Valued at a market cap of $12.7 billion, Regency Centers Corporation (REG) is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. The Jacksonville, Florida-based company’s portfolio features high-performing properties anchored by top-tier grocers, restaurants, service providers, and best-in-class retailers that foster meaningful connections within neighborhoods and communities.

Shares of this retail REIT have lagged behind the broader market over the past 52 weeks. REG has declined 3.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.1%. Moreover, on a YTD basis, the stock is down 3.6%, compared to SPX’s 16.4% return.

However, zooming in further, REG has outpaced the Real Estate Select Sector SPDR Fund’s (XLRE) 4.2% drop over the past 52 weeks. Meanwhile, it has trailed behind XLRE’s 2.5% uptick on a YTD basis.

On Oct. 28, REG delivered its Q3 results. The company’s same property Net Operating Income (NOI) increased 4.8% year-over-year to $274.2 million, while its FFO of $1.15 advanced 7.5% from the year-ago quarter, meeting analyst estimates. Additionally, REG raised its fiscal 2025 guidance, now expecting Nareit FFO in the range of $4.62 to $4.64 per share and core operating earnings between $4.39 and $4.41 per share. Yet, its shares plunged 3.1% in the following trading session.

For the current fiscal year, ending in December, analysts expect REG’s FFO to grow 7.4% year over year to $4.62. The company’s FFO surprise history is promising. It exceeded or met the consensus estimates in each of the last four quarters.

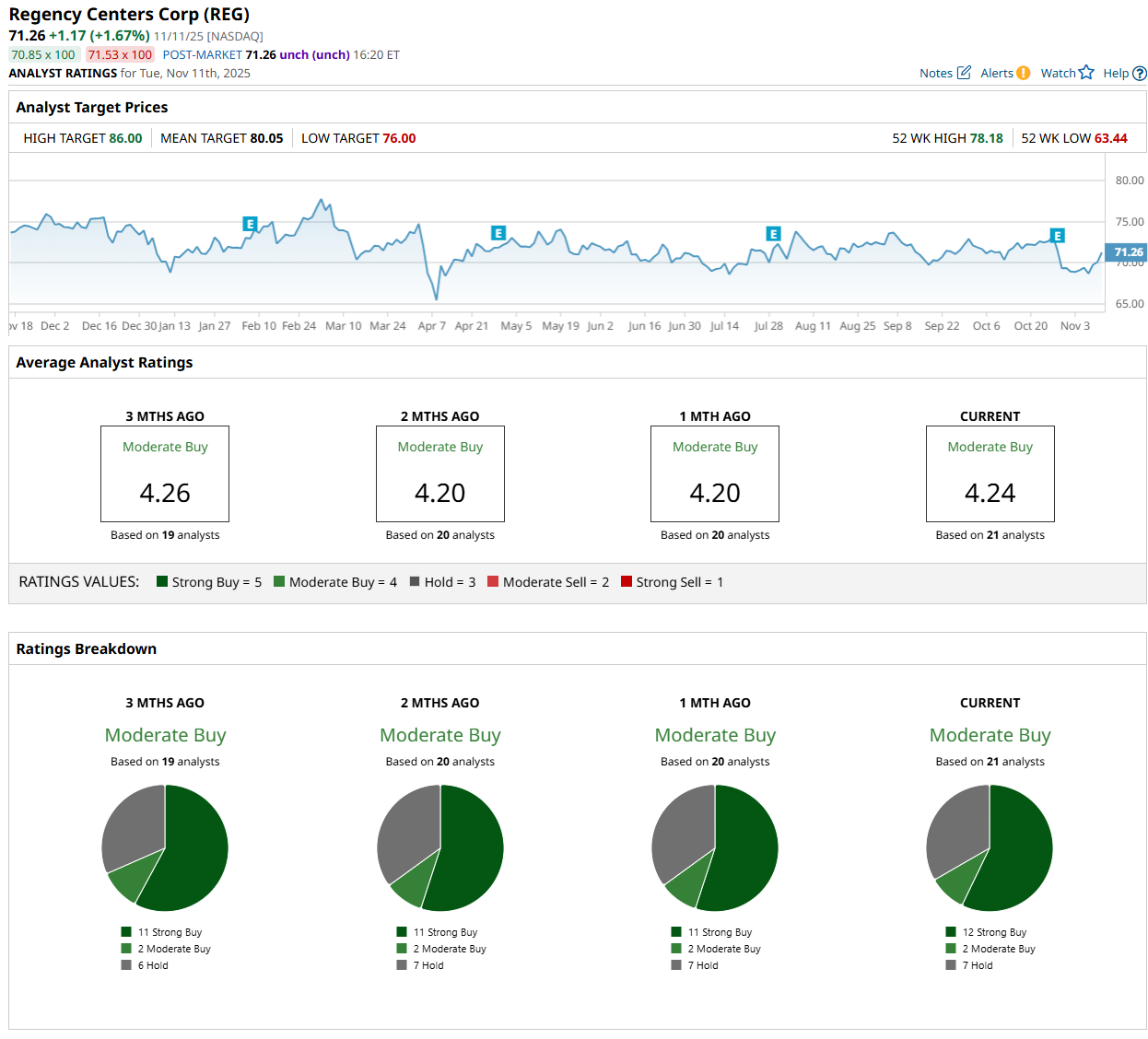

Among the 21 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” two "Moderate Buy,” and seven "Hold” ratings.

This configuration is slightly more bullish than a month ago, with 11 analysts suggesting a “Strong Buy” rating.

On Nov. 11, RJ Milligan from Raymond James Financial, Inc. (RJF) maintained a “Buy” rating on REG, with a price target of $80, indicating a 12.3% potential upside from the current levels.

The mean price target of $80.05 also represents a 12.3% premium from REG’s current price levels, while the Street-high price target of $86 suggests a 20.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?

- Tesla Just Lost Its Cybertruck Leader. Should You Buy, Sell, or Hold TSLA Stock?

- Palantir Achieved ‘Eye-Popping Growth’ and Is a Buy Through Year-End, According to Wedbush

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?