Palantir (PLTR) is holding nicely above rising 21, 50 and 200-day moving averages and is a highly rated stock among many analysts.

Today, we are looking at an unbalanced iron condor, with a slightly bullish bias.

This can be achieved by trading more put spreads than call spreads.

As a reminder, an iron condor is a combination of a bull put spread and a bear call spread.

First, we take the bull put spreads. Using the December 19 expiry, we could sell two put spreads with the $160-$150 strike prices. That spread could be sold for around $1.10. Selling two contracts would generate $220.

Then the bear call spread, which could be placed by selling the $240 call and buying the $250 call. This spread could also be sold for around $0.60.

Trading two put spreads for every one call spread gives the trade a slight bullish bias, but also more risk on the downside.

In total, the iron condor will generate around $2.80 or $280 of premium.

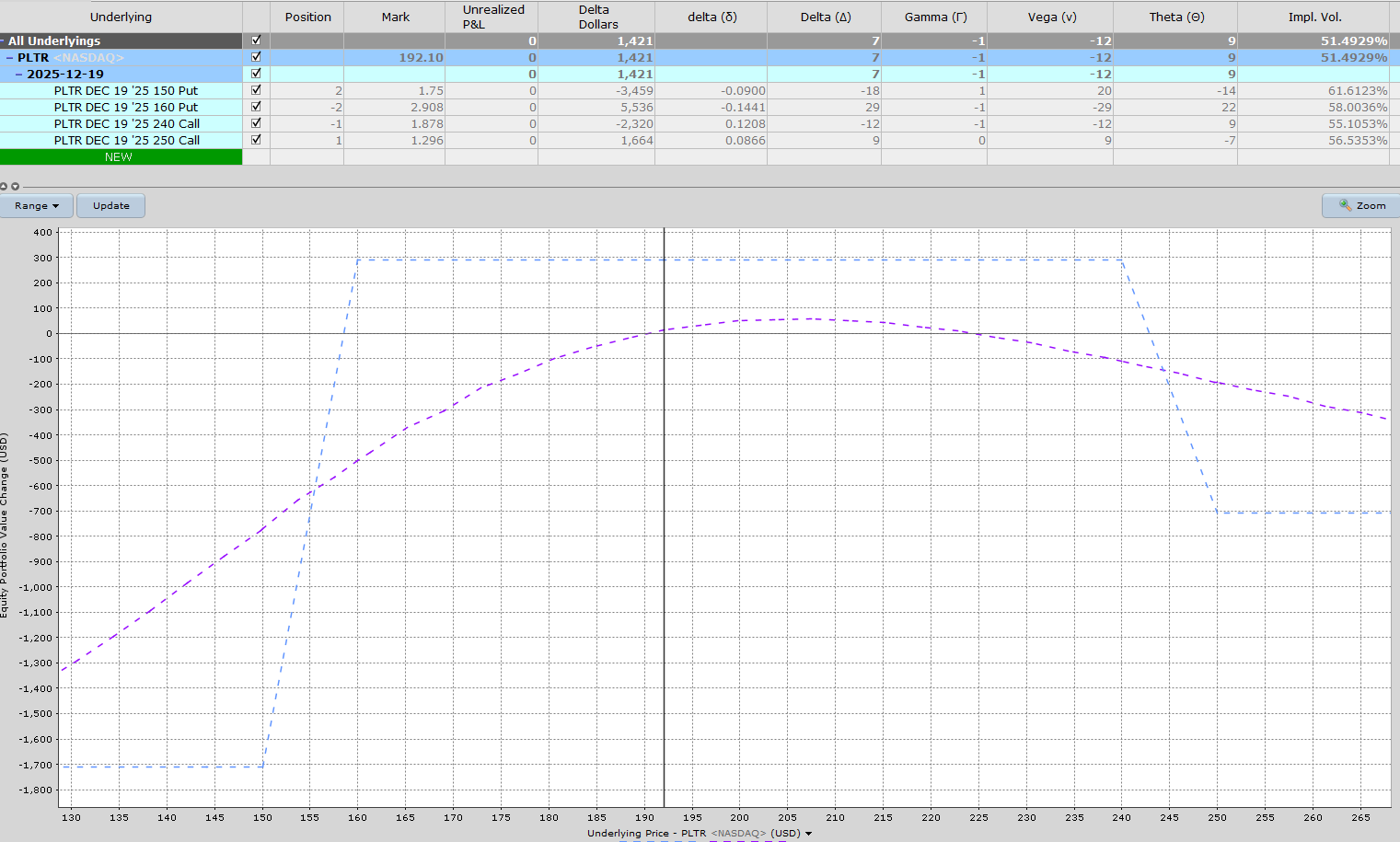

The profit zone ranges between $157.20 and $242.20. This can be calculated by taking the short strikes and adding or subtracting the premium received.

The maximum risk is $1,720 on the put side and $720 on the call side.

If we take the premium ($280) divided by the maximum risk ($1,720), this iron condor trade has the potential to return 16.3%.

A stop loss in this case might be calculated based on 25% of capital at risk, so a loss of around $430.

Below you can see the risk graph showing the profit and loss at expiration and also the T+0 line.

Company Details

The Barchart Technical Opinion rating is a 96% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Of the 21 analysts covering PLTR stock, 4 have a Strong Buy rating, 14 have a Hold rating, 1 has a Moderate Sell rating and 2 has a Strong Sell rating.

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community principally in the United States. Palantir Technologies Inc. is based in Denver, Colorado.

Summary

Unbalanced Condors are a great way to play a neutral to slightly bullish outlook on a stock.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?