.

Moreover, shares of Honeywell have lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 7.7% rise over the past 52 weeks.

Honeywell’s shares climbed 6.8% on Oct. 23 after the company raised its 2025 adjusted EPS forecast to $10.60 - $10.70, despite a $0.21 hit from the planned Solstice materials unit separation. The company also reported better-than-expected Q3 2025 adjusted EPS of $2.82 and revenue of $10.41 billion, driven by strong aerospace sales up 15% to $4.51 billion. Investor optimism rose further as management projected stronger 2025 pricing and stabilization in tariffs and inflation pressures.

For the fiscal year ending in December 2025, analysts expect Honeywell’s adjusted EPS to grow 7.6% year-over-year to $10.64. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

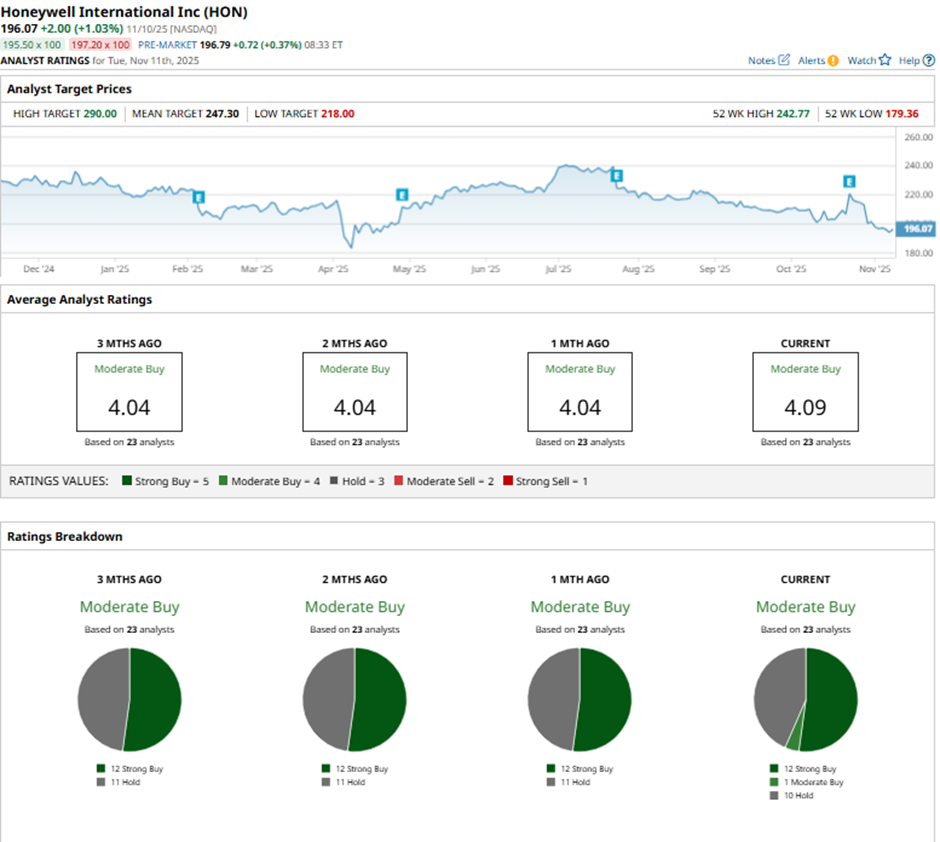

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and 10 “Holds.”

On Nov. 4, Bank of America Securities analyst Andrew Obin reiterated a “Buy” rating on Honeywell International and maintained a price target of $265.

The mean price target of $247.30 represents a 26.1% premium to HON’s current price levels. The Street-high price target of $290 suggests a 47.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart