If you’re familiar with the covered call options strategy, you know it’s a beginner-friendly way to generate consistent income.

But what happens when the market moves unexpectedly, and your covered call is no longer a perfect fit?

That’s where rolling comes in.

In his latest video, Gavin McMaster breaks down exactly what it means to roll a covered call, why traders do it, and how to manage your positions like a pro — using real examples from Salesforce (CRM), NVIDIA (NVDA), and Apple (AAPL).

What Does “Rolling” a Covered Call Mean?

Rolling simply means closing your existing covered call and opening a new one — either with a different strike price, a new expiration date, or both.

You can think of it as adjusting your trade to fit new market conditions. It’s not about “starting over”; it’s about keeping your position working for you.

Why Traders Roll Covered Calls

There are four main reasons traders roll:

- To collect more premium: If your covered call has lost most of its value (say, 80%), you can buy it back cheaply and sell a new one closer to the current price for extra income.

- To avoid assignment: If the stock has moved up and your short call is in the money, rolling can prevent your shares from being called away.

- To regain upside: If you’re bullish and want to capture more price appreciation, you can roll to a higher strike.

- For tax reasons: Rolling can delay a taxable sale of shares that would otherwise trigger capital gains.

Rolling Down for More Income: CRM Example

Let’s say you sold a $265 call on Salesforce (CRM), and the stock dropped. That call might now be worth only $0.90.

You could buy it back and sell a new call at a lower strike of $250 for $2.67, netting about $1.75 in additional premium.

That boosts your annualized return from 8.2% to 24.5%, but it also reduces your upside. If CRM rebounds, you might have to sell your shares at $250 instead of $265.

So rolling down increases income, but sacrifices some potential gains.

Rolling Up for More Upside: NVDA Example

Now flip it. Let’s say NVIDIA (NVDA) rallied through your covered call strike at $190.

You could buy back your in-the-money call and sell a new one at a higher strike; say $195. You’re paying to get more upside potential — essentially “buying back” part of your gains.

You can reduce that cost by rolling up and out (to a higher strike and later expiration), which spreads risk and sometimes even brings in a small credit.

Rolling Out for More Time: AAPL Example

When expiration is near and you still like the setup, you can roll out in time.

In Gavin’s Apple (AAPL) example, he rolled a $260 strike call expiring in 3 days out to a series expiring in 2 weeks — the same strike, just with more time.

He paid $0.47 to close the old position and received $2.65 for the new call, netting roughly $2.15 in new income for extending the trade.

That’s the beauty of time decay as an options seller. It lets you generate consistent income without changing your stock position.

Why Rolling Matters

Covered calls aren’t always “set it and forget it” trades. Markets move, and your call strategy should move with them.

Rolling gives traders flexibility to:

- Keep generating income as conditions change

- Manage risk without selling shares

- Adjust to volatility and trend shifts

- Stay in control of tax outcomes

“The goal of rolling,” Gavin explains, “is to adapt as the market moves and keep your position working for you.”

Tools to Make It Easier

You can explore these strategies and find real covered call ideas right on Barchart:

- Covered Call Screener → — instantly scan for high-yield setups across any stock or ETF.

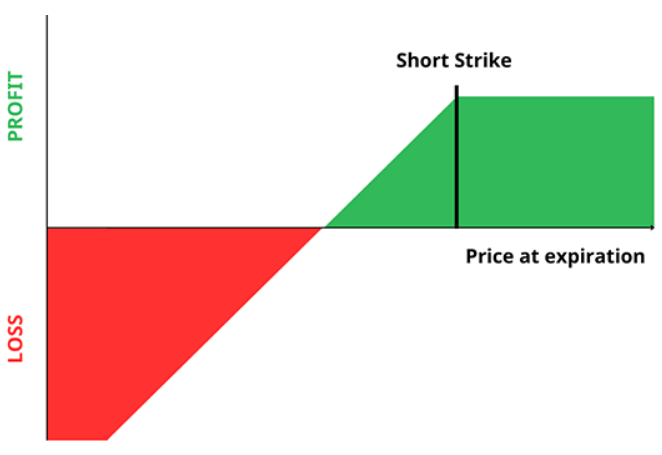

- Profit/Loss Charts→ — visualize different strike/expiration combinations before you roll.

- Learning Center → — learn more about options, spreads, and income strategies.

Final Takeaway

Rolling covered calls might sound advanced, but it’s one of the most practical ways to manage your positions — and keep your income flowing no matter how the market moves.

Watch the Clip: Rolling Covered Calls Explained →

- Stream the Full Video: Covered Call Adjustments: Rolling for Income and Upside

- Explore Barchart’s Covered Call Options Screener

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- Heavy Put Option Activity in Advanced Micro Devices Implies AMD Stock Is Overvalued - But Is It?

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- Enovix (ENVX) Offers the Most Daring Contrarians a Quant-Driven Upside Opportunity