Wall Street's most unlikely success story isn't found in Silicon Valley boardrooms but in shopping mall storefronts where kids stuff plush animals. While Nvidia (NVDA) has dominated headlines in recent years, Build-A-Bear Workshop (BBW) has delivered returns of over 1,160% over the past five years, compared to the 1,380% returns of NVDA stock.

The company's fiscal second quarter marked its most profitable ever, with revenue hitting $124.2 million and growing 11% year-over-year (YoY). This performance stands in stark contrast to that of traditional retailers, as competitors like Claire's have shut hundreds of locations across America. Build-A-Bear operates 627 stores spanning 32 countries, with 100 new locations opened in just two years and plans for 60 more this year.

CEO Sharon Price John credits the company's resilience to its experiential retail model. The process of stuffing a bear, adding a heart, and dressing the finished creation generates emotional connections that drive customer loyalty. Marketing experts describe this ritualistic experience as nearly impossible to replicate through online shopping.

Adult nostalgia fuels much of the growth, with 40% of customers now being grown-ups rather than children. Recent surveys show 92% of adults still own childhood stuffed animals, which validates the timeless appeal of teddy bears across generations.

Let’s see if BBW stock is still a good buy right now.

Should You Invest in BBW Stock Today?

In fiscal Q2 2026 (ended July), the company reported an 11% YoY revenue increase, while net income rose 33% to $15 million. Notably, adjusted earnings surged by 47% to $0.94. Over the last six months, revenue increased by 11% to $252 million, while pre-tax income rose by 31% to $35 million, and earnings growth reached 45%.

The company’s EBITDA margin stood at 17% in the last two quarters, up from just 4.5% in fiscal 2020. This margin improvement was attributed to annual store contribution margins exceeding 25% combined with the expansion of the higher-margin commercial wholesale segment.

Management responded to the strong performance by raising full-year guidance. The updated outlook reflects increased expectations for both revenue and pretax income, based on current tariff rates, as well as higher projections for net new store openings.

The company now expects to add at least 60 new locations this year, up from the previous target of 50 units. International expansion drove much of the store growth, with 86% of new openings during the quarter occurring outside North America.

The brand now operates in 32 countries through three distinct models: corporate-managed stores, partner-operated locations, and franchises. Partner-operated units now total 157 locations, representing 25% of the overall store count.

The digital transformation strategy continues to gain traction. E-commerce demand increased 15% in the quarter, driven by successful product launches and strong social media marketing campaigns.

The Summer Fruit Stand collection exemplified this approach, generating triple-digit growth in media impressions through integrated campaigns across Instagram, TikTok, and other platforms.

Mini Beans, the collectible line priced around $10, delivered an 80% YoY revenue growth. The company expanded wholesale distribution of Mini Beans through partnerships with Hudson airport stores and Applegreen convenience locations. International partners also began selling Mini Beans in their standalone toy stores, creating additional revenue streams beyond traditional Build-A-Bear workshops.

Is BBW Stock Still Undervalued?

Analysts tracking BBW stock forecast revenue to increase from $496.4 million in fiscal 2025 to $624.4 million in 2030. During this period, adjusted earnings are expected to increase from $3.77 per share to $6 per share.

Today, BBW stock trades at 11.8x forward earnings, higher than its three-year average of 8.74x. If it trades at 10x earnings, the retail stock could deliver 20% returns over the next three years.

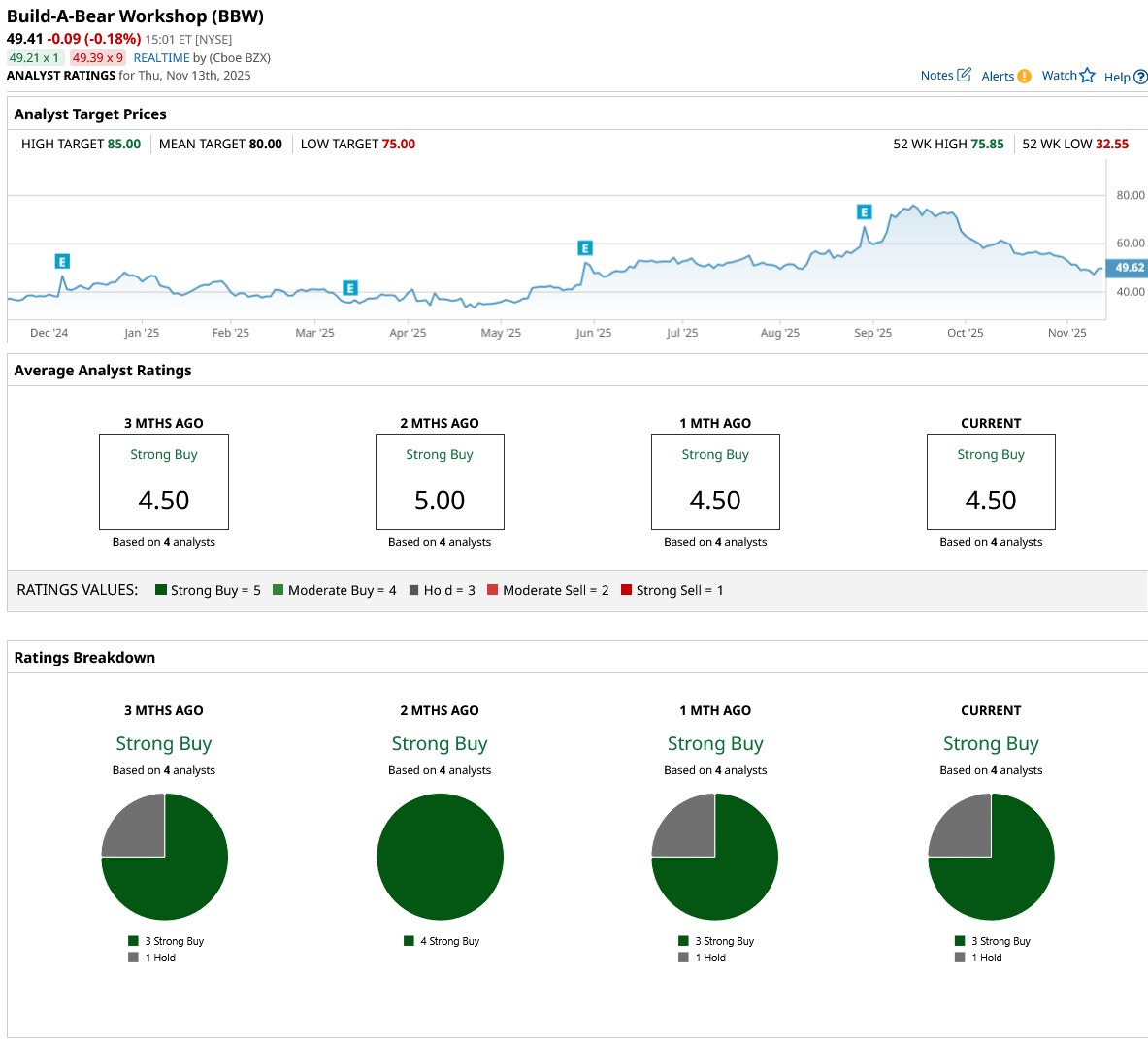

Out of the four analysts covering BBW stock, three recommend “Strong Buy,” and one recommends “Hold.” The average BBW stock price target is $80, indicating an upside potential of 60% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?