Advanced Micro Devices (AMD) shares rallied on Wednesday after the AI chips specialist said its data center revenue will grow by 60% annually over the next three to five years.

In an interview with CNBC, the company’s chief executive, Lisa Su, also downplayed concerns of overspending on artificial intelligence, saying “I think it’s the right gamble.”

Including today’s gains, AMD stock is up roughly 230% versus its year-to-date low in early April.

AMD Stock Looks Strongly Positioned to Hit $1,000

AMD’s analyst day presentation on Nov. 11 also forecast its overall revenue to grow by 35% yearly through the end of this decade, which would effectively more than quadruple its top line in five years.

Assuming that the Nasdaq-listed firm retains its current price-sales (P/S) multiple of about 15x, an over 4x increase in revenue would push its market cap up to a whopping $1.7 trillion by 2030.

That would translate to a per-share price of more than $1,000 (provided the number of outstanding shares remains unchanged as well), indicating potential for a 300% return within five years.

Of course, this math is an oversimplification of how things typically work in the financial markets, particularly the assumption that a high-growth company like Advanced Micro Devices will retain its P/S multiple as it matures.

However, it’s not like AMD shares are currently trading at a super stretched price-sales multiple in the first place. Peer Nvidia (NVDA), for example, is going for a much higher 37x at the time of writing.

Wells Fargo Raises Price Target on AMD Shares

Wells Fargo’s senior analyst Aaron Rakers reiterated his “Overweight” rating on AMD following its “stronger-than-expected financial model framework at its analyst day.”

According to Rakers, the semiconductor stock could hit $345 next year as the company continues to gain share across all of its core verticals, including AI accelerators, general-purpose GPUs, and personal computers.

“Accelerating operating leverage and earnings power in excess of $10 a share by 2027,” are among other reasons he cited for his bullish view on AMD stock.

Rakers’ upwardly revised price objective indicates potential upside of more than 35% in Advanced Micro Devices over the next 12 months.

Wall Street Agrees With Rakers’ Bullish View on AMD

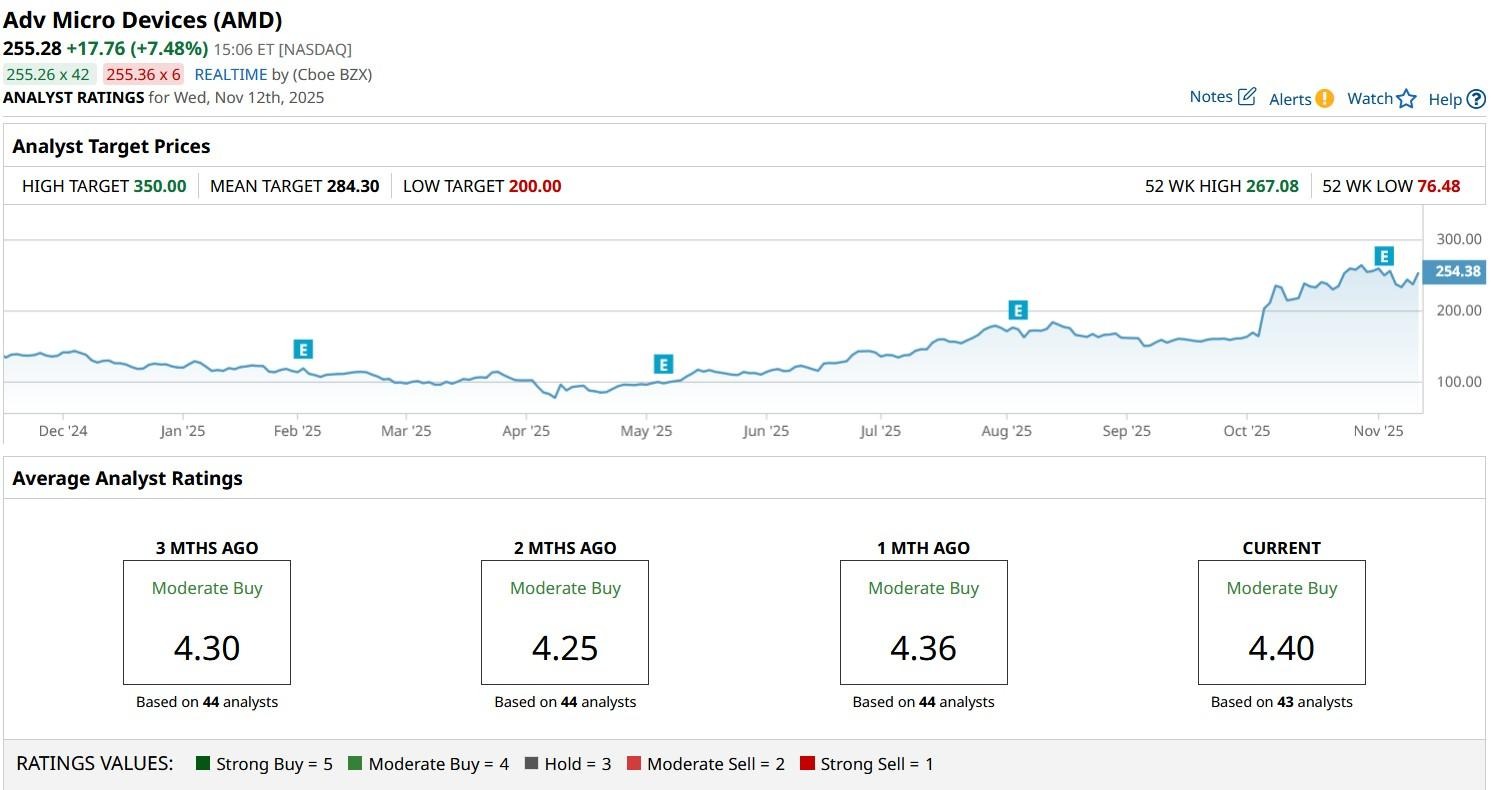

According to Barchart, the consensus rating on AMD shares currently sits at “Strong Buy.”

While the mean target of about $234 suggests downside risk from current levels, other Wall Street analysts, much like Aaron Rakers, could raise their estimates for AMD stock after the company’s “Analyst Day.”

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?

- Is It Too Late to Buy Palantir Stock in November 2025?