With a market cap of $193.8 billion, Caterpillar Inc. (CAT) is the world’s largest manufacturer of construction and mining equipment, industrial gas turbines, diesel-electric locomotives, and diesel and natural gas engines. Founded in 1925 and headquartered in Irving, Texas, the company operates through Construction Industries, Resource Industries, Energy & Transportation, Financial Products, and Other segments.

Caterpillar has been on a powerful climb, with shares soaring 43.2% over the past year, handily outperforming the S&P 500 Index ($SPX), which has gained 14.1%. The momentum is even stronger year-to-date, with CAT rallying an impressive 56.6%, outpacing the benchmark’s 16.4% gain.

Even against its own industry peers, CAT stands tall. The machinery titan has outpaced the Industrial Select Sector SPDR Fund’s (XLI) 7.7% surge over the past year and 17.1% gains in 2025.

Shares of Caterpillar jumped more than 11% on Oct. 29 after the company released its impressive third-quarter earnings. Its results showcased strong momentum across key markets, with revenue climbing 10% year over year to $17.6 billion, driven by higher equipment volumes and exceptional demand in its Energy & Transportation segment, particularly for power-generation equipment tied to the accelerating build-out of data-center infrastructure. While adjusted earnings of $4.95 fell slightly and margins softened due to higher manufacturing costs, tariffs, and weaker price realization, the company still delivered robust profitability and generated substantial operating cash flow.

For the current fiscal year 2025, ending in December, analysts expect CAT's adjusted EPS to decline 16.3% year-over-year to $18.34. The company has a mixed earnings surprise history. It missed the Street's bottom-line estimates in two of the past four quarters, while beating on two other occasions.

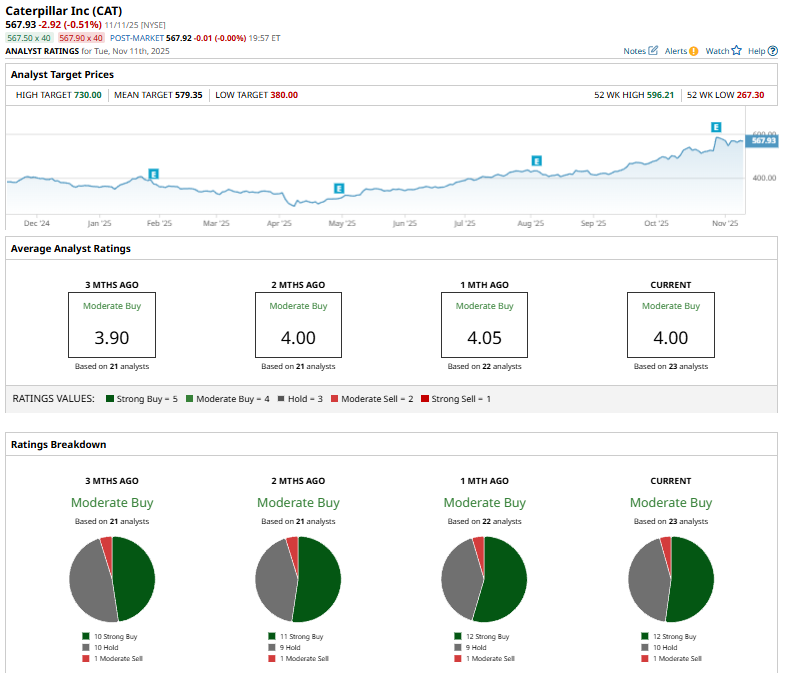

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy,” 10 “Holds,” and one “Moderate Sell.”

This configuration is slightly more bullish than it was two months ago, with 11 “Strong Buy” recommendations for the stock.

On November 6, HSBC upgraded Caterpillar to “Buy” from “Hold” and lifted its price target to $660 from $405, citing a strong third-quarter performance with higher volumes and a 25% jump in orders, driven largely by power generation demand. The firm highlighted Caterpillar’s expanding turbine business, especially its increasing exposure to data centers, and new capacity investments as key drivers of long-term growth potential.

Caterpillar’s mean price target of $579.35 indicates a premium of 2% from the current market prices. The Street-high target of $730 suggests a notable 28.5% upswing potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?

- Tesla Just Lost Its Cybertruck Leader. Should You Buy, Sell, or Hold TSLA Stock?

- Palantir Achieved ‘Eye-Popping Growth’ and Is a Buy Through Year-End, According to Wedbush