Intellia Therapeutics (NTLA), a clinical-stage biotechnology company, saw its shares plunge more than 22% on Friday, Nov. 7, after management acknowledged a patient’s death in a gene-editing study for its lead candidate in the Q3 earnings release. The U.S. Food and Drug Administration (FDA) has also put the Phase 3 study on hold, causing the stock to fall just over 14% year to date.

Intellia develops in vivo CRISPR-based gene-editing therapies to treat or cure genetic diseases by precisely editing DNA directly inside the body. Meanwhile, Cathie Wood, known for her bold conviction in cutting-edge innovation, has been steadily increasing her stake in Intellia.

Let’s find out if Intellia stock is still a buy.

The Nex-Z Clinical Hold: Temporary Setback or High Risk?

Intellia works on one-time treatments that could permanently fix the root cause of certain genetic diseases. The company announced its third-quarter results on Nov. 6, indicating both challenges and encouraging developments in its pipeline. The company’s two flagship programs, nexiguran ziclumeran (nex-z) and lonvoguran ziclumeran (lonvo-z), are approaching late-stage milestones in the treatment of rare but significant genetic diseases.

However, management also acknowledged that Intellia’s lead drug candidate, nex-z, has suffered a temporary setback. The drug is being developed to treat transthyretin (ATTR) amyloidosis, a serious condition caused by protein misfolding. Unfortunately, in late October, the FDA placed a clinical hold on the company’s Phase 3 MAGNITUDE and MAGNITUDE-2 trials after a patient death was reported. While the case is being investigated, Intellia has stated that the incidence featured “complicating comorbidities” and that serious liver-related adverse effects happened in fewer than 1% of patients in the MAGNITUDE trial. The company is currently working closely with regulators and medical experts to develop its risk mitigation strategy. It plans to provide an update once it receives the FDA’s formal hold letter.

Despite this hurdle, management stressed that the science behind nex-z remains compelling. Earlier trials have shown the therapy can deeply and consistently reduce transthyretin protein after a single dose, suggesting the potential for a one-time, lifelong treatment. Intellia will present new long-term data for ATTR-CM patients on Nov. 10, 2025, at the American Heart Association (AHA) Scientific Sessions.

Some analysts remain skeptical following the FDA hold. For instance, RBC Capital Markets and William Blair analysts believe that until Intellia offers a clear regulatory way forward, it is tough to be optimistic about the stock.

Meanwhile, Intellia’s second program, lonvo-z, is balancing for the temporary setback. Designed to treat hereditary angioedema (HAE) by inactivating the KLKB1 gene, lonvo-z could dramatically reduce or even eliminate HAE attacks after a single treatment. The company has completed enrollment in its Phase 3 HAELO study, with top-line data expected by mid-2026 and a potential U.S. launch in the first half of 2027.

In the third quarter, Intellia reported $13.8 million in collaboration revenue. However, as a clinical-stage company, it incurred a net loss of $101.3 million. Intellia had $670 million in cash, cash equivalents, and marketable securities at the end of the third quarter, enough to cover operations until mid-2027, including the anticipated commercial launch of lonvo-z.

Is There an Opportunity in Intellia?

Intellia has long been a part of Cathie Wood’s portfolio, with a weightage of 1.14% in the ARK Innovation ETF (ARKK) and 2.6% in the ARK Genomic Revolution ETF (ARKK). On Oct. 28, ARK scooped up 479,411 shares of Intellia Therapeutics, worth approximately $7.09 million, through two of its funds. This marked the second consecutive day of accumulation, indicating Cathie Wood’s continued bullish outlook on the gene-editing innovator.

If lonvo-z achieves positive Phase 3 results and proceeds with commercialization as planned, Intellia might transition from a clinical-stage company to a revenue-generating gene therapy leader over the next few years. This could validate Wood’s belief in the stock’s long-term prospects.

However, if the FDA does not lift its hold on nex-z and the lead candidate suffers further setbacks, Intellia’s gene-editing approach might be rendered ineffective. This is not unusual for a clinical-stage biotech company, making them a high-risk investment. Any clinical trial delays or failures can cause the stock to plummet, but any favorable news can also propel it upward.

Thus, Intellia remains a high-risk, high-reward investment. Investors should monitor Intellia’s regulatory path forward. Furthermore, investors who follow Wood’s strategy of capitalizing on short term uncertainty to capture long-term disruption may wish to monitor any changes in Intellia's position in ARK Invest’s holdings in the future.

What Is the Target Price for Intellia Stock?

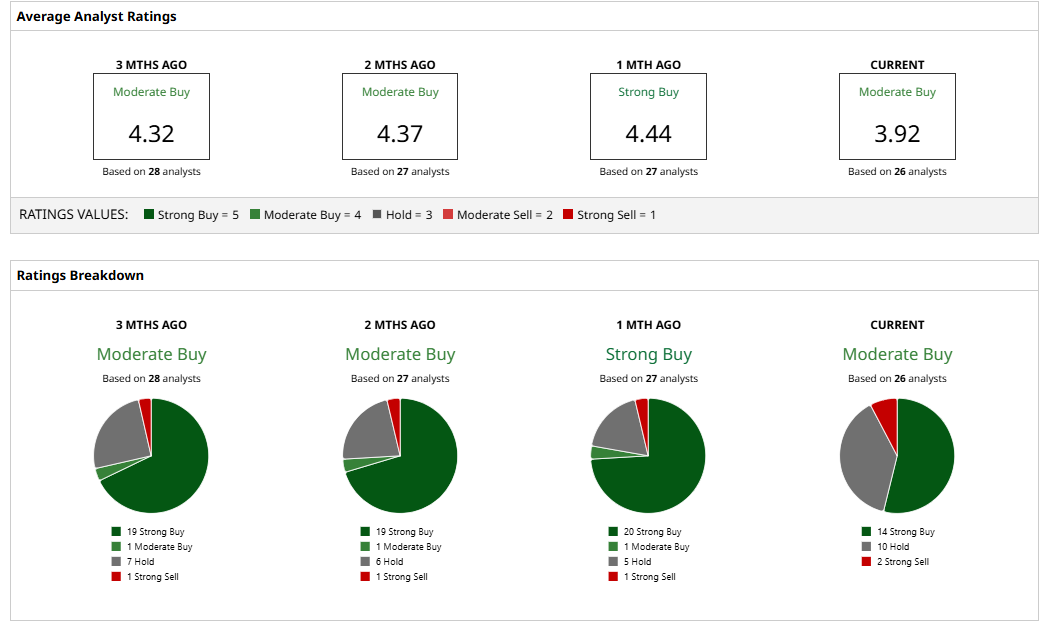

Overall, Wall Street rates Intellia stock as a “Moderate Buy.” Of the 26 analysts covering NTLA, 14 have a “Strong Buy” recommendation, 10 suggest it's a “Hold,” and two suggest a “Strong Sell.”

The average target price of $29.75 suggests the stock can rally as much as 201% from current levels. The stock has a high price estimate of $106.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart