With a market cap of $60.2 billion, Marathon Petroleum Corporation (MPC) is a leading independent refiner, transporter, and marketer of petroleum products in the United States. The company operates through two main segments: Refining & Marketing, which focuses on refining crude oil and distributing fuel products, and Midstream, which manages transportation and logistics for crude oil, natural gas, and refined products.

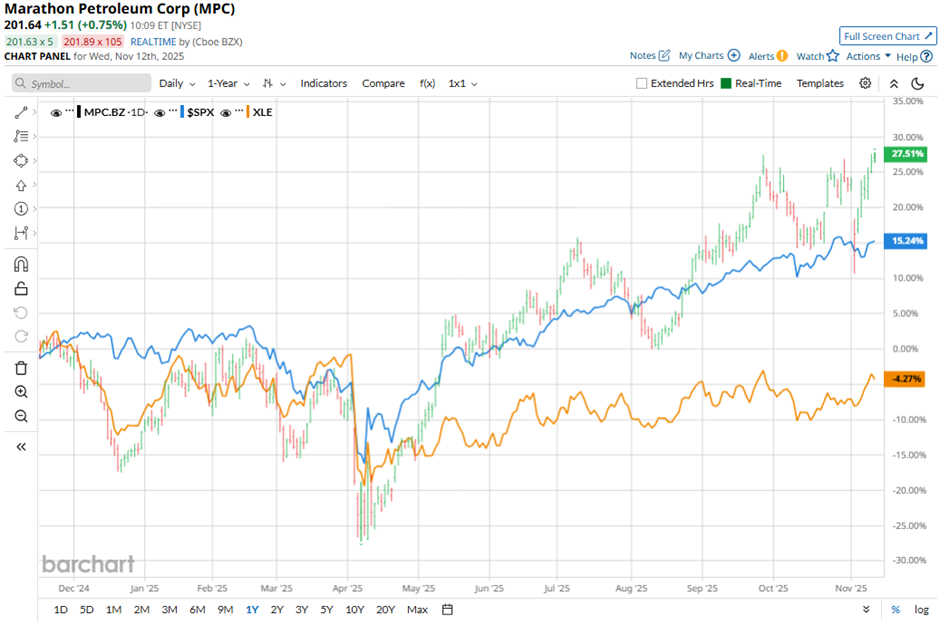

Shares of the oil refining specialist have outperformed the broader market over the past 52 weeks. MPC stock has increased nearly 30% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.6%. Moreover, shares of the company have surged 44.6% on a YTD basis, compared to SPX's 16.6% gain.

Looking closer, shares of the Findlay, Ohio-based company have outpaced the Energy Select Sector SPDR Fund's (XLE) 3.1% decrease over the past 52 weeks.

Shares of Marathon Petroleum tumbled 6.1% on Nov. 4 after the company reported weaker-than-expected Q3 2025 adjusted EPS of $3.01. The shortfall was driven by higher refining turnaround costs of $400 million and increased operating costs of $5.59 per barrel, alongside continued renewable diesel losses of $56 million. Additionally, lower-than-expected West Coast refining margins and downtime at the Galveston Bay refinery due to a June fire further weighed on investor sentiment.

For the current fiscal year, ending in December 2025, analysts expect MPC's adjusted EPS to grow 7% year-over-year to $10.39. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

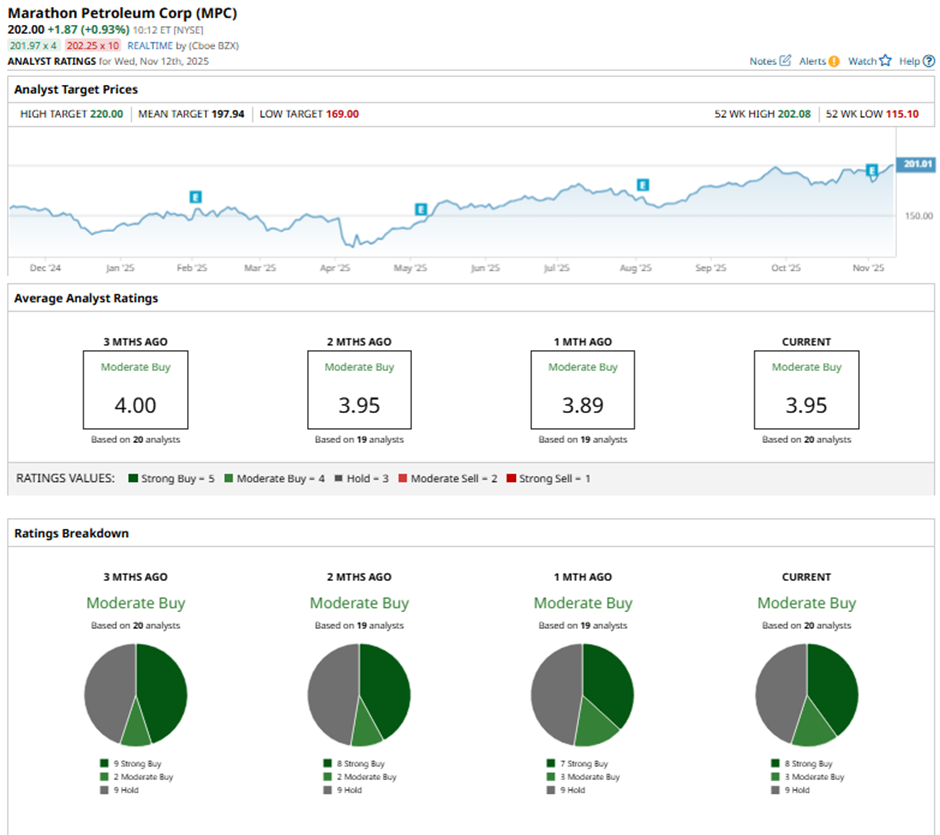

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, three “Moderate Buys,” and nine “Holds.”

This configuration is slightly less bullish than three months ago, with nine “Strong Buy” ratings on the stock.

On Nov. 5, Raymond James analyst Justin Jenkins lowered Marathon Petroleum’s price target to $200 but maintained an “Outperform” rating.

As of writing, the stock is trading above the mean price target of $197.94. The Street-high price target of $220 suggests an 8.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- D-Wave’s Contracts Could Be Worth ‘Millions of Dollars.’ Should You Buy QBTS Stock Now?

- Bargain Buy or Risky Bet? Bath & Body Works Slides to 52-Week Low

- Michael Burry Accuses Meta Platforms of ‘Common Fraud’ and Inflated Earnings. Should You Still Buy META Stock Now?

- As IBM Rallies on a Quantum Computing Breakthrough, Here’s Where the Stock Could Be Headed Next