Quantum computing represents one of the biggest potential addressable markets we've seen in some time, in a tech sector that has rewarded investors who have seen mega trends (and invested early) as they play out. Indeed, the ability to use these ultra-high-performance computers to solve some of the most complex problems out there is an intriguing proposition for investors looking for the next big thing.

One of the fast-moving players in this space, Hewlett Packard (HPE), is making big waves in the quantum computing world. Recent reports that the company (in addition to a group of seven other leading quantum computing companies, research firms, and tech giants) will be launching what they call the “Quantum Scaling Alliance” has this stock on the uptrend. HPE stock moved nearly 2% higher on Monday on the news. However, HPE stock has been struggling this morning and is down about 4% in early trading.

Let's dive into what to make of the announcement and whether HPE stock could have more room to run from here or if the company's fundamentals overshadow it.

Taking a Technical Approach to Market Leadership

What's interesting about this particular alliance is that it's not just the usual tech suspects included on this list (Synopsys (SNPS), Quantum Machines, Qolab, Applied Materials (AMAT), and HPE), but it also includes researchers from the University of Wisconsin. In other words, Hewlett Packard and the company's management team are looking to take a research-first approach in producing the leading technology in a sector that's still very much in its infancy.

If the consortium of companies and researchers can put together a world-class supercomputer, the potential windfall for companies like HPE could be massive. Investors are certainly looking at this long-shot bet as one to invest in, particularly given the fact that HPE mostly has cachet as a legacy tech company with little “new” going on.

Of course, we'll have to see how this rollout ultimately plays out. But for investors looking for a catalyst in considering HPE stock, this is one to watch.

Let's Look at Hewlett Packard's Fundamentals

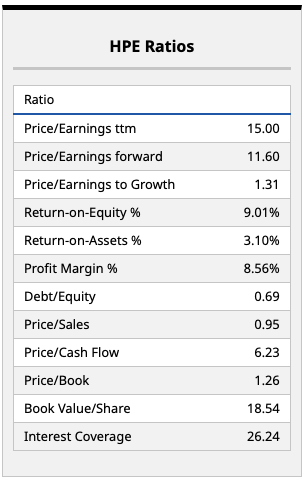

From a fundamentals perspective, Hewlett Packard is one of the most reasonably priced players out there. With a forward price/earnings ratio around 11 times, it's challenging to find any company that calls itself a technology giant with such a low earnings multiple.

There are certainly reasons for this depressed multiple relative to the company's peers. For one, Hewlett Packard's revenue growth rate has slowed. This is about as mature a tech company as they come, with low margins and paltry return-on-assets and return-on-equity figures. Investors in some of the top Magnificent Seven stocks will note double-digit figures across the board for the metrics I just mentioned.

That said, with a price/cash flow metric of just 6.2 times, investors are getting a massive free cash flow yield with this stock. If you think Hewlett Packard has a few more years (or a decade or two) of profitability left in the tank, this is a stock that certainly does look cheap. And if you're among the investors out there who believe that quantum computing and the company's recent moves to become a key player in this space could be as big as proponents of the technology think, then this could be one of those asymmetric bets worth making.

What Do the Analysts Think About HPE Stock?

Currently, Wall Street analysts have a price target of $26.44 on HPE stock, implying upside from here of around 15%. That's not bad, but that's also not enough for many investors to write home about.

Accordingly, Hewlett Packard does appear to be one of those unique tech stocks lacking the kind of growth catalysts investors have come to expect, with an ultra-low valuation. If quantum computing turns out to be such a catalyst, this stock's valuation suggests there could be plenty of room to run.

It really all depends on where individuals find themselves in the value vs. growth discussion and how much risk they're willing to take (and over what time horizon). Personally, I don't think HPE stock is a bad bet here, and I think there could indeed be much more than 10% upside with this stock. That goes double if a situation unfolds in which market participants really start buying into the quantum computing story with this name.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- This ‘Strong Buy’ Tech Stock Just Inked a Deal with AWS. Should You Buy It Now?