Circle (CRCL) shares crashed over 10% today even though the company behind the USDC stablecoin came in well ahead of Street estimates in its third financial quarter (Q3).

Investors are responding negatively primarily because the management now sees rising operating expenses ahead.

For the full-year, the financial technology firm guided for $495 million to $510 million in operating expenses today versus $490 million top in August.

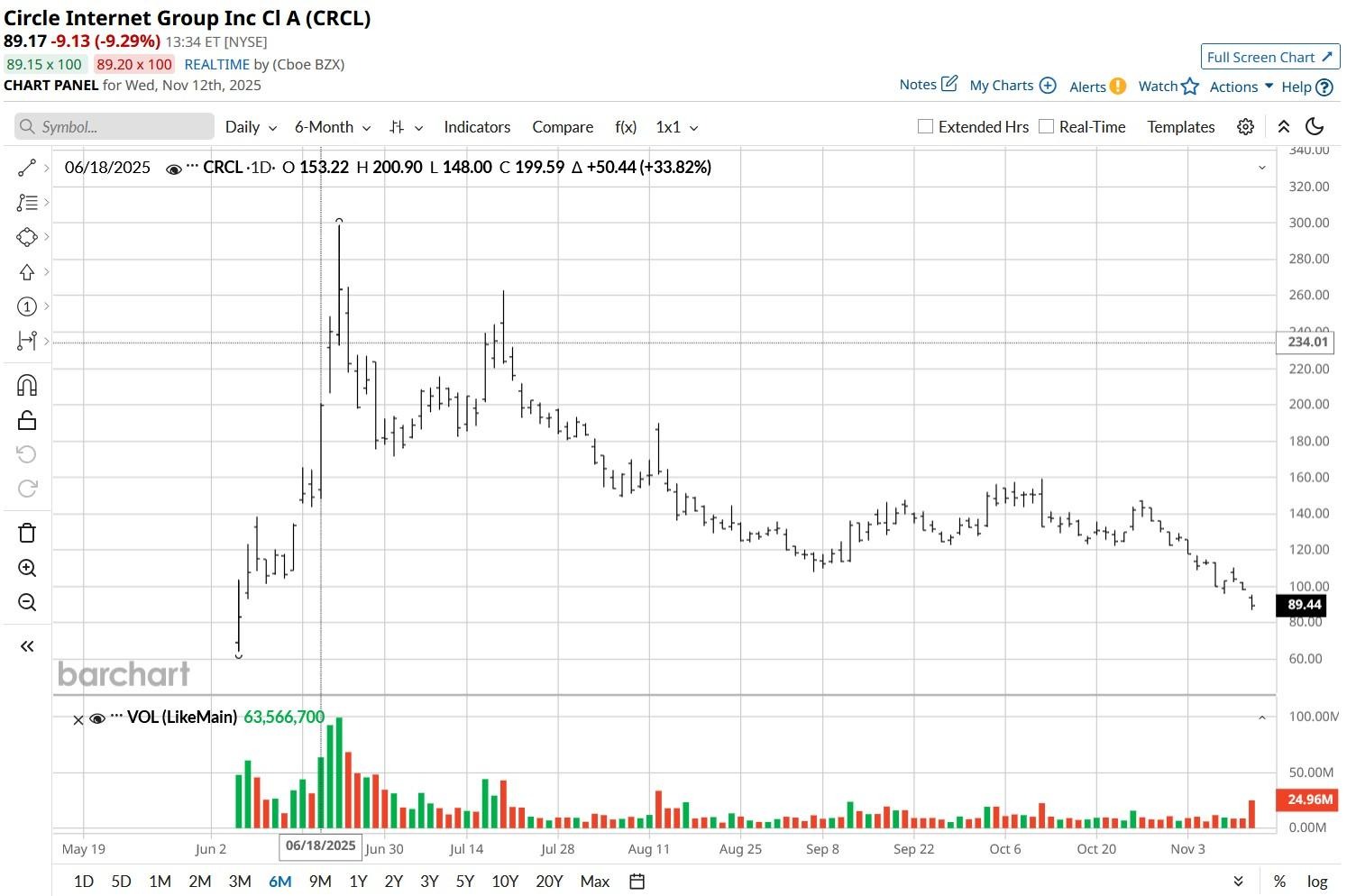

Following the post-earnings slump, Circle stock is trading about 65% below its year-to-date high, with a 14-day relative strength index (RSI) at 28.65 – suggesting oversold territory.

Technicals Suggest Circle Stock Is a Buy Here

From a technical perspective, the post-earnings dip in CRCL shares is totally worth buying into.

The near-term (14-day) RSI sliding below 30 signals bears have dominated recently, but the downward momentum is now exhausting and a bullish reversal could be near.

Meanwhile, the stock’s long-term (100-day) RSI remains at over 50, according to Barchart, reinforcing that bulls will likely stay in power over the longer term, and the broader uptrend is still intact.

The post-earnings decline has also contracted its price-sales (P/S) multiple to 10.6x only, which is fairly reasonable for a high-growth company like Circle Internet Group.

Is It Worth Buying the Post-Earnings Dip in CRCL Shares?

Investors should consider loading up on Circle shares on the post-earnings weakness also because the quarterly release had several positives beyond the strong headline numbers.

For example, the company’s chief executive Jeremy Allaire said USDC adoption continues to accelerate despite broader market volatility.

Circle remains fully committed to building “the new Economic OS for the internet” over the long term, he noted, adding the multi-year outlook for a 40% compound annualized growth in USDC circulation remains intact.

On Wednesday, the fintech raised its full-year guidance for non-reserve and other revenues as well, further strengthening the case for owning the crypto stock heading into 2026.

Wall Street Sees Massive Upside in Circle Internet Group

Wall Street analysts also remain constructive on Circle stock after the company’s Q3 earnings.

While the consensus rating on CRCL shares currently sits at “Hold” only, the mean target of about $167 suggests potential upside of a whopping 90% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.