Health insurance companies continue to experience volatility due to renewed rhetoric from President Donald Trump about the Affordable Care Act (ACA). Trump referred to the insurance companies companies as “BIG,” “BAD,” and “money sucking.” In reaction to these comments over the weekend, there was market tension in morning trading on Nov. 10 that impacted some of the biggest companies in this industry. These include Centene (CNC), Oscar Health (OSCR), and Elevance Health (ELV). The bigger companies such as UnitedHealth Group (UNH), Humana (HUM), and CVS (CVS) were also impacted.

Trump made these remarks as Congress grappled with ending the ongoing overnment shutdown – the longest in U.S. history. One key point of debate between lawmakers has been the expiration of subsidies within the ACA, informally known as Obamacare. His proposal that money be transferred to consumers from the government to bypass insurers was seen as posing potential revenue volatility to insurers that operate within the marketplace model.

About UnitedHealth Stock

Minnetonka, Minnesota-based UNH is the largest managed healthcare company in the U.S. The company has two main operating segments: UnitedHealthcare, its insured segment; and Optum, its health services and analytics segment. UnitedHealth Group has a market capitalization over $291 billion. Therefore, it is considered the industry leader, offering healthcare coverage and services to more than 150 million people worldwide.

In the past 52 weeks, the stock has ranged from $234.60 to $622.83, and is down more than 30% so far in 2025.

From a valuation perspective, UnitedHealth Group has a lower current valuation with a price-earnings multiple of 15.43x (TTM) and a forward P/E valuation multiple of 19.88x compared to its average over the past five years. The current price-sales multiple of 0.73x and price-cash flow multiple of 10.01x reflect that the company is moderately undervalued in relation to its past valuation and other similar companies such as Elevance and Humana. It has a ROE and profit margin that still performs well within the managed care sector with 19.23% ROE and 3.6% profit margin. The company has a debt-equity level of 0.71x.

Additionally, the company’s diversified portfolio has made UnitedHealth stronger and more stable within the industry. UNH has an attractive dividend history with an average yield of 2.6%.

UnitedHealth Maintains Outlook Despite Policy Headwinds

UnitedHealth last reported quarterly results on Oct. 28, with the company reporting earnings per share (EPS) of $2.59, or $2.92 on an adjusted basis, driven by strong momentum in the Optum and UnitedHealthcare businesses. The company posted revenue of about $113.2 billion, marking an increase of 12% year-over-year (YOY).

The company restored its guidance with 2025 expectations of $445.5 billion to $448.0 billion revenue and a minimum of $14.65 in GAAP EPS or $16.25 in adjusted EPS.

The management team has reaffirmed that 2026 will be the year that marks a return to solid growth in earnings, with drivers in Medicare Advantage and its healthcare technology division, Optum.

What Do Analysts Expect for UnitedHealth Stock?

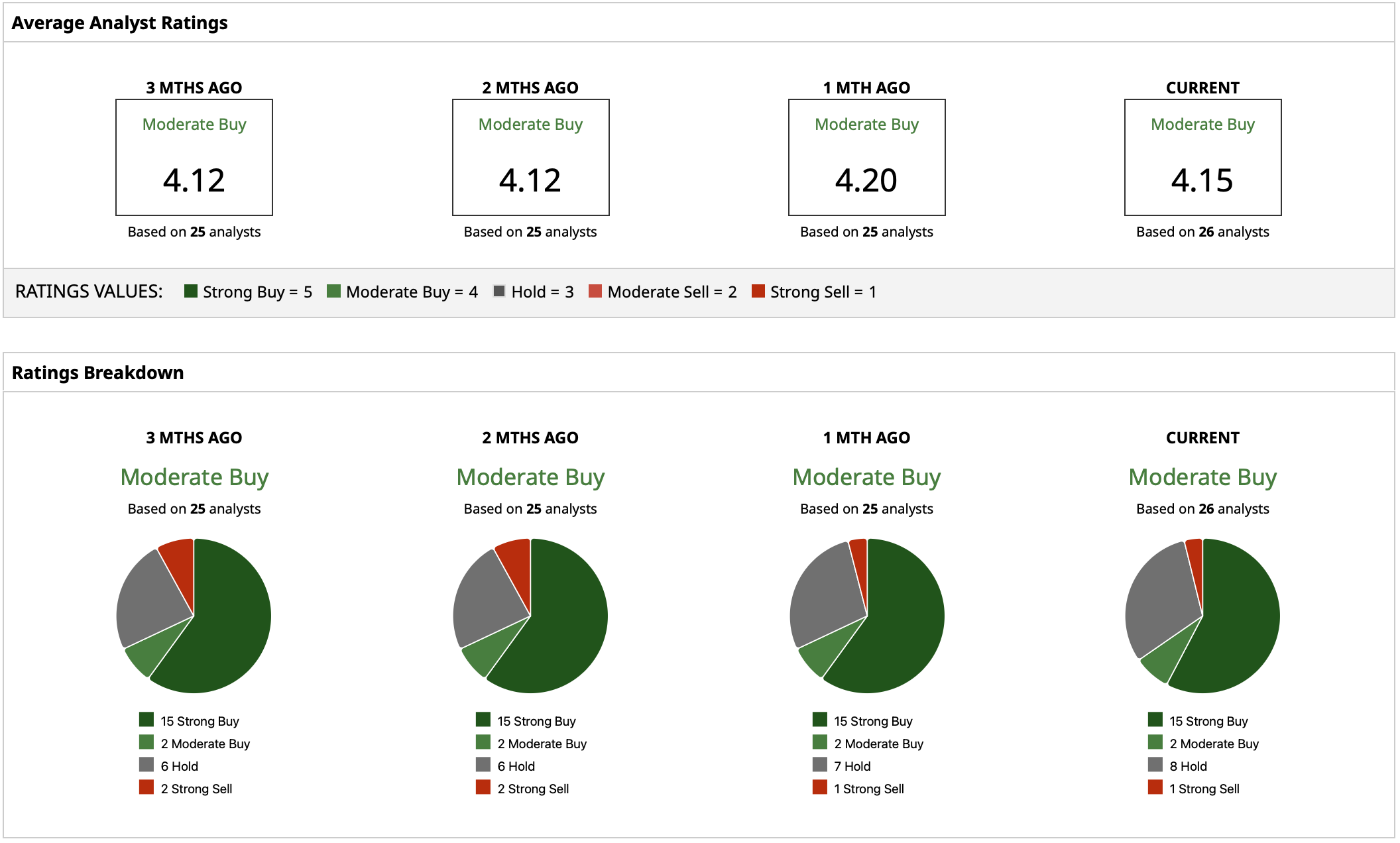

Although there has been political chatter in the short run, the market sentiment on Wall Street about UnitedHealth is cautiously optimistic. Analyst assign a “Moderate Buy” rating consensus, and the mean price target is $387.73 with a high and low price target of $440.00 and $198.00, respectively. Its mean target implies roughly 14% upside potential from here.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?

- Is It Too Late to Buy Palantir Stock in November 2025?