Valued at a market cap of $35.2 billion, Otis Worldwide Corporation (OTIS) is a global leader in manufacturing, installing, and servicing elevators, escalators, and moving walkways. The Farmington, Connecticut-based company's strong service portfolio, including maintenance and modernization offerings, generates stable recurring revenue, while continued investments in innovation and digitalization strengthen its market leadership.

This industrial company has lagged behind the broader market over the past 52 weeks. Shares of OTIS have declined 8% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.1%. Moreover, on a YTD basis, the stock is down marginally, compared to SPX’s 16.4% return.

Narrowing the focus, OTIS has also trailed behind the Industrial Select Sector SPDR Fund’s (XLI) 9.3% uptick over the past 52 weeks and 17.7% YTD rise.

On Oct. 29, shares of OTIS soared 2.3% after its better-than-expected Q3 earnings release. The company’s net sales improved 4% year-over-year to $3.7 billion, surpassing consensus estimates by 1.1%. Moreover, its adjusted EPS grew 9.4% from the year-ago quarter to $1.05 and came in 5% ahead of analyst expectations. Strong organic service sales growth, along with robust service operating profit margin expansion, supported its upbeat results.

For the current fiscal year, ending in December, analysts expect OTIS’ EPS to grow 5.5% year over year to $4.04. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

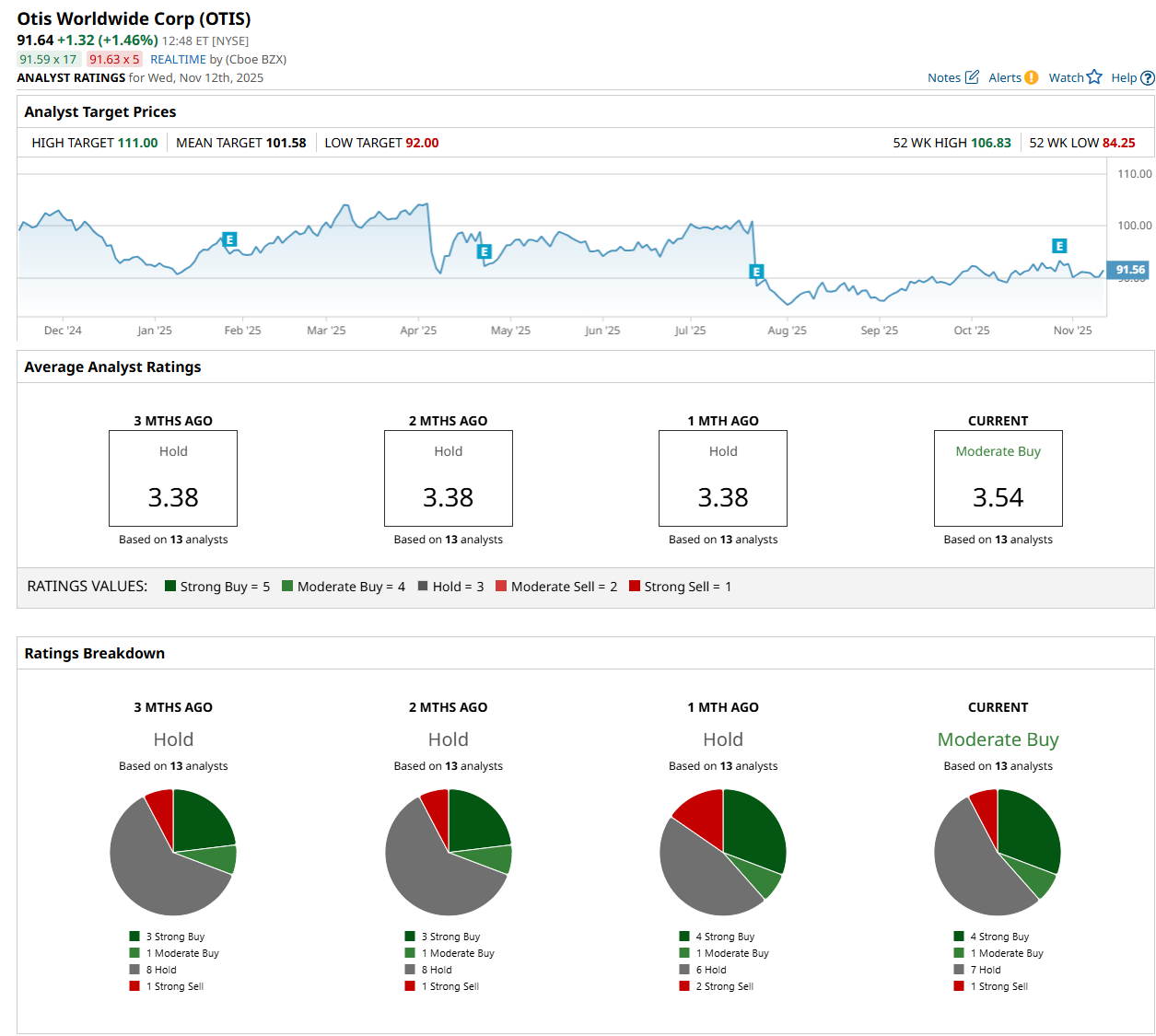

Among the 13 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on four “Strong Buy,” one "Moderate Buy,” seven "Hold,” and one “Strong Sell” rating.

This configuration is more bullish than a month ago, with an overall “Hold” rating, consisting of two analysts suggesting a “Strong Sell.”

On Nov. 7, Joe O’Dea from Wells Fargo & Company (WFC) maintained a “Hold” rating on OTIS, with a price target of $95, indicating a 3.7% potential upside from the current levels.

The mean price target of $101.58 represents a 10.8% premium from OTIS’ current price levels, while the Street-high price target of $111 suggests a 21.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rivian Wants to Be the Next Tesla With Huge Pay Package for CEO RJ Scaringe. Should You Buy RIVN Stock?

- AMD Strengthens Its Bull Case. Can the Stock Hit $350 in a Year?

- Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

- Western Digital Stock Soars 280% This Year. Is WDC Worth Chasing Now?