Rigetti (RGTI) stock is down another 12% on Nov. 13 as investors continue to punish the quantum computing company for missing revenue estimates in its third financial quarter.

For Q3, the Nasdaq-listed firm disclosed $1.95 million in revenue this week versus $2.17 million expected, prompting Benchmark analyst David William to lower his price target on RGTI today.

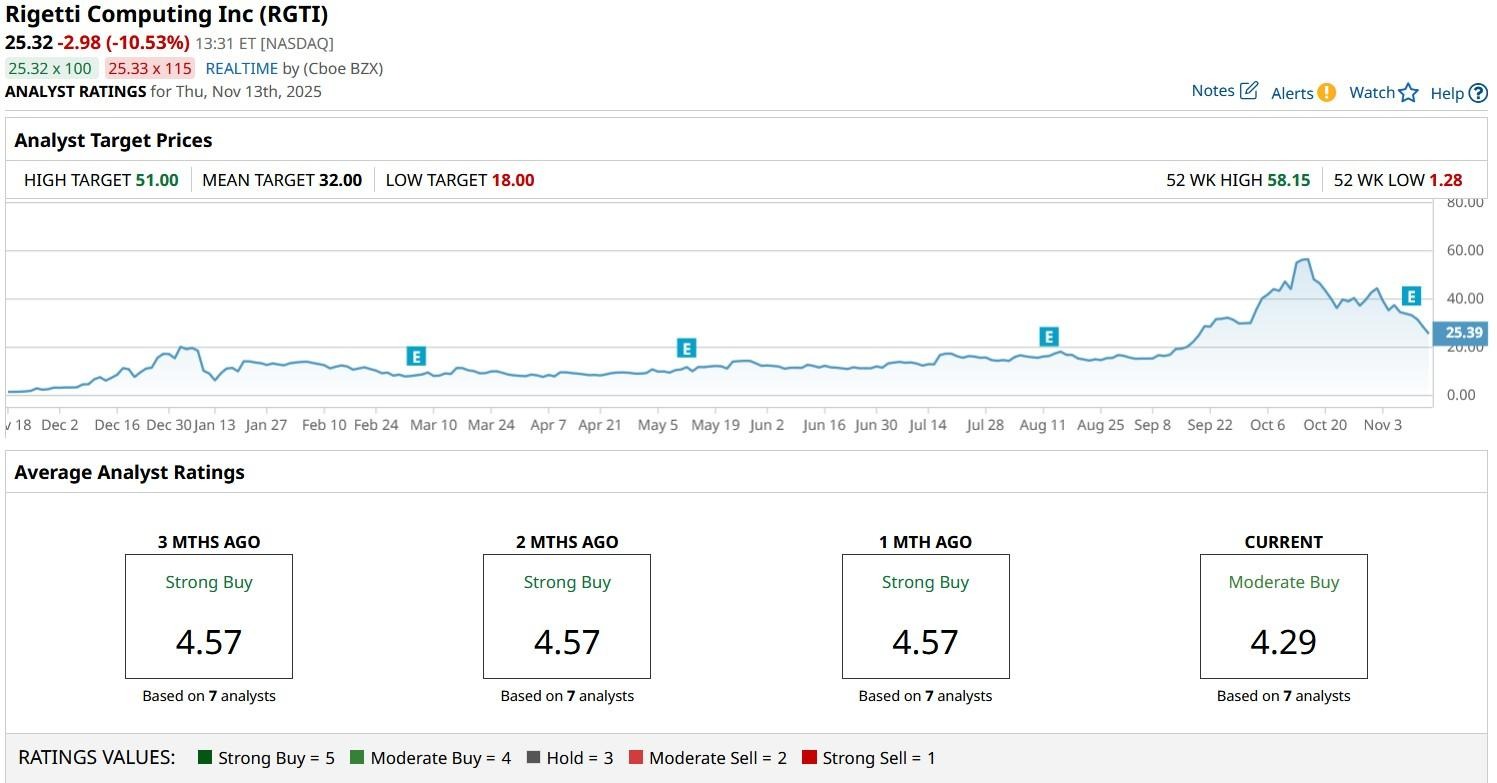

Rigetti stock is now trading about 55% below its year-to-date high set in mid-October.

Is It Time to Trim Your Exposure to Rigetti Stock?

While Benchmark sees momentum slowing down in quantum computing firms, there are adequate reasons to still load up on RGTI stock at current levels.

For starters, the Berkeley-headquartered firm narrowed its loss further to $0.03 only in its financial Q3, reinforcing that profitability is no longer a distant possibility but a near-term reality.

Rigetti shares are attractive after the pullback also because the company has already secured major strategic partnerships – including one with Nvidia (NVDA) – which position it as a leader at the AI-quantum frontier.

That’s perhaps why options data currently indicates a potential recovery in RGTI to roughly $36 over the next three months.

RGTI Shares Technicals Signal Near-Term Recovery

Investors should also note that William’s downwardly revised price target still suggests more than 55% potential upside in Rigetti shares from current levels.

In fact, in his research report, he explicitly recommended investors “to be opportunistic buyers on further weakness as volatility looks to be subsiding.”

Despite the recent selloff, RGTI is keeping above its long-term moving averages (100-day, 200-day), further indicating that bulls remain in control and the broader uptrend is intact.

Meanwhile, historical returns favor owning this quantum computing stock in the near-term as well. Over the past four years, RGTI shares have rallied over 10% on average in November and a much higher 86% in December.

Wall Street Remains Bullish on Rigetti Computing

Other Wall Street firms agree with Benchmark’s bullish view on Rigetti stock as well.

According to Barchart, the consensus rating on RGTI shares currently sits at “Moderate Buy” with the mean target of $32 signaling potential upside of well over 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?