Instacart (CART), officially Maplebear Inc., is a leading technology-driven grocery delivery and e-commerce company. Instacart connects millions of customers to more than 1,800 national, regional, and local retail banners encompassing nearly 100,000 stores across the U.S. and Canada. Customers order groceries, household essentials, and alcohol (where permitted) via Instacart’s website or app. Instacart’s flexible gig-economy model utilizes over 600,000 personal shoppers to pick, pack, and deliver, while also offering enterprise-grade solutions for retail partners to power e-commerce, advertising, and fulfillment.

Founded in 2012 and based in San Francisco, the company went public in September 2023.

About Instacart Stock

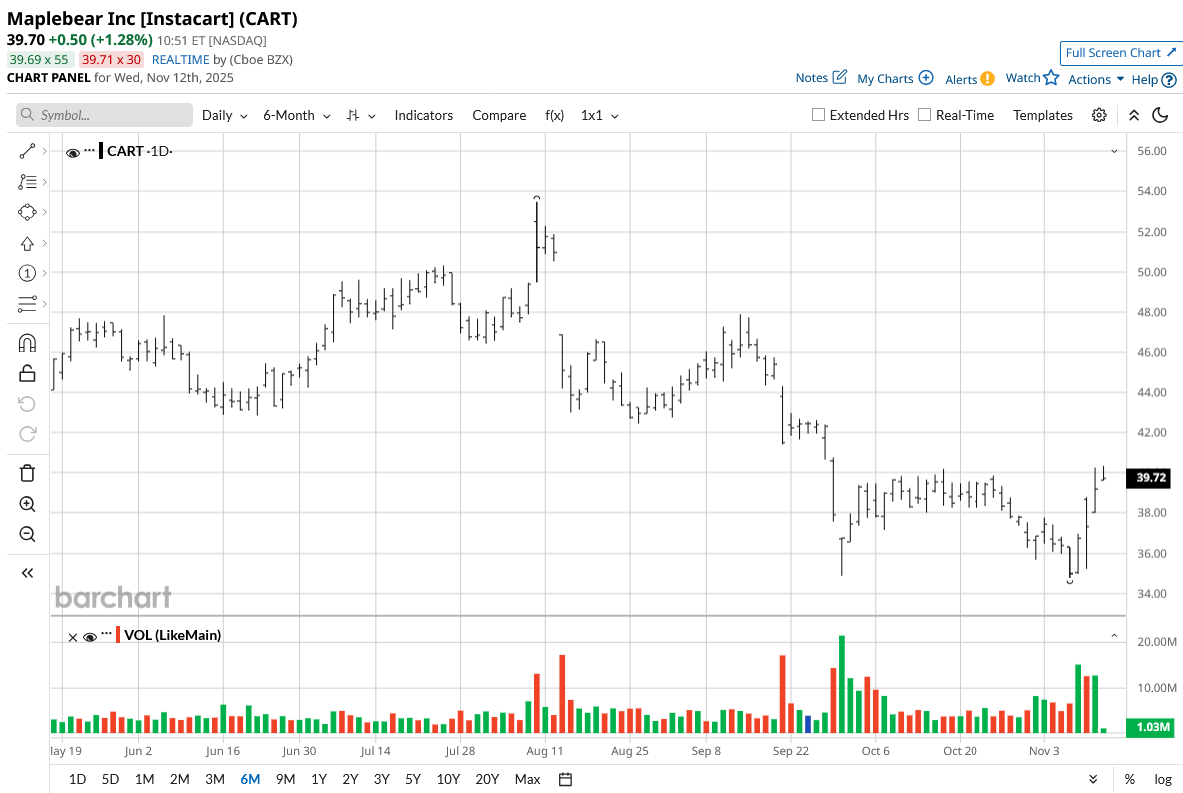

CART stock has shown renewed activity following strong Q3 results, posting a five-day gain of 9.7% yet remaining nearly flat for the month at 4.3%. Over the past six months, shares are down 8.4%, and the 52-week return stands at -17.3%, underperforming the Nasdaq Composite ($NASX), which has gained over 21% during the same period.

Instacart Delivers Strong Results

Instacart reported its Q3 2025 earnings on Nov. 10, delivering strong financial results that surpassed analyst expectations. The company posted revenue of $939 million, beating consensus estimates of $934 million. Adjusted earnings per share were $0.51, exceeding the $0.49 forecast. This marks a notable improvement and reflects growing demand across Instacart’s core grocery delivery and advertising businesses.

Delving into the financial details, Instacart experienced a 10% year-over-year (YoY) increase in gross transaction value, driven by a 9% rise in total orders. The company improved gross margins to approximately 31.5%, aided by greater operational efficiencies and cost control.

Free cash flow was $56 million, and cash and cash equivalents stood robustly at $2.15 billion, providing strong liquidity for ongoing investments and expansion. Advertising revenue now represents about 30% of net income, underscoring its growing contribution to profitability.

Looking ahead, Instacart issued cautious guidance amid intensifying competition and evolving consumer preferences. The company plans to prioritize increasing order frequency, enhancing AI-powered personalization, and expanding partnerships with retailers and brands. Expense discipline will remain prudent as Instacart navigates a challenging macroeconomic environment, aiming to sustain growth momentum while managing costs effectively.

Overall, the results reinforce Instacart’s strong position in the grocery delivery market and its strategic focus on innovation and scalability.

Should You Buy CART Stock?

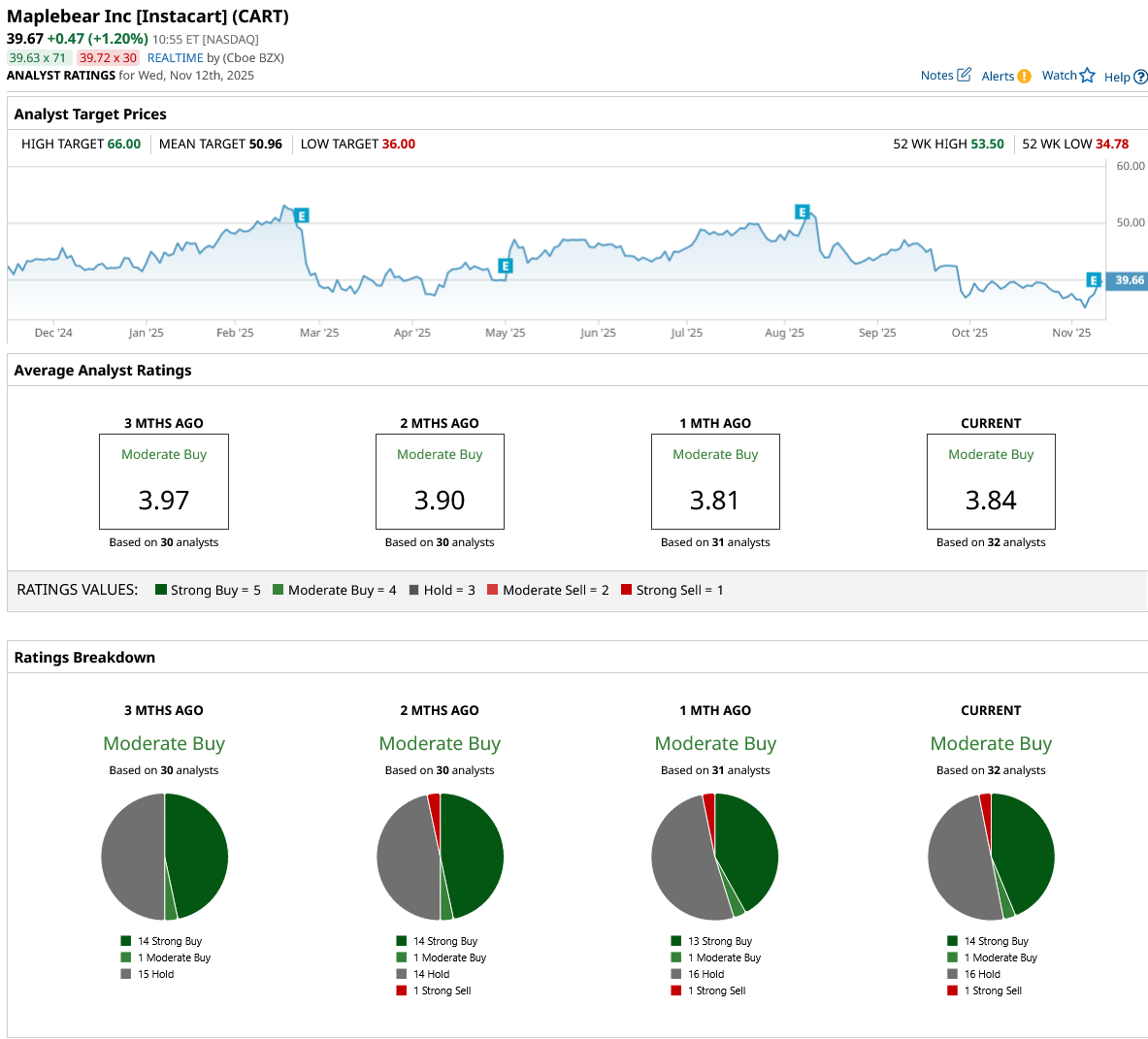

CART stock appears to have a positive tone among Wall Street experts with a consensus “Moderate Buy” rating and a mean price target of $50.96, reflecting an upside potential of 28%. However, the street-high target of $66 implies an upside of nearly 70% from the market rate. Goldman Sachs is leading the way on Instacart, giving CART stock its street-high target, although this was after lowering it from $67 due to concerns about its advertising business.

The stock has been rated by 32 analysts, with 14 “Strong Buy,” one “Moderate Buy,” 16 “Hold,” and one “Strong Sell.”

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CoreWeave Has a ‘Tremendous Long-Term Opportunity’ But Is Stuck in Limbo Here. Should You Buy, Sell, or Hold CRWV Stock for 2026?

- As C3.ai Explores a Sale, Should You Buy, Sell, or Hold AI Stock?

- D-Wave’s Contracts Could Be Worth ‘Millions of Dollars.’ Should You Buy QBTS Stock Now?

- Bargain Buy or Risky Bet? Bath & Body Works Slides to 52-Week Low