Valued at $76.5 billion by market cap, the New York-based Bank of New York Mellon Corporation (BK) holds the title of America's oldest bank in New York City. BNY provides various financial services and serves numerous institutions, corporations, government agencies, endowments, foundations, and HNIs globally.

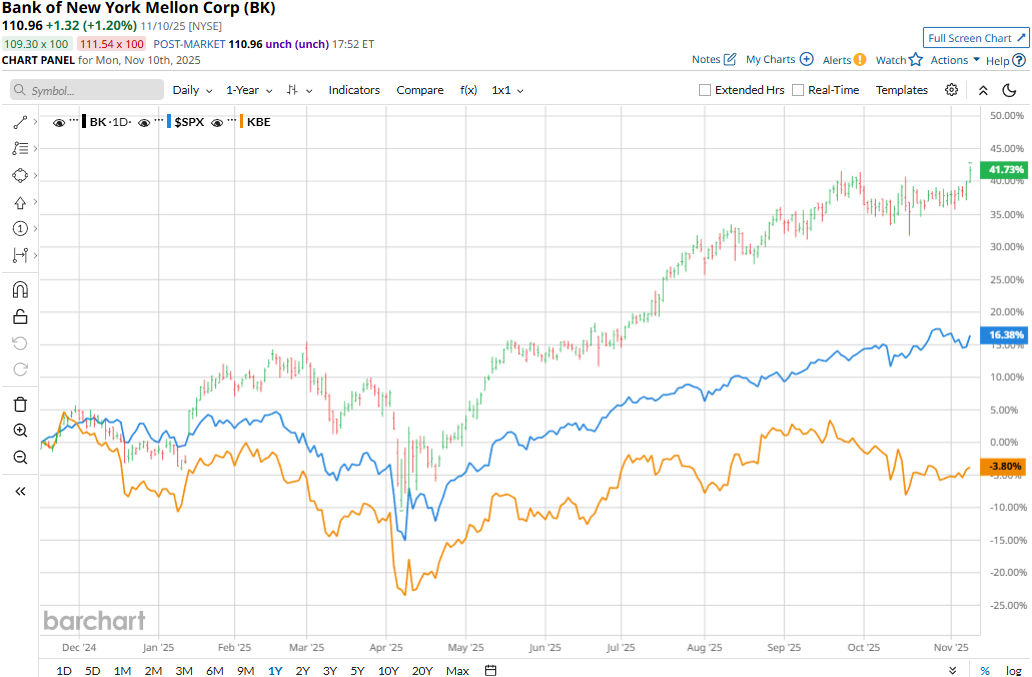

The banking giant has significantly outpaced the broader market over the past year. BNY stock has soared 44% over the past 52 weeks and 44.4% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 14% gains over the past year and 16.2% returns on a YTD basis.

Narrowing the focus, BNY has also outperformed the industry-focused SPDR S&P Bank ETF’s (KBE) 3.1% decline over the past year and 4% uptick on a YTD basis.

BNY Mellon’s stock prices dropped almost 2% in the trading session following the release of its mixed Q3 results on Oct. 16. Driven by growth in fee revenues and net interest income, the company’s topline for the quarter surged 9% year-over-year to $5.1 billion, beating the Street’s expectations by 2.4%. Meanwhile, its adjusted EPS grew 25.6% year-over-year to $1.91, surpassing the consensus estimates by 8.5%. Further, the company generated a solid ROTCE of 26%.

However, the company’s assets under management have remained constant at $2.1 trillion, the same as at the end of Q3 2024, which has impacted its investment revenues. Further, its deposits have observed a slight decline compared to Q2 2025. Moreover, its solid Q3 income statement experienced a significant boost due to the weaker US dollar, which isn’t a sustainable factor for long-term growth.

For the full fiscal 2025, ending in December, analysts expect BNY to deliver an adjusted EPS of $7.36, up 22.1% year-over-year. The company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

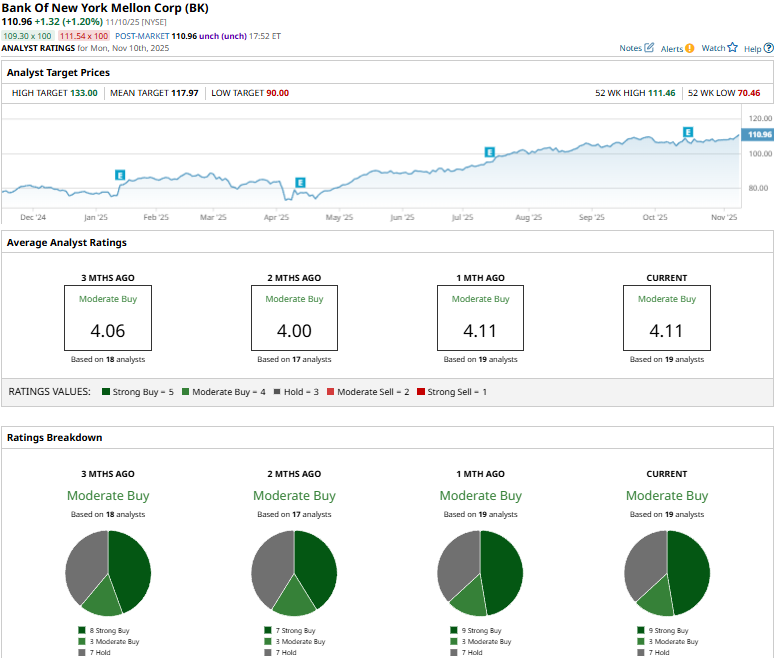

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buys,” three “Moderate Buys,” and seven “Holds.”

This configuration is slightly more optimistic than two months ago, when only seven analysts gave “Strong Buy” recommendations.

On Oct. 20, TD Cowen analyst Steven Alexopoulos maintained a “Buy” rating on BNY and raised the price target from $130 to $133.

As of writing, BNY’s mean price target of $117.97 represents a modest 6.3% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Stock Yields More Than 8% and Analysts Say You Can ‘Count on It’ Here

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?