With a market cap of $42.7 billion, ONEOK, Inc. (OKE) is a leading U.S. midstream service provider offering gathering, processing, transportation, storage, and export services for natural gas, natural gas liquids (NGLs), refined products, and crude oil. The company operates through four segments: Natural Gas Gathering and Processing; Natural Gas Liquids; Natural Gas Pipelines; and Refined Products and Crude.

Shares of the Tulsa, Oklahoma-based company have underperformed the broader market over the past 52 weeks. OKE stock has declined 36.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.6%. Moreover, shares of ONEOK are down 31.4% on a YTD basis, compared to SPX's 15.9% gain.

Looking closer, shares of the company have also lagged behind the Energy Select Sector SPDR Fund's (XLE) 2.7% drop over the past 52 weeks.

Despite ONEOK reporting better-than-expected Q3 2025 earnings of $1.49 per share on Oct. 28, shares fell 2.8% the next day as investors focused on rising expenses and capital spending. Operating costs climbed 27% year-over-year to $738 million, while total capital expenditures surged to $804 million from $468 million, reflecting higher spending tied to the EnLink and Medallion acquisitions.

For the fiscal year ending in December 2025, analysts expect OKE's EPS to rise 3.5% year-over-year to $5.35. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

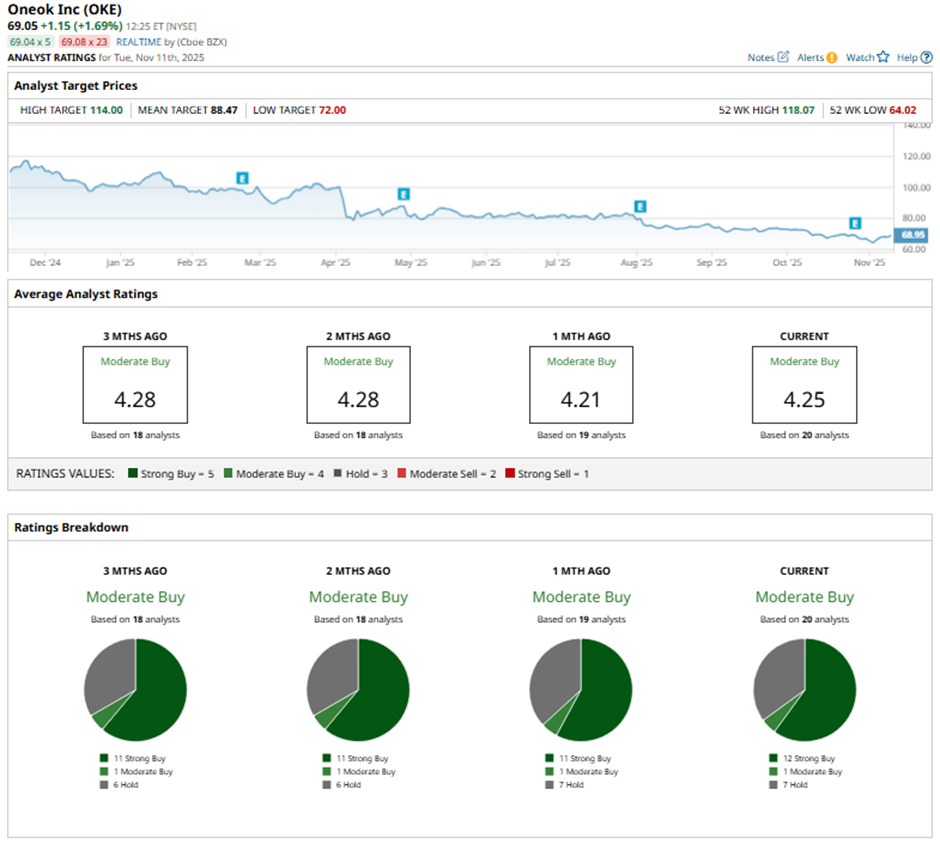

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is slightly more bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

On Oct. 31, Citi lowered its price target on ONEOK to $95 while maintaining a “Buy” rating.

The mean price target of $88.47 represents a 28.1% premium to OKE’s current price levels. The Street-high price target of $114 suggests a 65.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Peloton Is Betting on a Very Merry Christmas. Should You Buy PTON Stock Here?

- SoftBank Is Selling Nvidia Stock. Should You?

- CoreWeave Slips Into Oversold Territory on Earnings Plunge. Should You Buy the Dip in CRWV Stock?

- Enovix (ENVX) Offers the Most Daring Contrarians a Quant-Driven Upside Opportunity