Valued at $32.9 billion by market cap, Arch Capital Group Ltd. (ACGL) is a leading Bermuda-based financial services company. The firm operates through three main segments: insurance, reinsurance, and mortgage, offering coverage for property, casualty, and specialty risks across global markets.

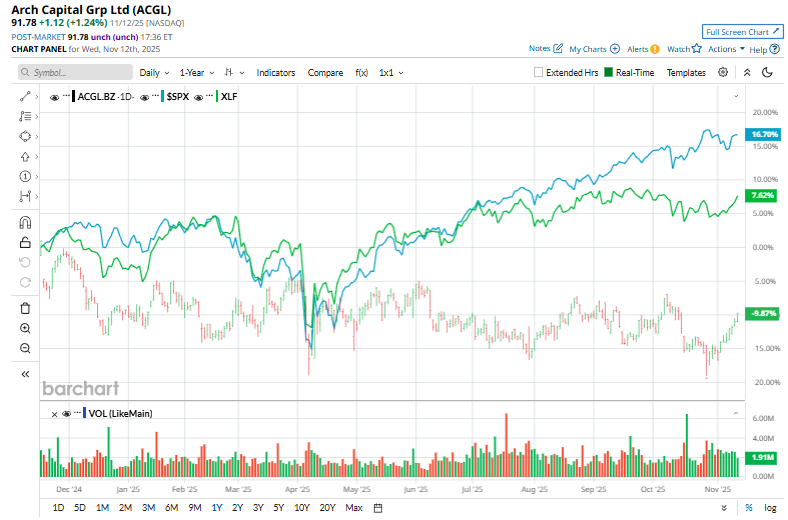

The insurance giant has underperformed the broader market over the past year. ACGL stock has dwindled 9.2% over the past 52 weeks and marginally on a YTD basis, compared to the S&P 500 Index’s ($SPX) 14.5% gains over the past year and 16.5% returns on a YTD basis.

Narrowing the focus, Arch Capital has also underperformed the sector-focused Financial Select Sector SPDR Fund’s (XLF) 7.9% surge over the past 52 weeks and 11.1% gains on a YTD basis.

On October 27, ACGL shares dipped 1.4% after the company released its third-quarter earnings. Net premium written fell 2.1% year over year to $3.96 billion, and its underwriting expense ratio surged 2.3% to 28.4%. On the bright side, net income surged to $1.34 billion, or $3.56 per share, while after-tax operating income climbed to $1.04 billion.

For the full fiscal 2025, ending in December, analysts expect ACGL to deliver an adjusted EPS of $8.97, down 3.3% year over year. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters by notable margins.

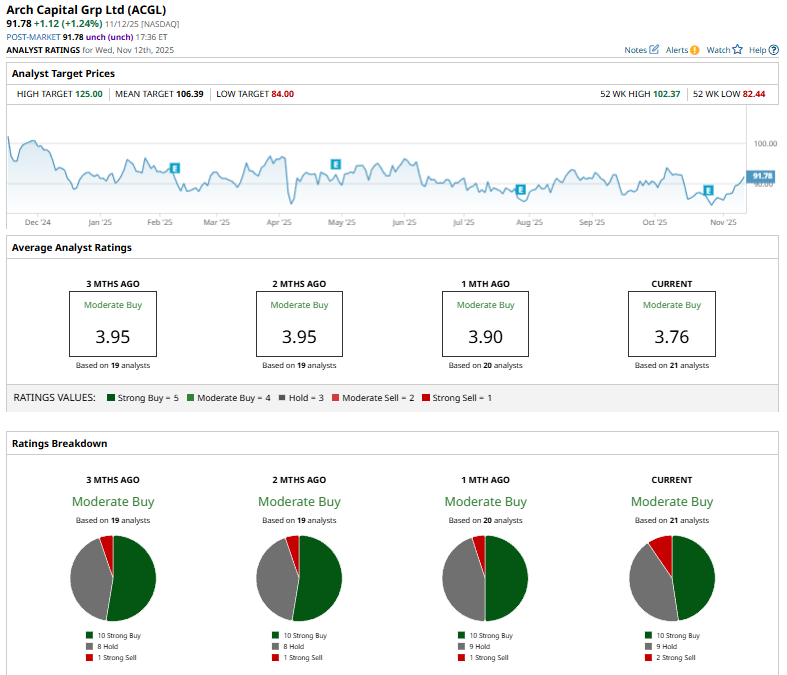

The stock maintains a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 10 “Strong Buys,” nine “Holds,” and two “Strong Sells.”

This configuration has been consistent over the past months.

On Nov. 13, Citizens JMP analyst Matthew Carletti reiterated a “Buy” rating on Arch Capital Group and maintained a $125 price target on the stock, which is also the Street-high price target.

ACGL’s mean price target of $106.39 suggests a 15.9% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart